After a terrifying start to the year, and a rip-roaring surge to new highs since June, it feels like someone tranquilized the stock market, which has drifted higher in four of the last five sessions as of mid-day Tuesday. We can't have Wall Street volatility in a presidential election year. It's not good for the incumbent party.

The market, as measured by the broad NYSE Composite Index, has barely budged since July 14 as it continues to trade near the 10,800 level first reached in May 2014. It's been five weeks of ennui capping three years of listlessness even as worries and obsessions have come and gone. The overarching theme? American stocks are the least bad option in a yield-starved world. And the Federal Reserve won't do anything stupid with the rate hikes.

Related: Why This Boring Market Is About to Get a Lot Wilder

Yet as the fundamental headwinds continue to build, and the market's rallies become increasingly narrow, more and more Wall Street professionals are getting frustrated, lagging their performance benchmarks or sitting on the sidelines as the "market" runs away from them.

What was supposed to be the year of the stock pickers has turned into the year of stock pickers getting slaughtered. Mutual fund managers who actively trade their portfolio had their worst first half ever, with less than 20 percent topping their benchmarks, according to Bank of America Merrill Lynch data. (And that follows a year in which two-thirds of active fund managers failed to beat the 1.4 percent total return of the S&P 500.)

What's driving the ongoing underperformance? A combination of high correlation (various markets rising and falling together), the narrowing gap between over-performing and underperforming stocks and the whipsaw reversals of relative performance across sector groups.

Related: The Ugly Truth Behind Last Week’s Big Jobs Numbers

Hedge funds, which are supposed to be the rock stars of the investment world, have been having a similarly tough time: According to the Barclays Hedge Fund Index, the average manager is carrying a 2.6 percent year-to-date gain vs. a 6.3 percent rise for the Dow Jones Industrial Average and an 8.3 percent rise for the Russell 2000 small-cap index.

Even some of the most well-known individual money managers are baffled. Stan Druckenmiller told the Sohn Conference earlier this year that we are in the endgame of a multi-decade global debt bubble and that investors should liquidate their assets. He cited the decline in corporate earnings which is now in its sixth quarter, the loading up of corporate debt to fund buybacks and "zombie" lending in China.

George Soros has reportedly built up a large bearish position. Carl Icahn recently warned of bubbles resulting from the Fed's long experiment with near-zero interest rates. Jeff Gundlach of Doubleline Funds recently said he thinks it’s time to "sell everything" and that "nothing here looks good." Even Bill Gross said in his latest monthly newsletter that he doesn't like stocks, bonds or private equity at these levels and in this environment.

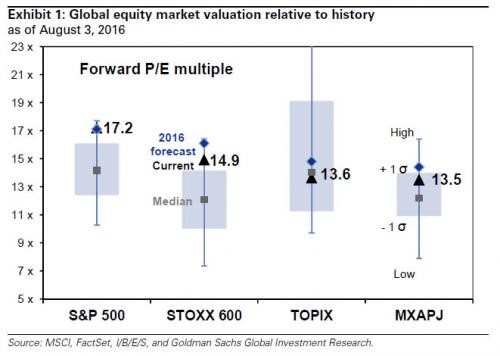

Even Wall Street banks like Goldman Sachs are sounding the alarm, telling their clients in a research note last week that stretched stock market valuations suggest prices could suffer a "tactical" pullback over the near term. They believe nervousness over the U.S. presidential election could push the S&P 500 down around 10 percent in the months to come before rebounding.

Over the next 12-months, Goldman is forecasting a 1 percent decline for U.S. stocks.

Related: Throwing Shade on the Dow's Record High

And yet for all the malcontent, investors have been forced via central bank interventions to get up and start dancing. Net long positions in the Dow and Nasdaq futures and options markets have surged to new post-recession highs this month, continuing an inexorable buy-in after reaching a small net-short position back in February.

America's stock market now stands alone, perhaps the final bubble to pop in Druckenmiller's endgame. U.S. equities are 38 percent above their peak from the previous bull market. Japanese stocks are 59 percent lower. European stocks are 29 percent lower. British stocks are at levels first hit 16 years ago. And emerging market stocks are down 35 percent from their highs.

Related: Home Prices Hit an All-Time High — Is This Another Bubble?

When can we expect the tense stasis to break? Probably not until the end of September, when the Federal Reserve could tease a December rate hike, when Donald Trump and Hillary Clinton face off in the first presidential debate and when the U.S. stock market enters what is seasonally the worst-performing part of the year.

Indeed, August-October selloffs have been a hallmark of the post-2009 bull market, with only two exceptions (2009 and 2012).