A key measure of inflation was flat in October, according to newly released government data, raising hopes that the still-healthy economy can avoid a recession even as inflationary pressure continues to dissipate.

The personal consumption expenditures price index rose 0.0% on a monthly basis in October, the Commerce Department reported Thursday. The same index rose 0.4% in both September and August.

On a 12-month basis, the PCE price index rose 3.0%, the lowest level since March 2021. The same index rose 3.4% on a 12-month basis in each of the three previous months.

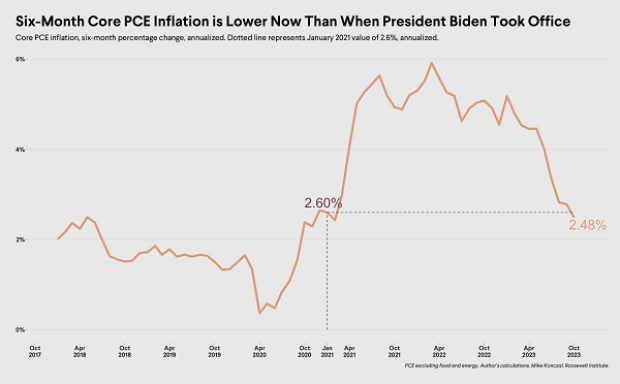

Another key measure closely watched by the Federal Reserve, the core PCE price index – which strips out volatile food and fuel prices – rose 0.2% on a monthly basis, and 3.5% on a 12-month basis. Looking at just the last six months, the core CPE rose at a 2.5% annualized rate – not far from the Fed’s 2% target.

Economist Mike Konczal of the Roosevelt Institute, a left-leaning think tank, noted that on a six-month basis, core inflation is now below where it was when President Joe Biden came into office (see his chart below). “This disinflation is simply unprecedented in the past 60 years,” he wrote. “But the supply shock challenges from reopening were equally unprecedented.”

Former Obama administration economist Jason Furman said the much-discussed “soft landing” scenario, in which inflation falls without a crushing recession or high unemployment, is looking more likely. “I’m later to proclaim it than many others but we're almost at the soft landing,” he said on social media.

Treasury Secretary Janet Yellen cited the same positive scenario. “Signs are very good that we’ll achieve a soft landing, with unemployment stabilizing more or less where it is, or in the general vicinity,” she told reporters.

Yellen also noted that in previous battles against inflation, the Fed had “found it necessary to tighten so much that they flipped the economy into a recession.” Yellen said she hoped that would be avoided this time around. “Perhaps it was necessary in order to reduce inflation and expectations of inflation that became ingrained, but we don’t need that now,” she said.

New York Fed President John Williams said Thursday morning that the central bank will probably hold off on any further interest rate increases. “[B]ased on what I know now, my assessment is that we are at, or near, the peak level of the target range of the federal funds rate,” he said. Williams added that Fed policy is the most restrictive it’s been in 25 years, and it may need to stay that way for “quite some time” to be sure that inflation is defeated.

Williams said he expects the headline inflation rate to end the year at 3%, before falling to 2.25% in 2024.