The U.S. government could spend more paying interest on its debt than it does on Medicaid by 2021 and the cost of debt service could surpass defense spending by 2024, according to a newly published analysis by the Committee for a Responsible Federal Budget.

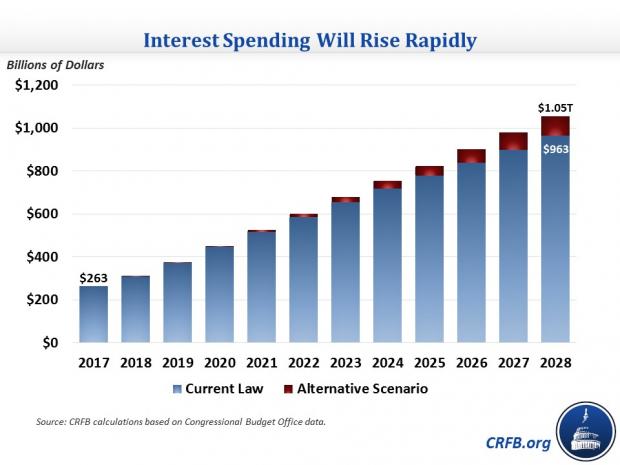

The analysis acknowledges that federal interest payments have been low by historical standards in recent years, as historically low interest rates have kept debt service costs in check even as the national debt grew. Last year, the federal government spent $263 billion on interest, or 1.4 percent of GDP, compared to an average of 2 percent of GDP over the past half century.

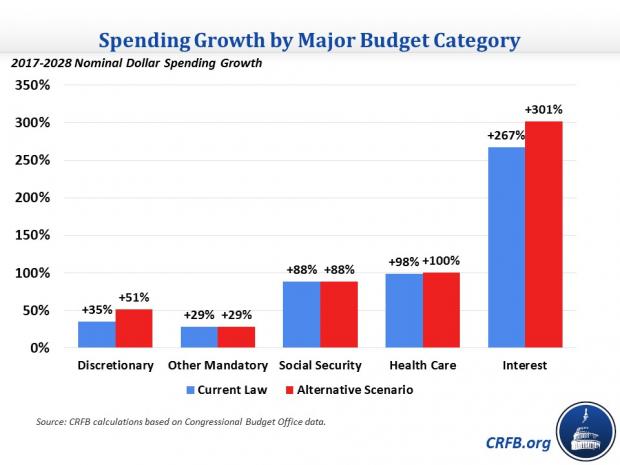

But, the budget watchdog group warns, interest on the debt is the fastest growing part of the federal budget, and the tax cuts and spending deals recently passed by Congress will speed that growth. As a result of rising deficits and higher interest rates, CRFB says, interest costs will almost quadruple in dollar terms and reach 3.3 percent of GDP by 2028, the highest level ever.

The $965 billion in interest payments CRFB projects for 2028 would be some $265 billion more than Congress approved for defense spending this year.

If temporary spending increases and tax cuts are made permanent — see President Trump’s comments about a “phase two” for tax reform— interest spending would climb even higher, to $1.05 trillion, or 3.6 percent of GDP.