President Obama unveiled an ambitious budget blueprint Tuesday that seeks more than $600 billion in fresh spending to boost economic growth but also pledges to tame the national debt by raising taxes on the wealthy, slashing payments to health providers and overhauling the nation's immigration laws.

The request sent to Congress offers a smorgasbord of liberal policy ideas in a year when riling up the Democratic base and drawing a vivid contrast with Republicans are critical to Obama's hopes of preserving his party's imperiled majority in the Senate.

His blueprint includes a few narrowly targeted spending cuts, but relies primarily on more than $1 trillion in new taxes to slow borrowing over the next decade – with much of the burden falling on major businesses and the wealthy. Obama would also direct some of the proceeds to new road and bridges, universal preschool education and expanded tax credits for the poor.

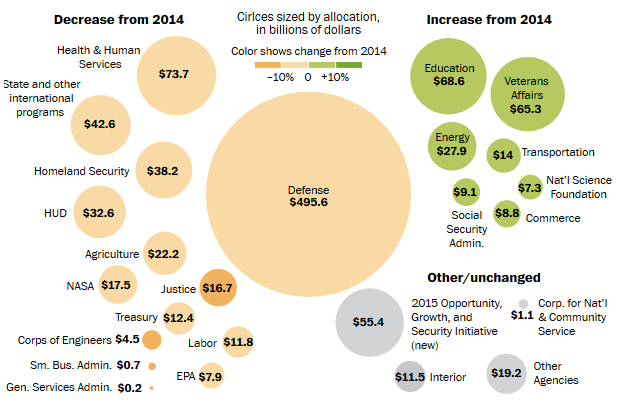

Graphic: An agency breakdown of Obama's budget »

To achieve Obama's agenda, however, Congress would have to approve virtually all of his ideas. And while the budget opens the door to potential areas of bipartisan agreement – including an overhaul of business taxes that would generate cash for job creation – it retreats from other compromises.

For example, Obama does not propose using a less-generous measure of inflation to calculate Social Security benefits, a move that would significantly slow spending growth in the program. Obama included the proposal, known as the chained consumer price index, in last year's budget in a failed bid to strike a grand bargain on the debt with Republicans.

"After years of fiscal and economic mismanagement, the president has offered perhaps his most irresponsible budget yet," said House Speaker John Boehner (R-Ohio). "Spending too much, borrowing too much, and taxing too much, it would hurt our economy and cost jobs."

In his message to Congress, Obama calls on lawmakers to now focus instead on jump-starting the sluggish economic recovery.

"We have made progress over the last 5 years. But our work is not done," he wrote. "This Budget provides a roadmap to ensuring middle class families and those working to be a part of the middle class can feel secure in their jobs, homes, and budgets."

Even as the government has made progress in reducing short-term borrowing in recent years, Obama's budget pledges to make a significant new dent in the nation's debt over the next decade. He proposes to reduce borrowing by an additional $1.4 trillion by 2024, building on $4 trillion in deficit-reduction enacted by Congress since the budget wars began three years ago.

As a result, the White House projects that the deficit will fall to $434 billion in 2024, or 1.6 percent of the overall economy, down from 3.7 percent this year. That would be the smallest deficit since 2007, before the Great Recession dealt a terrible blow to government finances.

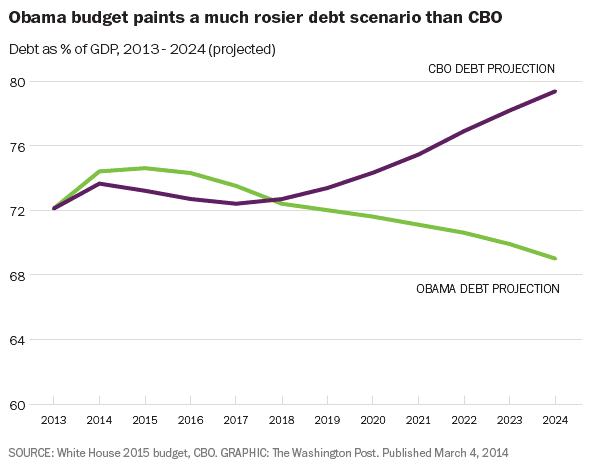

A shrinking deficit would reduce borrowing, thereby allowing the overall debt to grow more slowly. The White House estimates that the debt would shrink to 69 percent of the economy by 2024, compared to 74.4 percent today.

The projections are far rosier than those made recently by the non-partisan Congressional Budget Office, which estimates that the deficit will be 4 percent of the size of the economy in 2024 and the debt will grow to 79 percent of GDP.

The Obama budget would build on a spending deal reached late last year between Rep. Paul Ryan (R-Wis.) and Sen. Patty Murray (D-Wash.), the chairs of their respective chamber's budget committees. Under the deal, which largely replaces the deep domestic and defense cuts known as sequestration for two years, agency spending levels are set through September 2015.

In his budget, Obama argues that the deal provides insufficient spending; he proposes $56 billion in additional funding to agencies, offset by $28 billion in alternative spending cuts and tax hikes.

The new spending, known as an Opportunity, Growth and Security Initiative, will pump money into preschool programs, the National Institutes of Health, manufacturing institutes, climate research, job training and a new parental leave proposal, among other benefits for the middle class. Obama would also expand a tax credit for poor, working-class Americans valued at $60 billion over 10 years.

To pay for those initiatives, the president takes aim at a variety of tax breaks that benefit the wealthy – limiting the value of retirement savings accounts, a loophole known as "carried interest" that allows many private equity and hedge fund managers to reduce their tax burden, among others.

Reprising one tax proposal from last year that also hits middle class and lower income Americans, Obama proposes a new tax on tobacco to pay for the early-childhood initiative.

After 2015, Obama proposes to replace the remainder of sequestration with a combination of tax hikes as well as cuts in other mandatory spending programs, such as Medicare. Obama would seek, for example, to raise premiums for wealthy seniors and force drug companies to offer larger discounts on prescription drugs.

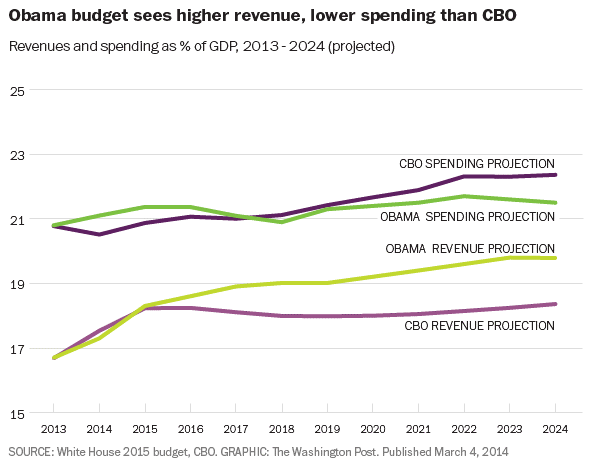

Like the CBO, the Obama administration does not paint an overly optimistic picture of economic growth over the next decade, with an average inflation-adjusted growth rate of just 2.6 percent per year over the next 10 years.

Rather, the rosier budget picture is primarily the result of increased tax revenue. In 2024, Obama projects collecting $500 billion in more revenue in 2024 than is estimated under current law.

This article first appeared in The Washington Post

Read more at The Washington Post: