Over the past week, the stock market has gone from full-fledged panic to a powerful rebound. The S&P 500 has moved back over its 200-day moving average. The Russell 2000 small-cap index, which led the overall market lower after forming a double-top pattern in March and July — a technical indication that buyers have run into resistance — is up more than 6.4 percent from its lows last week.

Investors have been soothed by indications from global central bankers that their stimulus will not be suddenly and dramatically cut off, no matter the pace of economic growth. It's an open question whether investors will continue to feel that calm as the Federal Reserve brings its QE3 bond purchase program, which has been in place since late 2012, to an end.

Related: The Bull Market Isn’t Dead Yet

A number of other indicators suggest stocks are looking attractive here in a way that they haven't in years. While the risks are higher than the bulls readily admit heading into the end of the year, these are factors worth exploring.

Credit Suisse equity strategist Andrew Garthwaite highlights the fact that investor pessimism is quite high. For instance, net longs in S&P 500 futures have dropped to November 2011 lows, according to his data. Insider buying vs. selling is close to a three-year high, suggesting that corporate directors are loading up here. His equity sentiment indicator has fallen near a two-year low. And corporate buybacks are picking up again.

Overall, Garthwaite believes the market may have gotten ahead of itself discounting a global economic slowdown that, while existent, isn't as bad as the market was pricing in. Consider that the ratio of European cyclical stocks to defensive stocks is at a post-2009 low, or that investor risk appetite is pricing in a fall in the measure of new factory orders in the U.S. ISM survey consistent with zero percent GDP growth.

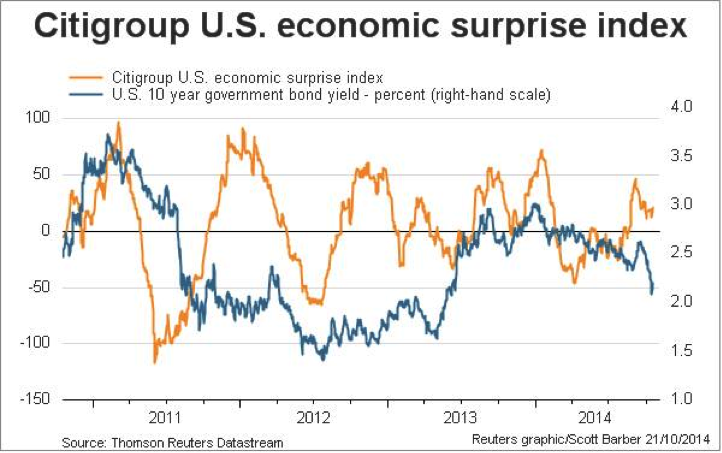

The bond market is really leading the way on this, as shown in the chart above.

The harrowing intra-day selloff on October 15 was driven in large part by panicked buying of long-term U.S. Treasury bonds in an apparent flight to safety. This dynamic has been pushing down U.S. bond yields, which as the chart shows, can be interpreted as the bond market's outlook on where the U.S. economy is going. Yields have tracked well with the U.S. Citigroup Economic Surprise Index, which compares where the economic data is coming in relative to analyst estimates.

Right now, bond yields are discounting a fairly large drop in the economic data that hasn't yet materialized — and perhaps never will.

Related: Stock Market Scare: Could Recession Loom as Profits Drop?

The drop in yields is on a scale that hasn't been seen since 2011, when the Fed was bringing its $600 billion QE2 bond-buying program to an end. Yields started rolling over in early 2011 in an apparent vote of "no confidence" in the health of the economy without the steady flow of cheap money from the Federal Reserve.

The difference then was that the economic data actually led the way down in yields. This time, yields are falling but the data has remained relatively solid, with the unemployment rate falling to 5.9 percent as the job openings rate increases to levels not seen since the dotcom bubble.

The question now becomes: Which is right, the ongoing pessimism in bonds or the nascent confidence in stocks? It all depends on how the economic data performs in the weeks and months to come as the Fed carefully tries to normalize its policy stance and inch closer to the first short-term interest rate hike since 2006.

Top Reads from The Fiscal Times: