The Congressional Budget Office projected last month that the federal budget deficit for this year would be about $900 billion, up 15 percent from last year but about $84 billion less than it had previously forecast.

Similarly, Goldman Sachs just trimmed its deficit projection for 2019 — though it says the deficit will be higher than CBO expects.

In a new note to clients, Goldman economist Alec Phillips projects that the 2019 deficit will be $950 billion (4.5 percent of GDP), down from a previous forecast of $1 trillion.

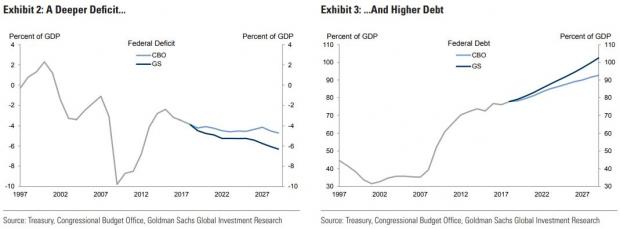

Goldman still says the trajectory of the debt “remains problematic,” with the deficit likely topping 6 percent of GDP by 2029 and the federal debt likely to surpass 100 percent of GDP by then. The bank notes that CBO’s deficit outlook for each of the next four years, while slightly improved over recent months, is still nearly 1 percent of GDP larger than it was two years ago.

“The main source of the deterioration continues to be a lower projected level of individual and corporate tax receipts following enactment of the 2017 tax law, and to a lesser extent the increase in discretionary spending that Congress enacted in 2018,” Phillips writes.

And while CBO’s baseline forecast said that the deficit wouldn’t hit $1 trillion until 2022, Goldman sees it passing that mark next year. “Over the next couple of years, we expect Congress to raise spending caps and to extend various expiring tax and health provisions, which accounts for most of the difference between our estimates and the CBO baseline,” Phillips explains.

Phillips also notes that actual federal spending has come in shy of the expected increases. While Congress boosted spending in 2018 and 2019, a significant portion of the allocated funding has not been spent, especially in the non-defense portion of the budget. “One potential reason for this might be the lack of federal net hiring; while the federal hiring freeze President Trump announced shortly after taking office has officially ended, federal non-defense employment is [8,000] lower than it was at the time of the announcement,” he writes.

Phillips also notes that the rising deficit doesn’t appear to be a priority for either party — or for the American public at the moment. “While this is likely to change eventually,” he writes, “there is little indication that political leaders will take proactive steps to reduce the deficit through tax increases or spending cuts in the next few years.”