In less than a month, the fate of the free world will hang in the balance, at least if you judge based on the nerves being demonstrated on Wall Street. On Sept. 17, the Federal Reserve will decide whether or not to raise interest rates, which have been at 0 percent for eight years.

Every economic data point, every comment from Fed official and every word of every official statement is deconstructed, reassembled and synthesized for clues on what's to come. After Wednesday's release of the Federal Open Market Committee’s July meeting minutes, which were more dovish than expected, traders are more confused than ever. Just as a September liftoff was beginning to look like a sure thing, things are now on a knife's edge.

Related: Soft Economic Data Could Provide a Hard Lesson for the Market

The takeaway from the release: The Fed is worried about downside risks to its economic outlook, risks associated with tightening too soon and evidence that inflation will remain low. As a result, the futures market pushed back its expectation of the first rate hike sine 2006 from September to December. According to Bank of America Merrill Lynch, there is now only a one-in-three chance of a September liftoff.

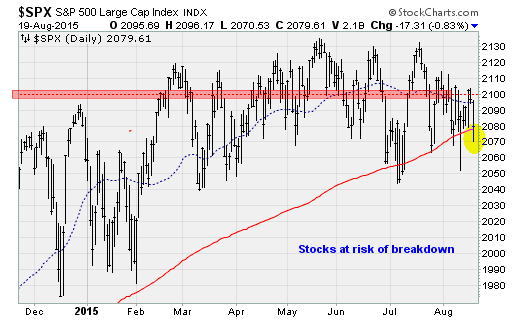

The stakes for the market are huge. After months in the doldrums, the S&P 500 index finally looks set to break down and out of the trading range that has been in place since late last year. The critical level is the 200-day moving average, which the bulls have been vigorously defending since late June — mirroring a similar defense of the 200-day moving average on the Shanghai Composite by Chinese authorities.

The range-bound S&P masked deeper woes in individual stocks, something I've been hammering about for months. Just 48 percent of the stocks in the S&P 500 are actually in uptrends, a sign of a narrowing base of support to hold the 200-day average. This is evidence of deep vulnerability.

The playbook that we've seen over the last few years is that whenever global markets are at risk, the major central banks zoom in with more policy stimulus.

And indeed, after the release of the Fed minutes that seemed to be the case again: The Dow Jones Industrial Average, which was down 229 points at its nadir, charged back into positive territory as traders joked that another round of bond-buying stimulus (QE4?) was more likely at this point than an actual rate hike. But then the sellers reemerged, and they’ve continued selling in Thursday’s session.

Along with the persistent selloff in China and a collapse in commodity prices that has dropped crude oil below $41 a barrel for the first time since 2009, this suggests a sea change could be underway. Investors could be realizing that more cheap money stimulus isn't coming…or isn’t going to work this time. If so, the long-term uptrend that has held stocks aloft since late 2011 is at risk, as shown above.

Indeed, a recent research paper from the Federal Reserve Bank of St. Louis finds that after six years of quantitative easing that swelled the Fed's balance sheet to $4.5 trillion, the policy "has been ineffective in increasing inflation" and only seems to have boosted stock prices. Moreover, the policy could've very well driven the inequality gap noted by so many.

The ongoing pressure on China and the energy sector, with knock-on impacts on corporate earnings, doesn't look like it's going anywhere either.

Everything now depends on the flow of data in the weeks to come, especially the August payroll report on Sept. 4. In the minutes, "several" officials thought "maximum employment could take longer to achieve," citing slow wage growth. They also worried that a premature rate hike would further strengthen the dollar, which in turn would further pressure oil and other commodity prices and thus further weaken the inflation outlook.

Related: The Clearest Sign That the Job Market Hasn’t Really Recovered

If there is no rate hike in September, Societe Generale economist Aneta Markowska wonders whether a 2015 hike will happen at all since neither October nor December are attractive options. October lacks a scheduled press conference (ostensibly, Fed Chair Janet Yellen will want to explain the reasoning behind the liftoff once it happens), while a December hike would coincide with lower year-end trading volumes, magnifying a potential bond market selloff. December might also be too close to another potential seasonal GDP slowdown in the first quarter of 2016.

Mark your calendars: If the last couple of days were any indication, the Sept. 17 policy announcement will give stocks a wild ride.