The market has gone into suspended animation following a feeble bounce back from the very scary selloff of late August. Volatility in Chinese markets has more or less stabilized as Beijing aggressively tries to contain the runaway stock losses and currency turmoil. Now, all the attention has turned to what, if anything, the Federal Reserve will do on Sept. 17.

At this point, no action looks like the most likely outcome; continuing a policy of near 0 percent interest rates that's been in place since 2008. Stocks should celebrate the confirmation of a dovish Fed that, when signals are mixed, will prefer to keep the flow of cheap money going.

But the risk of a hawkish surprise and unexpected rate liftoff cannot be fully dismissed (the futures market puts the odds of this at just 28 percent), and that would no doubt send stocks careening lower. No wonder trading volume is drying up and activity is light heading into next week.

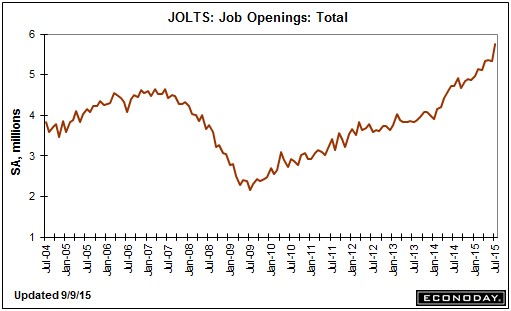

Quick context: Over the past year, the running expectation was that the first interest rate hike since 2006 would occur sometime in 2015 as the job market continues to heal and the business cycle expansion reaches full maturity (if not outright old age). The unemployment rate has fallen to 5.1 percent. The number of job openings is at a record high since the data started in 2000 amid ongoing signs of shortages of skilled labor. And the economy grew at a 3.7 percent annual rate in the second quarter.

Related: 5 Million Job Openings, So Why Can’t You Get Hired?

By historical standards, the beginning of a policy normalization is way overdue, with risks of financial bubbles, malinvestment and investor overconfidence building: Coming out of the 1990-1991 recession, rate hikes started with the unemployment rate at 6.6 percent. Coming out of the 2001 recession, rate hikes started with the unemployment rate at 5.6 percent.

Indeed, Cleveland Fed President Loretta Mester recently said the economy was "at or near full employment" — admitting one of the Fed's policy goals has been met even as interest rates remain at emergency levels.

More dovish Fed officials are worried about recent market turmoil, still-low inflation, the drag from a strong dollar and potential disinflationary effects from the economic slowdown in China and other emerging market economies. This chatter intensified in the wake of the Aug. 24 "Black Monday" selloff when the Dow Jones Industrial Average dropped more than 1,000 points at the open as blue-chip stalwarts like GE (GE) dropped 20 percent or more.

Given Fed Chair Janet Yellen’s oft-repeated claim of being data dependent, a "no hike" decision will be increasingly difficult to justify. JPMorgan's Michael Feroli quipped that "Yellen's labor market dashboard just blew a gasket" following the release of the job openings data shown here.

One possible strategy for Yellen will be to focus on the slowdown in the hires rate, which fell to 3.5 percent from June's 3.7 percent and remains well below the prior high of 4.4 percent set in January 2001. As noted by analyst Philippa Dunne of the Liscio Report, the job openings rate is now below the hires rate, something that hasn't happened before.

Related: The Clearest Sign That the Job Market Hasn’t Really Recovered

She argues that the elevated hires rate reflects an "advanced case of tire-kicking around the country" as employers and potential employees circle each other wearily to see if they can get the upper hand. This is indicative of structural frictions in the labor market — caused possibly by issues like negative home equity limiting relocations or demographic shifts related to the retirements of baby boomers.

For his part, Deutsche Bank economist Joseph LaVorgna told clients he sees seven reasons why the Fed won't hike rates this month:

- Global stock markets are fragile.

- The dollar has been strong, weighing on GDP growth via trade.

- Financial markets continue to assign a low probability of a September rate hike based on futures trading (as noted above, odds stand at 28 percent vs. 54 percent last month).

- Several key Fed officials seem to be subtly backing away from a September move with words like "less compelling" and "complicating factors" and "significant...headwinds."

- There are meetings in October and December so the Fed can still hike this year if markets stabilize.

- The Fed, in his mind, doesn't fear a loss of credibility if it waits.

- And inflation continues to be soft, with the Fed's preferred measure up just 1.2 percent over the past 12 months.

With this in mind, the recent range-bound choppiness in stocks should continue until next week — when a dovish Fed could unleash a powerful rebound through October. Commodities, especially crude oil and gold, could be the big beneficiaries of a "no hike" decision.

Related: 6 Reasons Gas Prices Could Fall Below $2 a Gallon

While the team at Capital Economics puts the odds of a September hike at 50-50, citing the cumulative improvement in the economy over the last few years that makes maintaining emergency 0 percent interest rates hard to justify, they believe that higher core inflation driven by rising wages will force Yellen to hike rates much more aggressively next year — something that markets have definitely not priced in yet.

Put simply, the current stasis won't last long, even if the Fed holds off for now.