Alexandria Ocasio-Cortez, the youngest woman ever elected to Congress, has wasted no time in making waves in Congress, emerging as a focal point for the national press — and social media powerhouse to boot.

Her first speech from the House floor, delivered on Wednesday, set a minor record by becoming C-SPAN’s most-watched Twitter video of remarks by any member of the House. (“It is actually not about a wall, it is not about the border, and it is certainly not about the well-being of everyday Americans,” the 29-year-old congresswoman said of the shutdown. “The truth is, this shutdown is about the erosion of American democracy and the subversion of our most basic governmental norms.”)

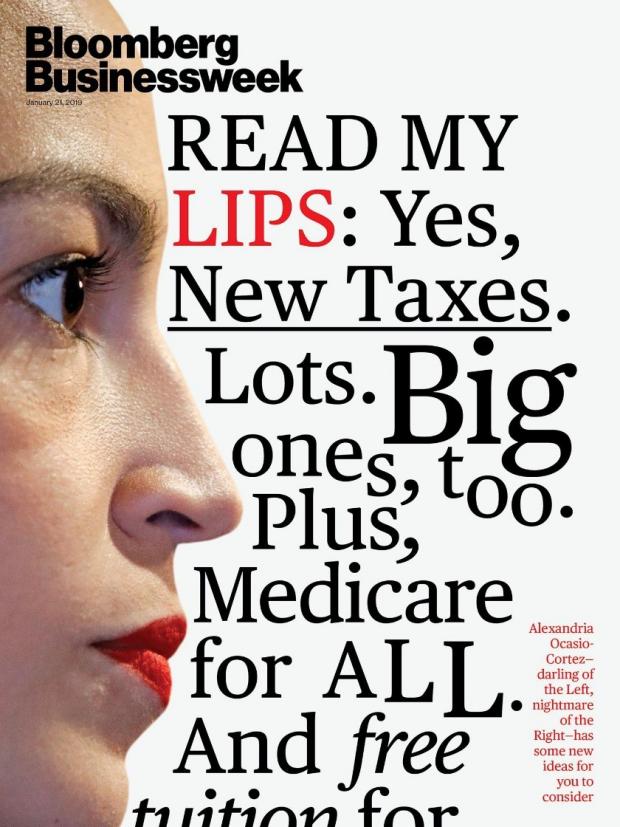

Ocasio-Cortez is also on the cover of Bloomberg Businessweek (“READ MY LIPS: Yes, New Taxes. Lots. Big ones, too. Plus, Medicare for ALL.”) The cover story by Peter Coy and Katia Dmitrieva looks at how Ocasio-Cortex has already changed the conversation around tax rates and the deficit, among other things. “What Ocasio-Cortez understands is that getting an idea talked about, even unfavorably, is a necessary, if insufficient, step on the path to adoption,” the authors write.

20190118_BW-AOC.jpg

Some fiscal highlights from their piece:

On her proposal to raise the top marginal tax rate to 70 percent: “Seventy percent! For perspective, the top rate under the tax law that passed in December 2017 is 37 percent. And now, suddenly, a number so extreme that no one in polite society dared utter it became a focal point of debate. Ocasio-Cortez’s fans—she has 2.4 million followers on Twitter alone—loved it. Some pundits dug up economic research defending rates in the 70 percent range. Others pointed out that Ocasio-Cortez was actually lowballing the historical comparison: Top rates were 90 percent or higher as recently as the 1960s. Defenders of low tax rates heaped abuse on her, which backfired on them by inflaming her supporters.”

On budget deficits: “To pass any of their initiatives, Ocasio-Cortez and her allies will have to defeat the proven Republican strategy of using budget deficits as a justification for opposing new spending. That’s where Modern Monetary Theory comes in. It says a government can spend money without raising taxes—indeed, without even borrowing from the public via bonds. The government simply creates new money to pay its bills. The only constraint on spending under MMT is that the government could use up too much of the nation’s productive capacity, which would result in high inflation. As long as inflation remains low, as it is now, deficits are no problem. The usual reply from other economists is that even a nation that owes debt in its own currency can suffer a crisis if investors lose faith in its ability to service the debt without resorting to the printing press.”