In economics, the examination of questions surrounding the distribution of income have been ignored or pushed into the background in the academic literature. However, rising inequality over the last several decades coupled with recent work by Thomas Piketty – which has had a surprisingly large and positive reception by the public – have propelled these questions to the forefront of economic analysis.

Until recently, most questions surrounding the distribution of income were considered out of the realm of serious, scientific analysis. The reason for this is based upon the distinction between positive and normative economics that sets bounds for professional conduct in economics. Positive analysis is the statement of falsifiable, factual claims. For example, the statement that there are two blue cars in the garage is a positive statement. It can be tested against observable data.

Related: What Piketty Left Out of His Argument

Normative statements are opinions – value judgments – that are not right or wrong. For example, the claim that blue cars are the most attractive is a value judgment of the individual making the statement. It is not a claim that can be falsified through data based analysis. Within economics, positive analysis is considered part of the “scientific mission” of economics, and normative questions are shunned.

This distinction can be applied to discussion and analysis surrounding the redistribution of income. To say that we should take a dollar from one person and give it to another makes the value judgment that hurting one person – taking money away from, say, a wealthy household – is somehow less important than helping someone else, perhaps a poor household.

Economists can say what would happen to GDP growth or other macroeconomic outcomes if we redistribute income, that is positive analysis, and for a long time it was believed that redistributing income would lower economic growth because it distorts the rewards to effort. But taking the next step and saying that income should be redistributed crosses the bounds of professional conduct.

Related: Get Used to It—The Rich Do Get Richer

Because of this, there was little reason for economists to think about redistribution. Any redistribution to make income more equal would lower economic growth, an effect known as the equity-efficiency tradeoff, and there was no way to justify this through the value judgment that the redistribution helped more than it hurt.

This began to change with work such as a paper by Jonathan D Ostry, Andrew Berg, Charalambos Tsangarides of the IMF showing that societies with more unequal distributions of income tend to grow slower, and that redistributing income does not have a negative effect on economic growth. It may even help economies to grow faster. The exact mechanism for this is unknown, though the paper suggests that “excessive inequality is likely to undercut growth – for example by undermining access to health and education, causing investment-reducing political and economic instability, and thwarting the social consensus required to adjust in the face of major shocks.”

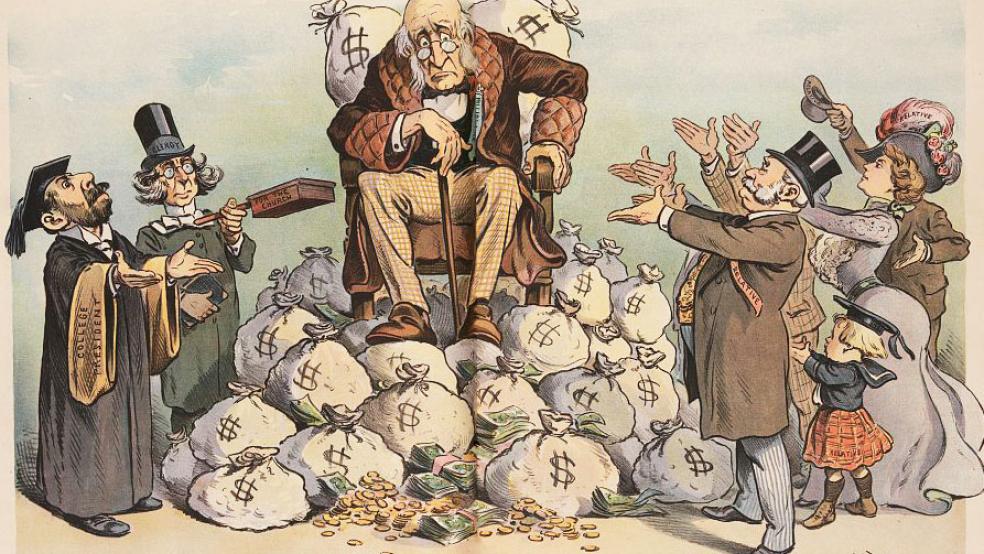

When thinking about income redistribution, one important question to answer is whether the rising inequality over the last few decades arises from the natural outcome of capitalism and markets, or from distortions in the distribution of income and wealth that have crept into our economic system. If inequality is a natural outcome of capitalism, then redistributing income could theoretically have either positive or negative effects on growth. It is ultimately an empirical question, and recent evidence points away from negative effects.

Related: In American Politics, the Wealthy Get What They Want

If, on the other hand, rising inequality is at least in part due to distortions in the market system arising from monopoly power, political power, or other factors that interfere with the distribution of income – if the rewards do not create the correct incentives for work, entrepreneurship, and innovation – then the redistribution question is much easier to answer. In this case, redistributing income is unlikely to harm economic growth, and it is very likely to enhance it.

Piketty’s work has highlighted questions about inequality and the redistribution of income, and he treats inequality as a natural outcome of capitalism. He does allow for political influence as rising inequality concentrates power, but the main story is one where inequality is due to natural forces in capitalist economies.

My view is that distortions due to market failures arising from monopoly/monopsony power, the failure of markets to clear due to the presence of wage and price rigidities, political influence, and so on are an important source of rising inequality. But there is no reason why both can’t be true. Inequality could be a natural outcome of capitalist systems, and market failures could magnify unequal outcomes, but the main point is that economic research has not yet settled these fundamental questions.

Inequality in the US is approaching levels that could begin to undermine economic growth, and there are those who argue we are already there. For this reason the failure to fully understand the reasons for rising inequality, and the consequences of inequality and redistribution for important economic outcomes such as economic growth, could have dire effects on the economy.

It is good to see economists finally treating these questions as serious academic research.

Top Reads from The Fiscal Times: