Until now, the media and consumers have focused mainly on how much monthly insurance premiums will cost individual buyers on the Obamacare exchanges.

Now that the plans are available, there’s a range of premiums—including some relatively low cost options—depending on the age and location of the purchaser, the size of his family, and whether he smokes. Most analyses find that young, healthy consumers will pay higher premiums than those they’re currently paying on the individual market (with richer benefits), while older consumers will find plans with lower premiums than they find now.

Looking solely at the premiums, however, doesn’t give a true picture of a plan’s cost, since many of the low-premium plans come with extremely high deductibles and other out-of-pocket costs.

“Some of the premiums are competitive and lower than we thought they’d be, but those offer relatively skinny benefit packages,” says Caroline Pearson, a vice president with Avalere Health.

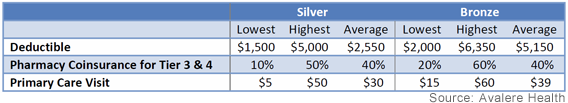

Avalere, a private market analysis firm, studied the out-of-pocket costs for silver plans in six states and found that the average annual deductible, before plan coverage kicks in, was about $2,550, more than twice the average deductible in an employer-sponsored plan. In 2013, 78 percent of single enrollees in employer-sponsored plans had a deductible, with an average value of $1,135 per year.

RELATED: WHY DIVORCE ATTORNEYS WILL LOVE OBAMACARE

Most people who buy insurance on the exchanges are doing so because they’re not eligible for an employer-sponsored plan, so the comparison is not entirely fair. “You’re not getting insurance as generous as what’s available in the average employer plan,” says William Custer, director of the Center for Health Services Research at Georgia State University. “But you are getting more coverage for the dollar than what you can buy on the individual market today.”

And even employers are moving toward high-deductible plans, which shift more of the burden of health care costs to employees. While in 2013, only 17 percent of employers were offering high deductible plans, 44 percent of employers are now considering them as their only option, according to a report by PwC.

Consumers who use high-deductible health plans, purchased either via their employer or through the exchanges, can offset the cost of the high-deductible by setting a tax-favored health savings account.

Bronze-level health plans typically have the lowest premiums and the highest deductibles, which can reach more than $5,000. Some gold and platinum plans have no deductibles at all, although their premiums are much higher.

The Affordable Care Act limits total out-of-pocket spending at $6,350 for individuals and $12,700 for families. Currently, a third of plans available on the individual market have out of pocket costs exceeding that limit, according to a study by HealthPocket. Low-income consumers will get a federal subsidy to offset their premiums and will have lower caps on their deductibles.

RELATED: 5 OBAMACARE PROBLEMS THAT SHOULD HAVE BEEN FIXED

The average consumers will have a choice of more than 50 health plans across the four metal levels, with the average consumer seeing a premium of $328. The majority of uninsured consumers will find premiums worth less than $100 per month, after tax credits and Medicaid coverage, according to the Department of Health and Human Services. About 7 million people are expected to sign up through the exchanges, which launched last week and have been plagued with significant glitches.

Experts say that consumers consider the total costs of their deductible, premiums, other out-of-pocket costs such as copays, and the scope of the healthcare network before making a decision on the right healthcare plan. Many of the bronze health plans rely on coinsurance for prescription benefits, with the most expensive drugs requiring a 40 percent copayment by the consumers.

Consumers with chronic health problems or who take pricey prescriptions might be better served by purchasing a more expensive gold or platinum plan with higher premiums and a low deductible that might cost more upfront but would provide better coverage for their needs.

All plans fully cover preventive care. They must all offer coverage for maternity and mental health services, lab services, emergency and hospital care, but how much is paid by the insurer and how much is paid by the consumer varies by plan.

Young, healthy individuals who rarely go to the doctor might be better off selecting a plan with cheap premiums and high deductibles. These are the individuals that Obamacare architects are most concerned may ultimately opt not to purchase insurance at all. Those who choose not to buy insurance would face a fine of either $95 or 1 percent of their income, whichever is greater. That penalty ratchets up in future years. Experts say skipping out could be a costly mistake.

“Having no insurance is like having an infinite deductible and no financial protection at all against a catastrophe,” says Larry Levitt, a senior vice president with Kaiser Family Foundation.