The two-year budget deal passed by Congress and signed into law by President Trump earlier this month lifted spending caps for the next two years imposed under the 2011 Budget Control Act, effectively ended the era of spending restrictions under that law.

The 2011 law called for across-the-board “sequestration” spending cuts as a mechanism to force Congress to pursue other, less indiscriminate deficit reduction measures. Lawmakers failed to agree on a deficit-reduction plan, but nearly all of the sequester cuts were erased in later budget deals.

“The verdict on the law, including from its authors, is stark: it was a colossal failure,” the Associated Press reported last month.

A new analysis, however, a different conclusion — and highlights the hazards inherent in long-term budget projections.

CQ Roll Call Budget Editor Peter Cohn analyzed the impact of the 2011 law and found that discretionary spending did fall “dramatically” — but many of the savings resulted from changes unrelated to the law or actions by Congress, like lower interest rates and troop drawdowns in Iraq and Afghanistan.

In a new CQ Budget podcast, Cohn says that interest payments between fiscal 2012 through fiscal 2021 will wind up being roughly $3 trillion less than the Congressional Budget Office projected before the 2011 law was enacted. “That’s essentially $3 trillion in spending cuts that Congress had absolutely nothing to do with,” Cohn says.

Troop drawdowns in Iraq and Afghanistan saved nearly $1.9 trillion relative to the Congressional Budget Office’s projections before the 2011 law was passed, he adds. And the projected cost of entitlement programs has fallen by some $2 trillion as well, though largely as the result of economic shifts and other changes.

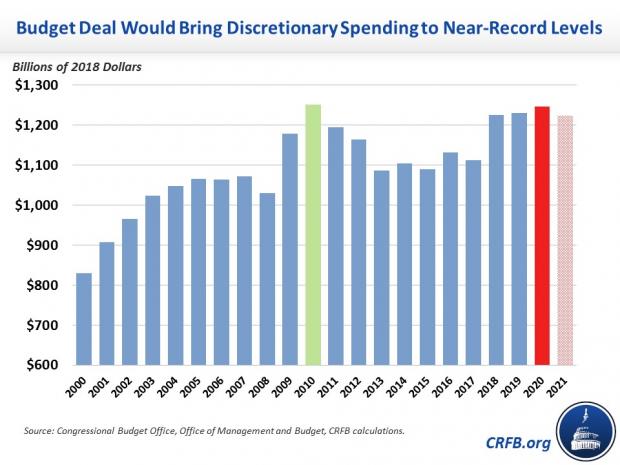

Even without those savings, though, Cohn says the Budget Control Act was “very effective” in cutting spending, at least initially. “There were big cuts to discretionary spending. People forget how much higher the levels were back in 2010,” he says. “With inflation, they’re just back to where they were in 2010 right now, even with all these big spending deals that everybody’s bashing right now.”

Overall, Cohn says, cumulative deficits are down by about $3.5 trillion over a 10-year period compared with 2011 projections — and they’d be significantly lower if not for tax cuts enacted over the past decade. The Budget Control Act was supposed to save $2.1 trillion.