The stock market has been under pressure for the first time in months. The Eurozone is faltering. China's credit issues never really went away. American airplanes are once more pounding bombs into the Iraqi desert. Russia and Ukraine. Gaza. There's a lot to worry about.

Related: Iraq, Middle East Paying for Obama’s Miscalculation

Amid the geopolitical unrest, there one's shining beacon of good news to get optimistic about: After a weather- and inventory-related drag in the first quarter, the American economy is charging ahead in a big way. According to the folks at Cornerstone Macro, the economy is on track to grow at a near 5 percent annualized rate in the current quarter — up from the pitiful 1 percent average for the first half of the year.

The job market is also looking very strong, with higher wages on the horizon. Employer costs, a proxy for wages, it growing at its best rate since 2009. David Rosenberg, chief economist and strategist at Gluskin Sheff + Associates, estimates that at its current pace, the labor market could suffer an outright shortage of workers by 2020. And hiring intentions, based on a survey by Manpower, are at six-year highs.

If you survey the data, good news is popping up everywhere.

Consider that the breadth of industries reporting higher employment has moved to the highest level in 14 years — going back to the highs seen when Bill Clinton was in the White House. Or that manufacturing employment is growing at its fastest pace in over 30 years, up 6.2 percent from its low in early 2010.

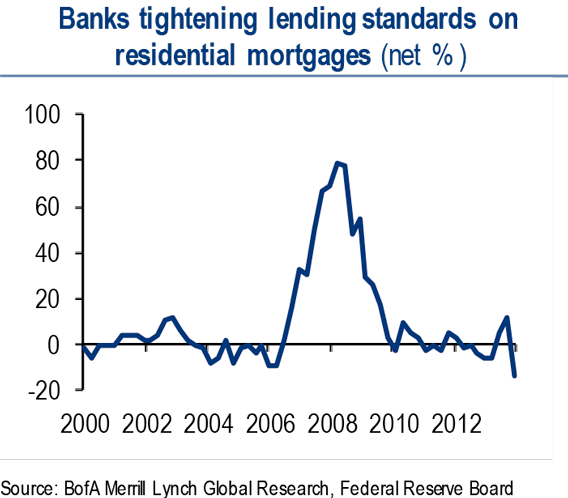

Housing looks ready to rebound, too, with lumber orders up and banks loosening lending standards on a scale that exceeds even what was seen during the housing bubble according to the July Loan Officer Opinion Survey.

Initial weekly jobless claims have been plunging as fewer and fewer folks are laid off, with the four-week moving average of this measure falling to 2006 lows. Steel production is on the rise. Heavy truck sales increased at a 5.4 percent month-over-month rate in July to levels not seen since 2007. Total U.S. vehicle production increased at a 17.2 percent annualized rate in the second quarter, pushing overall production to levels not seen since 2004.

If the economy can manage a 4.9 percent expansion in Q3, we'd be looking at the best quarterly performance since 2006. And at the current pace of job creation, Cornerstone is looking for the creation of 1.8 million jobs over the next eight months.

Fed Study: One-Fourth of Americans ‘Just Getting By’ Financially

While all this is great news for American workers and homeowners, it's not clear whether it will translate into additional earnings growth and stock market gains. For one, a stronger economy will increase pressure on the Federal Reserve to tighten policy, with unknowable consequences for the stock and bond market. Also, increased growth in the context of a tight job market could result in wage pressure that weighs on corporate profitability.

None of this diminishes what looks ready to unfold: A surge of economic vitality that could finally result in a modicum of job security and higher take-home pay for regular working folks. Happy Monday!

Top Reads from The Fiscal Times: