In late September, the U.S. Treasury filed its final trading plan to rid itself of its holdings of General Motors (NYSE: GM) stock, signaling the imminent end of one of the most controversial chapters in U.S. corporate history.

The Treasury Department estimates that its final loss on the GM bailout will be $9.7 billion. A few years from now, taxpayers may look back and breathe a sigh of relief that the government got out when it did.

Right now, all seems well, at least on the surface. GM has posted net income of over $1 billion in each of the past four quarters. Its U.S. market share, though a mere shadow of what it was decades ago when the Department of Justice seriously considered breaking up the company, has stabilized at 18 percent.

A review of the GM's more recent SEC filings, though, indicates that the company has sold vast numbers of vehicles to borrowers who have a high chance of defaulting on their loans. Additionally, the financial condition of many of its dealers has suddenly and seriously deteriorated.

Related: 10 Priciest Classic Cars

GM is hardly unique in lending money to consumers with low credit scores. Recent Bloomberg reports have indicated that the subprime auto loan market is growing, and that the industry's underwriters are increasing their loan-to-value thresholds. According to Bloomberg, "borrowers with imperfect credit ... account for more than 27 percent of loans for new vehicles," up from 18 percent four years ago.

GM is relying on subprime borrowers far more than its competitors, though. The company's third-quarter financial report informed investors that "88 percent of the consumer finance receivables in North America were consumers with FICO scores less than 620," which is the “less than perfect" credit threshold for the subprime market. Consumer receivables 31 or more days past due, at $1.075 billion, were 34 percent higher than a year earlier. By contrast, Ford's receivables in that same category dropped by 20 percent during this year's first nine months. [Update: See response from GM below.]

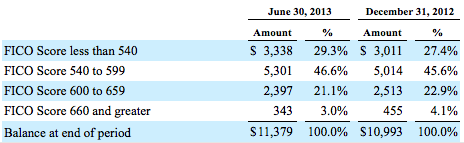

GM appears to be cutting back on its level of disclosure just as things are getting worse. As seen below, its June 30 financial statement went into great detail about the credit scores of its North American borrowers:

In its report for the quarter ended Sept. 30, GM removed these details, replacing them with the terse "under 620" sentence cited earlier.

Industry experience shows that 51 percent of borrowers with credit scores between 550 and 599 will go 90 days or more delinquent. With scores from 500 to 549, that chance increases to 71 percent.

Almost 76 percent of GM's consumer loan portfolio at the end of June, up from 65 percent at the end of 2011, consisted of borrowers who are more likely than not to go seriously delinquent. Though the company's reduced disclosure prevents us from knowing for certain, that percentage was probably higher in September.

Related: Here's an Easy Way to Cut Your Car Insurance Payments

History shows that many delinquent borrowers will go from being behind on their payments to not making them at all. GM is keeping its assembly lines running on a huge gamble that their number won't be significant, and that its losses on the repossessions which do occur will be immaterial. That bet, in turn, depends heavily on a belief that an economy with the worst post-recession recovery since World War II won't flatten out or go back into the tank.

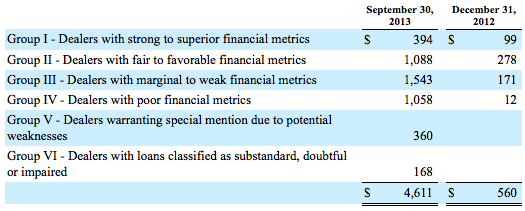

As if it needed more problems, many of GM's dealers have begun showing troubling signs of financial weakness, as seen below:

GM describes these dealer loan balances as "post-acquisition finance receivables" that "originated since the acquisitions of GM Financial and the Ally Financial international operations" in 2010. GM expects this portfolio "to grow over time as GM Financial originates new receivables."

These loans have apparently become a temporary refuge for seriously troubled dealers. In just nine months, "dealers with poor financial metrics" or worse have gone from owing the company $12 million to being in hock for almost $1.6 billion. The obvious question is whether the dealers are good for it. If they aren't, another huge write-off looms. One also has to wonder how much these balances, especially their troubled components, will continue to grow in the coming months.

To be clear, GM, which had over $28 billion in the bank in September, isn't going bankrupt any time soon. But whether it can remain profitable is certainly an open question.

Update and clarification: GM Financial Communications and Investor Relations spokesman Tom Henderson responded to this story in an email that said, in part, that “the story as written would lead the average reader to think that all of GM’s financing operations were handled by GM Financial. Anyone who follows our industry and company closely knows this is not the case. In fact, GM Financial handles only 10 percent of our retail financing transactions in the U.S.” [Emphasis his throughout.]

Henderson also wrote that, as of the third quarter, GM’s overall subprime financing as a share of total retail financing was 7.8 percent, compared to 6.1 percent for the industry. “On a year over year basis, it is also important to note that our subprime financing went down as a percent of our overall financing activities, while the industry went up,” he wrote.

Henderson also took issue with the point that consumer receivables 31 or more days past due had risen 34 percent from a year earlier, to $1.075 billion.

“While the dollar amount of past due receivables increased, the most important statistic to note is past due receivables as a percent of total contract amount due,” Henderson said in his email. “This measure improved significantly year over year, from 7.4 percent to 5.6 percent – a 24 percent decline. The reason is simple – as vehicle volumes have grown in the past several years, so have financing volumes (US industry sold 11.8 million in 2010 and is tracking toward 15.8 million in 2013). The fact that GM Financial past due receivables have dropped as a percent of total contractual amount due is evidence that they are very diligent in applying standards when making subprime loans.”

Tom Blumer responds: GM's disclosure essentially tells us that 88 percent of GM Financial's $19.117 billion in consumer finance receivables (disclosed in Note 4 to GM's financial statements) is due from borrowers with a FICO score below 620. That's about $16.8 billion in financial exposure, or about $16.3 billion after deducting the company's current allowance for losses. Given the track record of consumers with scores that low or much lower going 90 days or more delinquent (per Fair Isaac, the developer of credit scoring), I believe that my contention that GM has taken on significant balance sheet risk is valid.

Mr. Henderson acknowledges that overall subprime retail financing exceeds the industry average by 1.7 percentage points, or 28 percent. Mr. Henderson's contention that we should be comforted by the current lower component of overall balances which are delinquent (5.6 percent at Sept. 30, 2012 vs. 7.4 percent a year ago) is questionable. Rising sales means rising volumes of subprime loans where the consumers involved may not have fallen behind during the earlier months of their loan terms. However, many months remain on most of these loans. Based on Fair Isaac's detailed studies, it would not be a surprise if many of these newer loans to go delinquent during the next year or two — especially if the economy flattens out.

Top Reads from The Fiscal Times: