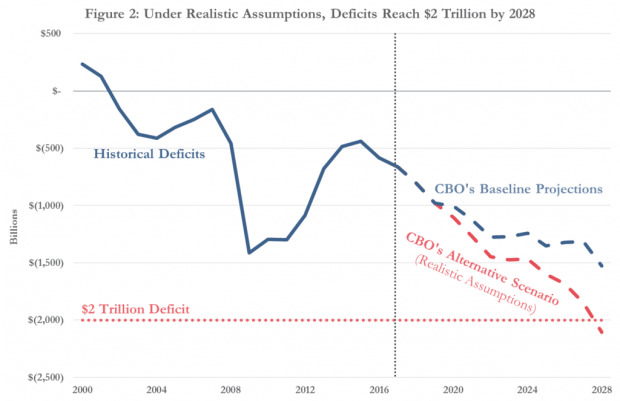

The Congressional Budget Office confirmed this week that the deficit is on pace to surpass $1 trillion in 2020 and climb higher from there barring action by leaders in Washington, potentially reaching $2 trillion by 2028.

The deficit outlook is unusual for this stage of an economic cycle. “Normally, this type of troubling fiscal picture is the temporary result of an economic downturn, but this time, the indefinite expansion of the nation’s debt comes deep into an economic expansion, when debt (as a share of the economy) is usually stabilizing or on a downward path,” the Bipartisan Policy Center’s Shai Abbas, Tim Shaw and Jack Rametta write in a new analysis.

Does it matter? The yield on 10-year Treasuries, now hovering just above 2.8 percent, doesn’t indicate imminent crisis or panic, even though it has risen significantly in recent months. But the Bipartisan Policy Center’s analysts offer three reasons to be troubled by the impending trillion-dollar deficits:

- First, rapidly expanding debt will depress economic growth over time and could potentially lead to a fiscal crisis if borrowers lose faith in the country’s ability to repay.

- Second, rapidly increasing debt constrains the government’s ability to effectively respond to emergencies, such as recessions, wars, or natural disasters.

- Third, as government debt grows and interest rates rise, interest payments on federal debt will exponentially increase and will make up a growing portion of federal spending, crowding out priorities like defense, investment, and safety net programs.

Read the full BPC analysis here.