The U.S. economy entered its 120th consecutive month of growth in June, tying the record for continuous expansion set between 1991 and 2001, but the effects of the painful recession that ended in 2009 are still evident in some parts of the country. A new report from Pew Charitable Trusts examines the lingering damage done to state finances during the worst economic crisis since the 1930s.

“Certainly, budget pressures have eased in several ways,” the report says. “But in the aggregate, states still have not fully restored cuts in funding for infrastructure, public schools and universities, the number of state workers, and support for local governments.”

Rising costs for Medicaid and pensions are claiming a larger share of states budgets, and there’s growing concern that reduced spending on other services triggered by the recession may become permanent.

Here some highlights from the Pew report, which you can read in full here:

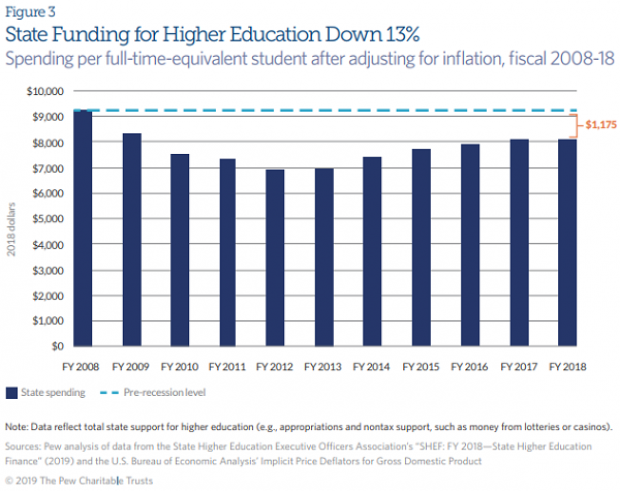

State spending on higher education has not recovered.

Facing revenue shortfalls, many states slashed spending on education in the wake of the recession. The thirds largest component of state budgets, financial support for higher education in 2018 was 13% lower than it was in 2008 on an inflation-adjusted basis. “Many states now rely primarily on tuition revenue from students and their families, rather than state support, to fund public higher education,” the report says. And that shift in funding source may be permanent, with students now expected to cover more of the costs higher education.

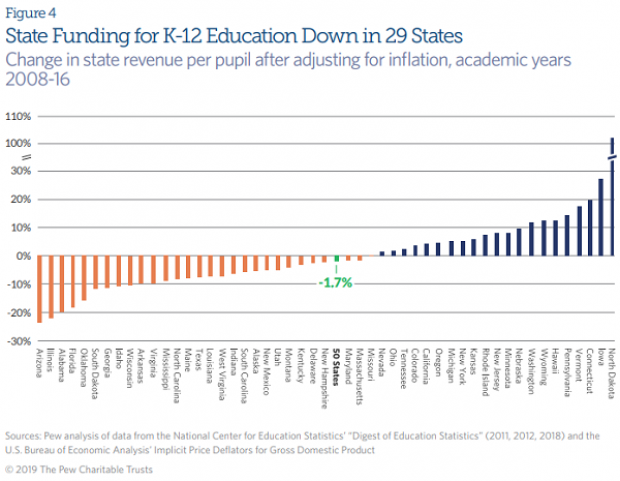

Most states are spending less on elementary and secondary education.

Twenty-nine states spent a lower percentage of revenue on K-12 education in 2016 than they did in 2008 on an inflation-adjusted basis. Overall spending in all 50 states is down nearly $120 per pupil, or about 1.7%.

