The red-hot job market added a few degrees of heat in July as payrolls grew by 528,000, the Labor Department reported Friday, smashing expectations and smothering growing concerns about a possible recession.

The unemployment rate fell, too, dropping to 3.5% – tying a 50-year low set in 1969 and touched again just before the pandemic began in 2020.

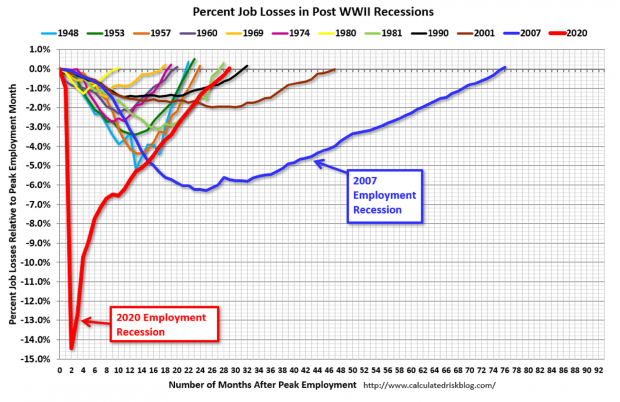

In raw numbers, the economy has now recovered all the jobs lost during the pandemic. Job growth was strong across all sectors in July, though the composition of employment has changed over time, with some industries growing and others shrinking during the last two-and-a-half years. One notable laggard: state and local government employment is still more than half a million jobs below where it was in early 2020.

Recession arguments muted: A growing chorus of analysts had expressed concerns in recent weeks that the economy is in or near a recession, based in part on two consecutive quarterly reports of negative GDP growth this year, but also on the assumption that the Federal Reserve’s campaign against inflation would inevitably cause a slowdown. But today’s report confirms once again the post-pandemic economy (which maybe should be called the late-pandemic economy given the high levels of Covid-19 transmission still being recorded) is odd in many ways, with inflation playing havoc on consumers’ spending patterns and expectations, even as the labor market remains exceptionally tight.

Overall, the jobs report suggests the economy is going strong, despite the negative GDP reports. “Economies in recession do not produce 528,000 jobs on a given month and have 3.5% unemployment rates,” said Joseph Brusuelas, chief economist at RSM. “Thus, claims that the economy fell into recession or is in recession fall flat and should be politely set aside.”

Democrats celebrate: President Joe Biden was happy to take credit for the strong report, saying in a statement that it reflects his “economic plan to build the economy from the bottom up and middle out.”

House Budget Committee chair John Yarmuth also highlighted the positive economic data, saying in a statement: “In President Biden’s economy, more Americans are working than at any other point in American history, wages are rising, and the well-being of working families is the priority. Our economy has created more than 9.5 million jobs since President Biden took office, thanks in no small part to the American Rescue Plan and President Biden’s unprecedented vaccination initiatives.”

But the Fed would like a word: The sizzling jobs report does suggest, however, that the Fed will continue to tighten monetary conditions, much to the disappointment of those who were hoping the central bank was getting ready to ease its campaign against inflation. “The July jobs report blew the doors off expectations,” said JPMorgan’s Michael Feroli. “Today’s numbers should mollify recession fears but amplify concerns that the Fed has a lot more work to do.”

Many analysts noted that wage growth accelerated in July, with average hourly wages rising 0.5% from the month before, equal to a 5.8% annual rate. That rate is still below inflation, meaning workers are actually worse off on average, but is still well above what the Fed was likely expecting or comfortable with, raising the odds that the central bank will deliver another 75-basis-point rate hike in September.

“The most concerning thing in this report is that we didn’t see the expected moderation in wage growth,” Karen Dynan, a former chief economist at the Treasury Department, told The Washington Post. “To be clear, strong wage growth does benefit workers in the short run. But the current pace of wage growth is not consistent with low inflation over the longer run.”

Calling it an “uncomfortably hot jobs report,” former Obama administration economist Jason Furman said it was “nice to see this many jobs added but it is scary about what it means for the size of the adjustment we may have coming.”

The bottom line: Another sizzling job report is good news for working Americans, but makes it that much more likely that the Fed will continue to take aggressive steps to slow the economy in the coming months.