Tax proposals from several Democratic lawmakers focus their benefits more on lower- and middle-income households and would cost less than the Republican tax bill passed in 2017, according to a new analysis by the liberal think tank Institute on Taxation and Economic Policy.

ITEP reviewed five proposals from Democrats – Sens. Kamala Harris, Corry Booker and Sherrod Brown and Reps. Ro Khanna and Rose DeLauro – and found that the majority of benefits flowed to the bottom 60% of Americans. By comparison, the majority of benefits in the Republican tax cuts were claimed by the top 20% of earners.

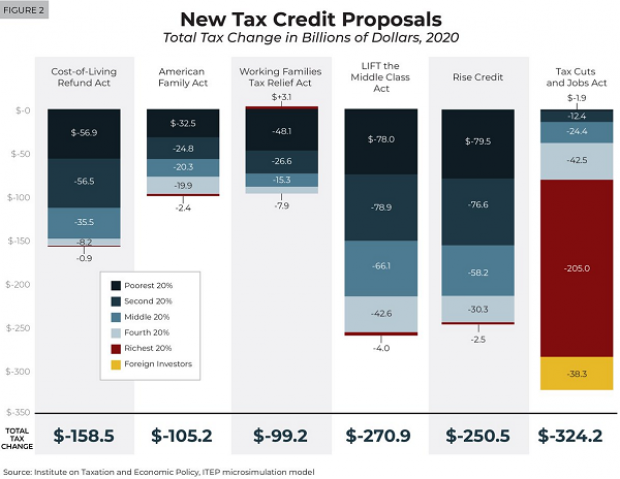

The proposals include Brown’s Working Families Tax Relief Act, which would expand the Earned Income Tax Credit and Child Tax Credit while delivering 91% of its benefits to households in the bottom 60%, at a cost of about $100 billion in 2020, ITEP said, with an average income boost of $610. At the opposite end of the cost spectrum, Harris’s LIFT the Middle Class Act would expand existing tax credits and create new ones at a cost of $270 billion in 2020, with 86% of the benefits flowing to the bottom 60% and an average income boost of $1,660, according to ITEP’s analysis.

ITEP’s Steve Wamhoff said that the Democratic proposals were essentially the opposite of President Trump’s tax overhaul. “There’s nothing in here for investors,” Wamhoff told The New York Times’ Jim Tankersley. “There’s not anything in here for high-income people.”

Tankersley tweeted that, “The plans, quite plainly, reflect very different theories of the economy. Trump cuts took supply-side view that best way to help low/middle-income workers is to cut biz taxes to stoke econ growth.” The Democratic plans, by contrast, use tax credits to directly boost incomes for lower- and middle-income workers.

See the chart below, which is available on ITEP’s site here, for a comparison of how the five Democratic plans, along with the 2017 GOP tax overhaul, benefit different income groups. And read the full ITEP analysis here.