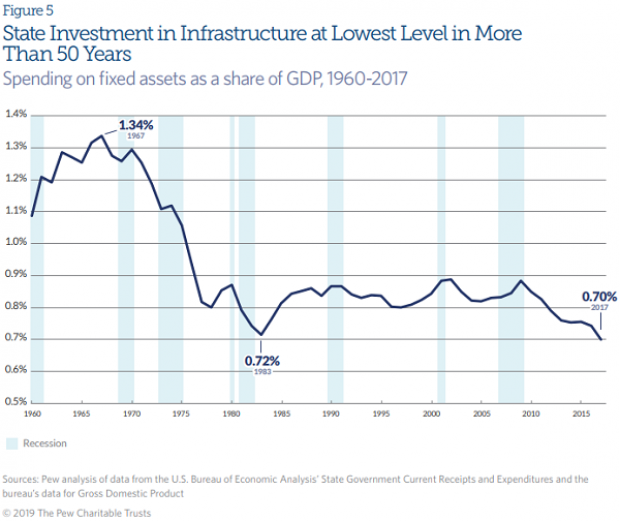

Investment in infrastructure is at the lowest level in 50 years.

Measured as a share of GDP, state spending on infrastructure in 2017 fell to the lowest point in more than half a century. Infrastructure spending dropped by 3.2% in real dollars in the decade following 2007. “States’ declining infrastructure investment relative to GDP is a sign that spending on fixed assets has not kept pace with economic growth,” the report says.

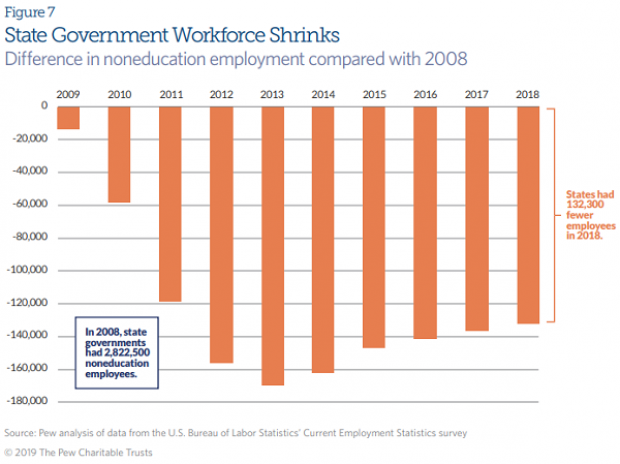

State workforces are smaller.

States shed about 170,000 employees in the five years following the recession, shrinking their workforces (excluding teachers and other public-school staff) through early retirements, buyouts and layoffs. Employment levels have risen since 2013, but are still 4.7 percent, or about 132,000 jobs, from the peak in 2008.

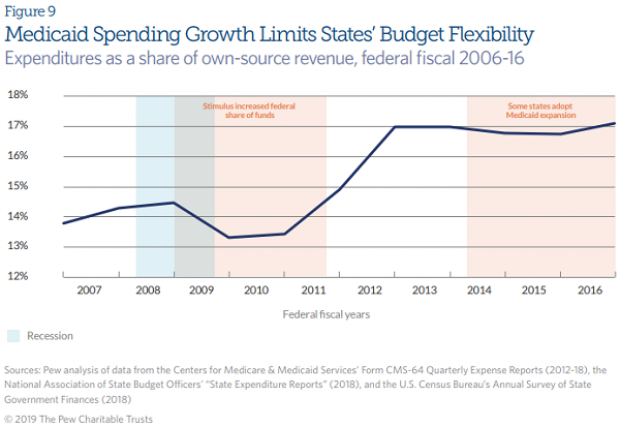

Medicaid costs are rising, putting a strain on spending.

State spending on Medicaid actually fell at the beginning of the recession, due to an infusion of federal stimulus funds that helped states deal with rising enrollments. But Medicaid spending at the state level has been climbing since 2010, and now accounts for a larger share of state budgets than it did a decade ago. “Nationwide, Medicaid expenses accounted for 17.1 cents of every state-generated dollar in 2016, compared with 14.3 cents in 2007, just before the recession,” the report says. And Medicaid costs are projected to grow, with states taking on more of the cost of providing care as the federal government reduces its contribution over time under the Affordable Care Act’s Medicaid expansion. In the long run, “[h]igher Medicaid costs can limit what states have left to fund other priorities, such as schools, transportation, and public safety.”