The U.S. economy added a robust 678,000 jobs in February, the Bureau of Labor Statistics announced Friday, in a report that showed stronger-than-expected growth in multiple sectors, including leisure and hospitality, health care and construction.

The unemployment rate fell to 3.8%, the lowest level since the pandemic began, and both the labor force participation rate and the employment to population rate rose.

Wages, however, barely budged, as average hourly earnings increased by just a penny, to $31.58. Though it’s too soon to say, the lackluster wage growth could be driven by the return of more workers to the job market, which could reduce upward pressure on wages.

Here’s a roundup of comments on the report:

Pandemic easing: “Covid is loosening its grip — the virus ruled through fear and that fear is fading. You see that around the country, as people are willing to go back out to jobs that they weren’t willing to take in the midst of the pandemic.” –Austan Goolsbee, who led the Council of Economic Advisers in the Obama administration.

Torrid growth: “We added 678,000 jobs in February, for a total of 7.9 million jobs added since the end of 2020. It’s mindbogglingly fast and sustained growth—well over half a million jobs added per month on average for more than a year.” – Heidi Shierholz of the Economic Policy Institute.

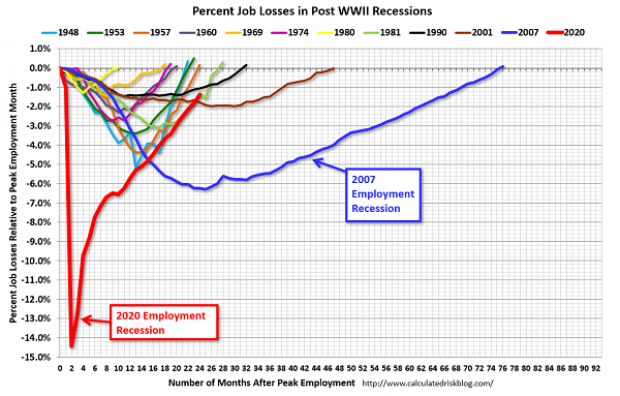

A triumph for fiscal policy: “We are on pace to recover EIGHT YEARS faster than we recovered from the Great Recession. Why do we have such a fast recovery this time around when other recent recoveries have been so weak? That’s because of CARES and ARPA.” – Shierholz again, crediting the $2.2 trillion Coronavirus Aid, Relief, and Economic Security Act and the $1.9 trillion American Rescue Plan Act for the rapid recovery. (See the chart below from Calculated Risk’s Bill McBride to get a sense of both the severity of the initial recession and speed of the jobs recovery.)

But still a ways to go: “Overall, the economy is still 3.5 million jobs and 1.4 million workers short relative to pre-pandemic projections (adjusted for lower than expected population growth), as labor supply continues to fall short of labor demand.” – Jason Furman, who also led the Council of Economic Advisers in the Obama administration.

Another green light for the Fed: “This report is likely to reaffirm recent comments from Federal Reserve officials indicating that they still plan to increase rates at their upcoming March meeting, despite the market volatility stemming from the situation in Ukraine.” – Mike Fratantoni, chief economist at the Mortgage Bankers Association.

Strong growth should continue: “The labor market continues to be quite hot. It looks like the labor market is still primed for lots of strong employment growth.” – Nick Bunker, an economist at Indeed.

But Russia’s invasion of Ukraine could change the picture: “Should that conflict lead to the removal of the 6 million barrels of oil per day that Russia exports—which we think is only days away—from the global markets, with a commensurate surge in oil prices, it is only a matter of time before there is a material change in the pace and composition of hiring in the American labor market.” – Joseph Brusuelas, chief economist at the consulting firm RSM.