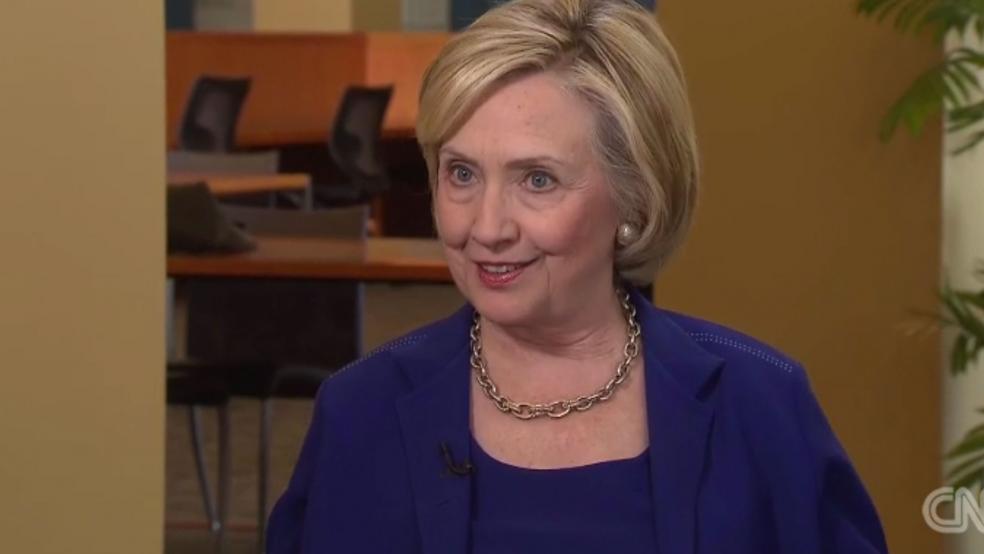

It’s no coincidence that in the space of a month, California declares Uber drivers to be employees, Hillary Clinton attacks the sharing economy, and the Labor Department issues guidelines on when to classify workers as employees, who are entitled to fringe benefits, or independent contractors, who are not.

What all three have in common is this: They are trying to stem the growth of independent contractors, the largest source of job growth in the United States, according to the American Staffing Association. California, Clinton and the Labor Department want companies to hire individuals as employees rather than as independent contractors. Although those people would get benefits as employees, their cash wages would decline.

According to the latest Employment Cost Index data published by the Labor Department, benefits make up 30 percent of compensation costs, and wages and salaries the remaining 70 percent. If independent contractors were reclassified as employees, their cash wages would decline and they would receive benefits such as health insurance, vacation, pension contributions and sick leave.

Someone who is earning $50,000 as an independent contractor might be paid about $35,000, plus fringe benefits, as an employee. Of course, as an independent contractor, he would owe the employer’s share of Social Security and Medicare, $3,750, as well as the employee’s share, the same amount. But he would have more cash in hand.

Forcing people into an employer-employee relationship gives the government more control over the workforce and more work to do, enforcing its regulations that apply to employees.

Some might value those benefits, but many others prefer to get more cash and to buy the benefits themselves. Alternatively, some might get benefits through another working family member, and so cash might come in more useful.

Both the new Labor Department guidance and the proposed overtime revisions would reduce workplace flexibility, especially important to women and millennials, who want the freedom to work flexible hours in locations of their own choosing without having to punch a time clock.

The Obama administration wants to require employers to hire workers as employees because they prefer to have workers in an employer-employee relationship rather than in a contractor relationship. Forcing people into an employer-employee relationship gives the government more control over the workforce and more work to do, enforcing its regulations that apply to employees.

Take the Affordable Care Act, for instance. The Internal Revenue Service levies penalties on employers who do not offer the right kind of health insurance to their employees. Penalties are severe — $2,000 per worker per year for not offering the right kind of health insurance, $3,000 per worker who gets subsidies on the health-care exchanges and $36,500 per worker per year, effective this month, on employers who reimburse workers for their health-insurance premiums. Those penalties are not levied on workers who are independent contractors. More employees, more revenue for the IRS.

The new guidelines hit particularly hard those firms that contract out some tasks — such as payroll or janitorial services — to avoid hitting the 50-person limit at which the Obamacare penalties apply.

Then, take the Family and Medical Leave Act. Employers are required to give 13 weeks of unpaid leave annually to employees for maternity and paternity care, as well as for chronic illness. Independent contractors do not have to receive this leave. Nor do they have to receive any other kind of leave.

When workers are employees, rather than independent contractors, it is easier to force them to join unions against their will. The Supreme Court has just agreed to take the case of Rebecca Friedrichs vs the California Teachers Association, and decide whether Friedrichs has the right to opt out of paying agency fees to the union. More employees broaden the potential pool of union members, with higher potential revenue from dues. Unions are major contributors to Democratic political causes, so just follow the money.

The Labor Department ties itself up in knots with its new guidelines. It opens by saying that “misclassification of employees as independent contractors is found in an increasing number of workplaces in the United States,” but offers no statistical evidence for the claim. Nowhere does the department appear to be concerned with the reverse scenario — independent contractors being misclassified as employees.

Then, the department lists factors to help courts make the distinction between “whether the worker is economically dependent on the employer (and thus its employee) or is really in business for him or herself (and thus its independent contractor).” But this is a false distinction. Just because you are in business for yourself does not meanA that you are not economically dependent on your clients.

Lawyers, landscaping firms, defense contractors — they are all in business for themselves, but they are economically dependent on their clients for business.

The new guidelines add another layer of regulations to the enforcement pot. Different government agencies have different criteria for whether workers are independent contractors or employees. The Labor Department has a six-pronged test, the Internal Revenue Service has a 20-factor test, and antidiscrimination laws have their own common-law test. Plus, states have different criteria for unemployment, workers compensation, wage and hour rules, and state taxes. It is practically impossible for small businesses, which rarely have legal departments, to stay out of trouble.

But wait ... there’s an app for that. The law firm Littler Mendelson, working with Neota Logic, a technology company, has developed the ComplianceHR Independent Contractor application. That enables employers to enter data on characteristics of their workers and find out whether someone is supposed to be classified as an employee or an independent contractor. The app applies logic based on tests under federal and state law and analysis of 1,500 independent-contractor cases. It produces an answer based on questions from an online questionnaire.

Tammy McCutchen, a principal at Littler Mendelson, told me: “The administration is locked in a 1930s-era industrial economy and simply refuses to acknowledge that the 21st-century economy works differently. The law needs to reflect the reality of how the modern economy works.”

The reality is that the sharing economy is growing, no matter how hard Hillary Clinton, the state of California and the Labor Department try to stand in the way.

__________________________________________________________________________________________

Diana Furchtgott-Roth, former chief economist of the U.S. Department of Labor, is director of Economics21 and senior fellow at the Manhattan Institute for Policy Research.

This piece was published originally in Market Watch.