Amid the controversy over the tax refunds the IRS is paying out this year, new research from the JPMorgan Chase Institute underscores the important role tax refunds play in the financial lives of millions of American families. Examining roughly 1 million bank accounts that received or paid taxes between 2015 and 2017, analysts found that tax-related transactions had “a significant and long-lasting impact on spending and saving patterns” for many households.

Here are some key findings from the report:

- About 80 percent of families in the study received one or more refunds and made no payment, while only 8 percent made payments.

- Families that received refunds had lower average take-home incomes ($49,992) than families that made tax payments ($71,091).

- Tax refunds were worth nearly 6 weeks of take-home pay on average ($3,602) in households that received them.

- Tax payments were worth roughly 2.5 weeks of take-home pay on average ($2,923) in households that made them.

- Families receiving refunds started spending them quickly, with most (72 percent) of the money spent within 180 days. At the same time, refunds had a lasting impact, with most accounts still above their pre-refund baseline six months later.

- In the week following receipt of the rebates, families increased spending on durables goods (101 percent above baseline), credit card balances (85 percent above baseline) and cash withdrawals (164 percent above baseline).

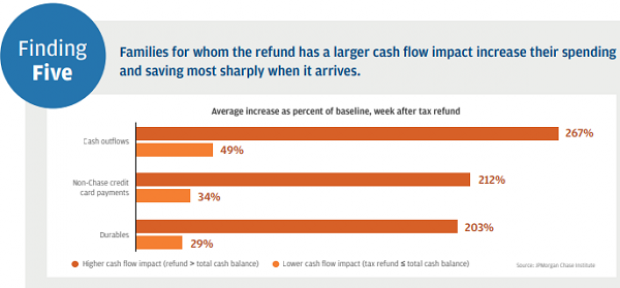

Tax refunds had a much bigger impact on families receiving large payments relative to their cash holdings (see the chart below). For these families, cash withdrawals, credit card bill payments and purchases of items like cars, appliances and electronics more than triple in the week after the first tax refund is received, the report said.

Why it matters: The report shows the extent to which American families use the tax system as a way to build up lump sums of cash. Those lump sums then play an important role in how families spend and save in the following weeks, and the effects can last for months.