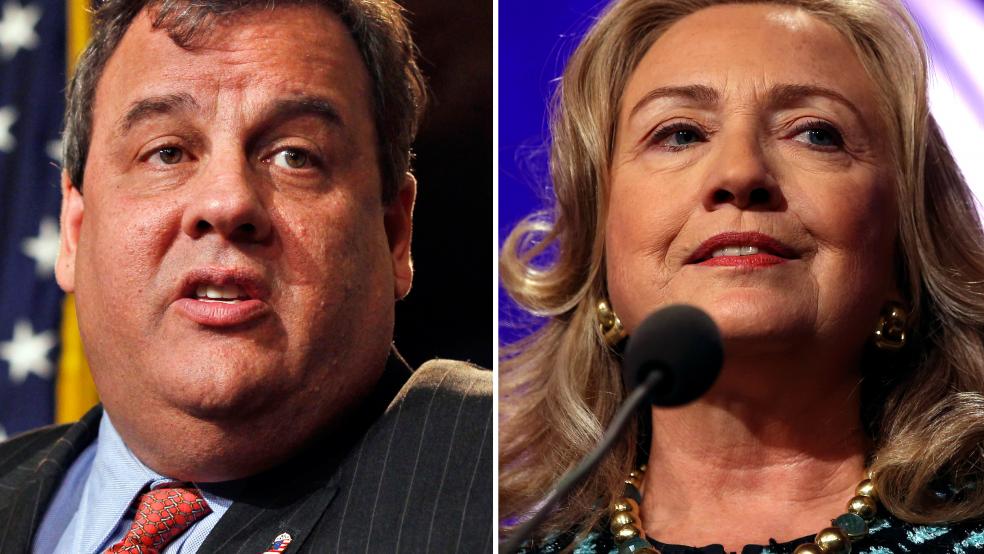

Even before the first ad is aired for next year’s midterm elections, the media has played leapfrog and anointed Hillary Clinton and Chris Christie the odds-on favorites to face off in the 2016 presidential election.

Hollywood has weighed in too, according to “Extra,” with endorsements for Clinton from Oprah and Elton John and Shaquille O’Neal and Jon Bon Jovi.

Now, the American Civics Exchange, a futures market that allows traders and others in financial services to gamble on political outcomes, is taking bets. It uses fake money as it awaits approval from the Commodity Futures Trading Commission (CFTC). ACE has a track record of success; it correctly predicted when the government shutdown would end.

Related: A Republican Who Could Actually Win the Presidency

According to the market, Christie is in the lead to represent the GOP, currently trading at $30 per share. His closest competitor, Paul Ryan, is trading at $11.

On the Democratic side, Hillary Clinton is a surer bet, trading at $67. Her closest competitor, Joe Biden, is trading at $12. (The price of the future correlates to percentage. For instance, a Clinton future worth $67 means that there is a 67 percent chance she'll be the nominee.)

These results track with recent polling. A CNN/ORC International poll held last month found that 24 percent of Independents who leaned right and Republicans favored Christie, with 13 percent pulling for Ryan. The same poll found that 63 percent of Democrats and left-leaning Independents favored Clinton, while 12 percent polled for Biden.

Presidential races are not the only futures the market trades. It predicts who will keep the House and Senate in 2014, giving Democrats a20 percent chance of retaking the House, and a 68 percent change of keeping the Senate.

| Outcome | Prediction (12/25) |

| GOP nominee 2016 | Christie (29%) |

| Dem nominee 2016 | Clinton (64%) |

| Dem Pres 2016 | Yes (66%) |

| Dem House 2014 | No (20%) |

| Dem Senate 2014 | Yes (67%) |

| Obamacare repeal | No (16%) |

| Indiv. Mandate delay | No (1%) |

| Device tax repeal | No (1%) |

| Keystone approval | Yes (66%) |

| Corporate tax cut | No (19%) |

| Govt shutdown in Jan 2014 | No (2%) |

| FDA Forxiga approval | Yes (80%) |

| Bitcoin regulation | No (35%) |

| TPP ratification | Yes (63%) |

| Minimum wage hike | No (40%) |

It also predicts bad news for opponents of the new health care law. On the market, Obamacare only has a 15 percent chance of being repealed, and there's only a 17 percent chance the individual mandate will fail.

For now, anyone can sign up to participate in the market. Each person is given $100,000 fake dollars. According to a report on NextGov.com, some participants have already doubled their fortune to more than $200,000.

Related: 5 Who Could Lead the Republican Party In 2013

"What’s been surprising is how sophisticated a really broad range of our traders are,” Flip Pidot, cofounder of the site, told NextGov. “People have emailed us and told us in forums about policy outcomes they’d like to see us use and they tend to be quite well reasoned."

It's not clear when the CFTC will make a decision whether to allow the exchange to trade real money. If it does, it would allow groups with economic interest in political outcomes to hedge against an outcome that is against their interests.

Getting CFTC approval could be a long shot. On November 26th, 2012 the Commission brought a suit against Intrade, a popular sports betting website that had delved into predicting the 2012 presidential election, for unregulated trading in gold and other traditional commodities. Intrade closed all its US member accounts one year ago and suspended all trading 3 months later.

Related: How the South Won the GOP and Lost the 2016 Election

Whether ACE gets the nod from the CFTC or not, it could influence the polls and the media. For instance, imagine a fake lobbying group called Washingtonians for Better Taxes, a group that advocates for lower taxes for the rich. Now imagine a huge tax reform package that would raise taxes on the rich goes before Congress. The group goes to ACE to determine the likelihood of a plan passing, allowing them to hedge spending based on the probability of the bill passing.

So if the ACE indicates that futures in the tax bill are trading at $51, Washingtonians for Better Taxes might ramp up efforts to get the bill below the $50 threshold, pushing chances of passage below 50 percent. However, if futures in the tax bill are trading at $90, meaning the package has a 90 percent chance at passing, they can ease up on lobbying.

They could also spend their money to rig the outcome.

Top Reads from the Fiscal Times: