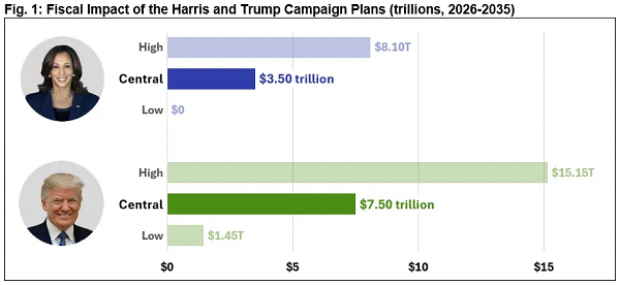

Tax and spending proposals from both presidential candidates would increase budget deficits in the coming years by trillions of dollars, according to a new analysis from the Committee for a Responsible Federal Budget, a nonpartisan group that advocates for debt and deficit reduction. Former President Donald Trump’s plans would raise deficits by an estimated $7.5 trillion over 10 years, CRFB says, while Vice President Kamala Harris’s proposed programs would add about half that at $3.5 trillion.

In recent weeks, Trump has added to his list of fiscal proposals, which now includes the elimination of taxes on tips, overtime pay and Social Security benefits. He also wants to extend the tax cuts provided by the 2017 Tax Cuts and Jobs Act that are scheduled to expire at the end of 2025, and lower the corporate tax rate from 21% to 15% for firms that manufacture products within the United States. Trump says he also wants to spend more on the military, immigration enforcement and assistance for homebuyers. On the revenue side, he has proposed trillions of dollars in new tariffs, while reducing spending on environmental regulations and education.

It's a complicated set of proposals, and to capture the potential effects over 10 years (2026-2035), as well as the inherent uncertainty involved in making long-term projections, the CRFB analysts provide a range of cost estimates, which include both revenue losses and gains over time. In its low-cost estimate, in which savings are maximized, CRFB says Trump’s proposals would increase deficits relative to the current baseline by $1.5 trillion over a decade. In its high-cost estimate, in which costs are maximized, Trump’s proposals would increase deficits relative to the current baseline by $15.2 trillion. The central estimate between the two extremes is $7.5 trillion — which includes $10.2 trillion of deficit-increasing measures, $3.7 trillion of deficit-reducing measures and $1 trillion of interest costs.

Harris’s plans include expanding the Child Tax Credit and the Earned Income Tax Credit, boosting health care subsidies under the Affordable Care Act, providing new subsidies for first-time homeowners, expanding access to preschool and child care, establishing national paid family and medical leave, extending the 2017 tax cuts for households earning less than $400,000 a year and exempting tips from federal income taxes. On the revenue side, her proposals include raising the corporate tax rate from 21% to 28%, raising taxes on investment income, and reforming international tax rules.

The low-cost estimate for Harris’s plan is $0 — that is, her revenue increases would cover her higher spending. At the high end, Harris’s plan would cost $8.1 trillion, while the central estimate comes to $3.5 trillion — $7.3 trillion of deficit-increasing measures, $4.3 trillion of deficit-reducing measures and $500 billion of interest costs.

Debt keeps growing: The estimates for both Trump and Harris are in addition to the current projections for the budget deficit, which is expected to add up to about $22 trillion over the next decade under current law. Those accumulated deficits would help push the debt-to-GDP ratio, which currently stands at 99%, to 125% by 2035. Under the central cost estimate for Harris’s proposals, debt-to-GDP would rise to 133%, while for Trump, it would climb to 142%.

The analysis suggests that Harris’s proposals would likely produce a significantly smaller increase in the deficit than Trump’s, and this result is consistent with other analyses from groups including the Budget Lab at Yale and the Penn Wharton Budget Model. However, neither presidential candidate has a plan to shrink debt and deficits over time. “Debt would continue to grow faster than the economy under either candidates’ plans and in most scenarios would grow faster and higher than under current law,” the report says.

Budget

Trump Would Increase Deficits by $7.5 Trillion, Harris About Half That

Reuters