Wealthy taxpayers are likely hiding half or more of their non-wage income from the IRS, the U.S. Treasury Department said Thursday as part of a new report detailing the Biden administration’s plans to raise an additional $700 billion in revenues through stepped-up tax enforcement.

The increased tax collections are a key component of President Joe Biden’s plan to pay for his $1.8 trillion American Families Plan, which would boost federal spending over 10 years on a host of social welfare programs, including public education, health care, child care, paid leave and nutrition assistance.

Minding the tax gap: The Treasury estimates that the tax gap — the difference between taxes that are owed and the amount that is actually collected — amounted to nearly $600 billion in 2019. In the absence of any changes in policy, that gap will total roughly $7 trillion over the next decade, representing 15% of all taxes owed.

“These unpaid taxes come at a cost to American households and compliant taxpayers as policymakers choose rising deficits, lower spending on necessary priorities, or further tax increases to compensate for the lost revenue,” the report says.

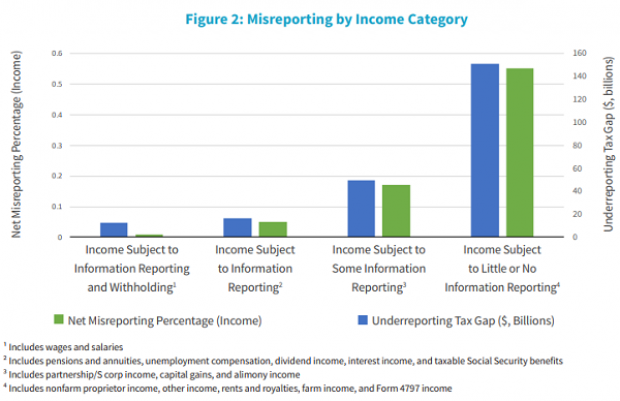

The largest contributor to the tax gap is connected to what the Treasury calls “less visible sources of income” — the billions of dollars that flow through “opaque income sources that accrue disproportionately to higher earners,” such as business partnerships and rental properties.

Unlike most labor income, which is reported directly to the IRS and is very hard to avoid paying taxes on, less visible income is easy to hide. The Treasury estimates that only about 45% of all such income gets reported and taxed, leaving the other 55% to flow into owners’ pockets tax-free.

Closing the gap: In keeping with Biden’s proposals, the report lays out four ways to close the tax gap: rebuilding the IRS, which has seen its budget cut by 20% over the last decade, at a cost of $80 billion over 10 years; requiring financial institutions to report all income flows directly to the IRS; providing modern technology for the IRS to replace systems that date back to the 1960s; and tighter regulation of tax preparers, with more substantial penalties for those who cheat.

According to an analysis by the Treasury Office of Tax Analysis, those measures could bring in an additional $700 billion over the next 10 years — an estimate the report says is on the conservative side. Some of the measures will take time to implement and produce fruit, so the revenues will increase over time, with estimates rising to $1.6 billion over the second decade.

But will the scorekeepers agree? While the Biden administration says it can raise huge sums through better enforcement of the tax code — and some experts have suggested that the Biden analysis is indeed conservative — other analysts have their doubts. “I don’t see any way they get to $700 billion, honestly,” former Congressional Budget Office Director Douglas Holtz-Eakin, now president of the conservative American Action Forum, told Bloomberg. “They should be thrilled to get to $200-250 billion.”

The official Congressional Budget Office estimate could prove critical. While the CBO provided no comment on the new Treasury report, experts say that the agency is unlikely to produce numbers as large as Biden’s if and when it analyzes the president’s proposal. Lower revenue estimates would further complicate an already difficult path for Biden’s plans, making it that much harder to build support among lawmakers looking to avoid passing another deficit-financed spending package.