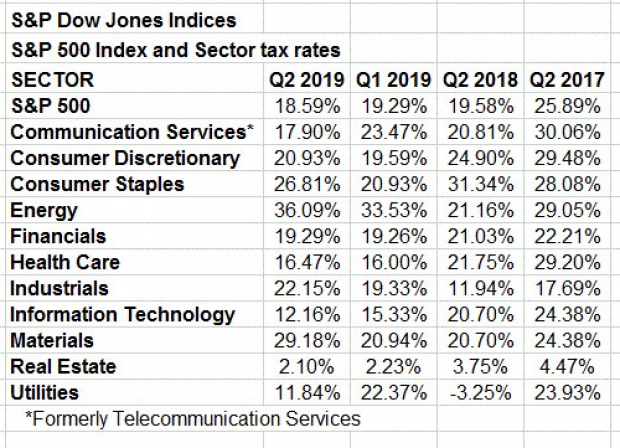

A chart from Howard Silverblatt of S&P Dow Jones Indices shows just how far corporate tax rates have fallen since the Tax Cuts and Jobs Act was passed.

According to Silverblatt's calculations, the average income tax rate for companies in the S&P 500 index was 18.59% in the second quarter of 2019.

In the second quarter of 2017, before the tax cuts took effect, the rate was 25.89%.

On an annual basis, the tax rate for S&P 500 firms was 24.37% in 2017, compared to 17.72% in 2018.