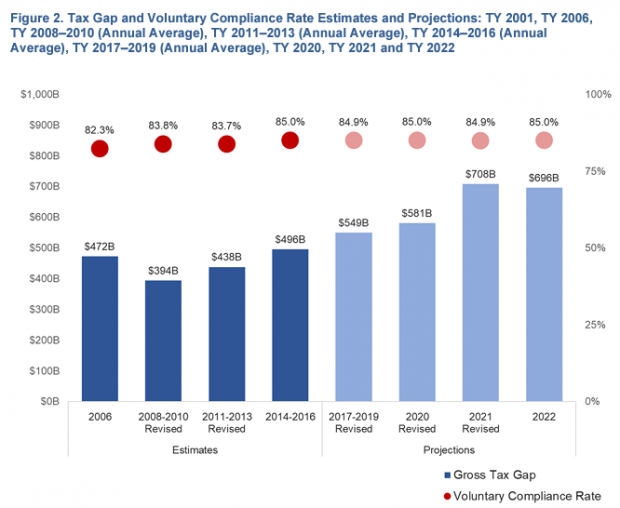

The Internal Revenue Service said Thursday that the tax gap — the difference between taxes owed and paid — was $696 billion as of 2022, the latest year analyzed. The agency projects that the total tax liability that year was $4.635 billion, but just $3.939 billion was paid on a voluntary and timely basis.

“The projected voluntary compliance rate of 85.0% remained about the same, but estimated true tax liability decreased, primarily due to a decrease in capital gains,” the agency said in a report.

The shortfall represents a slight decrease compared to projections of a $708 billion tax gap for 2021 (which was revised up from an initial estimate of $688 billion) — but it still marked notable increase compared with previous years. The projected gross tax gap for 2020 is $581 billion, while for tax year 2017 through 2019 it averaged $549 billion.

The nearly $700 billion 2022 gap includes $539 billion in underreported tax liabilities on returns filed on time, $94 billion in taxes that were reported on time but not paid and $63 billion owed by those who do not file their taxes on time.

Individual income taxes account for most of the annual shortfall, $514 billion. The agency expects $90 billion of the total gap will eventually be paid, leaving a net gap of $606 billion.