The IRS released its inflation adjustments for the 2019 tax year this week, which include new brackets and limits on deductions and exemptions. A few highlights:

- The standard deduction for single filers in 2019 will be $12,200 (up from $12,000 in 2018); $24,400 for married couples filing jointly (up from $24,000); $18,350 for heads of household (up from $18,000).

- The Alternative Minimum Tax exemption amount will be $71,700 (up from $70,300) and begin to phase out at $510,300 (up from $500,000); for married couples filing jointly, the AMT will be $111,700 (up from $109,400) and begin to phase out at $1,020,600 (up from $1 million).

- The maximum Earned Income Credit amount will be $6,557 for taxpayers filing jointly who have three or more qualifying children (up from $6,431).

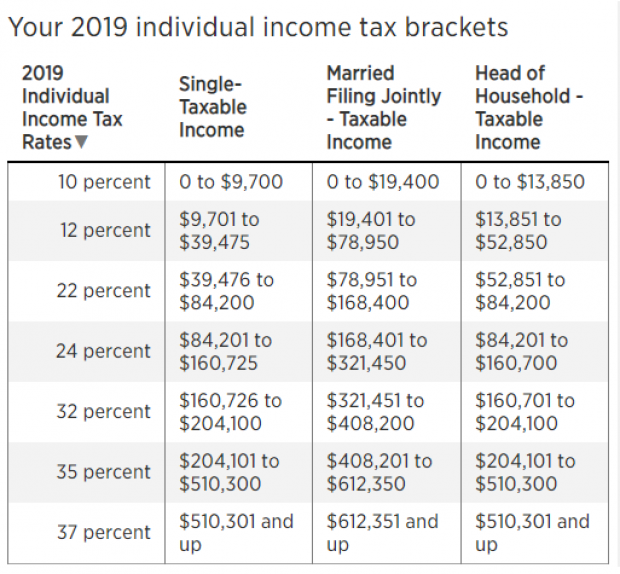

Here’s a summary of the individual tax brackets for 2019, via CNBC: