The economy grew at a 1.9% annual pace in the third quarter, according to preliminary data released by the Commerce Department Wednesday. Although the topline number was better than expected, the report confirms that growth is slowing, down slightly from a 2% annual rate in the second quarter.

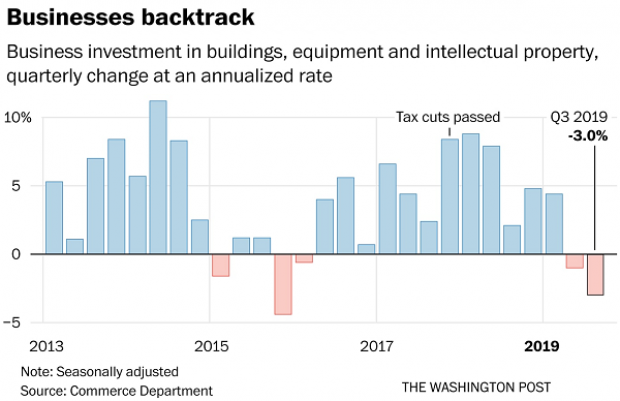

Growth was driven largely by consumer spending, which increased at a 2.9% rate, exceeding expectations. Business spending, however, saw its biggest drop since 2015, with nonresidential investment falling at a 3% annual rate, following a 1% drop in the second quarter.

“It’s the same theme: Strong consumer, weak business,” Michelle Girard, chief U.S. economist at NatWest Markets, told Bloomberg News.

Tax cuts aren’t having much of an effect: The drop in business investment once again raises questions about the 2017 tax cuts. Washington Post columnist Catherine Rampell pointed out that business investment was a key selling point for the GOP tax cuts: “Mechanism by which the GOP tax cut was supposed to supercharge growth was by supercharging business investment,” she wrote Wednesday. “Business investment instead *fell* last quarter, by 3% annualized.”

Ian Shepherdson of Pantheon Macroeconomics emphasized the point, saying the “capital spending numbers were awful and a bit worse than we expected, with structures investment -- oil rigs, offices, factories, commercial premises -- plunging 15.3 percent.”

To be sure, there were many other factors in play, with uncertainty around the Trump administration’s trade war likely playing a big role in suppressing overall investment. But that suggests that one part of Trump economic policy — the trade war — is swamping whatever positive effects might have been generated by another key part of his agenda, tax cuts.

Ernie Tedeschi, a managing director at Evercore ISI who served as an economist at the Treasury Department, said that it looks like the “2017 tax cut didn’t juice investment enough to withstand the trade war.”

Defeat is never an option: President Trump seemed unfazed by the lackluster GDP report, tweeting Wednesday morning about “The Greatest Economy in American History!” Numerous critics pointed out the fallacy of that claim — Politico’s Ben White tweeted, “This is true if you don't include 1934, 1935, 1936, 1937, 1939, 1940, 1941, 1942, 1943, 1944, 1948, 1950, 1951, 1953, 1955, 1959, 1962, 1963, 1964, 1965, 1966, 1968, 1969, 1970, 1972, 1973, 1976, 1977, 1979, 1983, 1984, 1985, 1986, 1987, 1988, 1989, 1992, 1994, 1996-2000, 04, 05” — while others noted that Trump had said the economy was “in deep trouble” when GDP growth was at the same level in 2012 during the Obama administration. Rampell dismissed Trump’s boast, tweeting, “You spent $2T in deficit-financed tax cuts to get us to exactly the rate of growth we had before you were president.”

Boosting the case for tax hikes: The failure of the Trump tax cuts to produce the promised increase in investment and wages could strengthen the case being made by Democratic presidential candidates that Republican fiscal policies have failed and need to be replaced with more a more progressive set of policies, said Greg Ip of The Wall Street Journal.

Multiple quarters of lackluster economic growth “make it easier for Democrats to claim Mr. Trump’s policies have mostly benefited corporations and the rich rather than ordinary workers,” Ip wrote Wednesday. “Massachusetts Sen. Elizabeth Warren has made this case most forcefully, promising to hit big companies with a new 7% corporate tax and the rich with a 2% to 3% tax on wealth over $50 million.”

Ongoing weak economic growth, combined with growing public support for raising taxes on the wealthy, could strengthen the argument that Trump’s tax cuts, at a minimum, need to be undone. “If next year’s election turns on taxes, it’s a fight Democrats are eager for,” Ip said.