Now that the Senate has passed its version of the GOP tax bill, the next step is for the two chambers of Congress to iron out their differences in conference to create a final piece of legislation for President Trump’s signature. While there’s currently little doubt that the conference members from the House and Senate will be able reach an agreement, the issues at stake are substantial and involve revenues worth hundreds of billions of dollars. They also touch upon vital political issues, such as the stability of Obamacare and the status of the individual tax cuts.

Like what you're reading? Sign up for our free newsletter.

Here are some of the key differences that must be resolved before Congress can deliver a tax bill to the White House:

- Phase-out of individual tax cuts: Many of the tax cuts for individuals expire at the end of 2025 in the Senate bill but are permanent in the House bill. The sunsetting of the individual rates in the Senate version is driven by the deficit restrictions imposed by the Byrd Rule; if the individual cuts are to be made permanent, the conference committee will need to find some other way to eliminate deficits beyond the 10-year budget window, as required by Senate rules.

- Timing of corporate tax cuts: The Senate bill delays the reduction of the corporate tax rate to 2019, while the House version takes effect in 2018.

- Alternative minimum tax (AMT): Killing the AMT has long been a Republican goal, but, as part of last-minute changes to raise revenue, the Senate bill was rewritten to leave the existing corporate AMT in place and retain the individual AMT but with a higher exemption amount. The tweak could have unintended consequences, with some experts warning that it undermines a tax credit for research and development that’s vital to some businesses.

- Pass-throughs: The bills treat pass-through businesses differently, and while the rules are quite complicated, the politics could prove even more so. Lawmakers in both chambers see this as an essential issue and have strong opinions on how it should work, and this issue has potential to become a sticking point.

- Obamacare mandate repeal: The Senate bill’s repeal of the Obamacare mandate saves about $318 billion over 10 years but threatens to destabilize the individual markets, resulting in higher premiums and millions fewer people with health insurance. While House Republicans aren’t likely to balk at including repeal in the final bill, it could still be a problem for Sen. Susan Collins (R-ME), a pivotal vote in the upper chamber, whose support for the final package could depend on Congress’s treatment of separate measures designed to stabilize the Obamacare markets.

- Estate tax: The Senate bill doubles the estate tax exemption to $11 million for individuals and $22 million for couples. The House bill doubles the exemption for six years, and then repeals it entirely.

“We expect the final structure of the bill to reflect more of the Senate bill than the House bill, including a 20% corporate tax rate effective in 2019, the Senate’s more restrictive limit on net interest deductibility, and the Senate’s treatment of pass-through income,” Goldman Sachs economists wrote to clients Sunday.

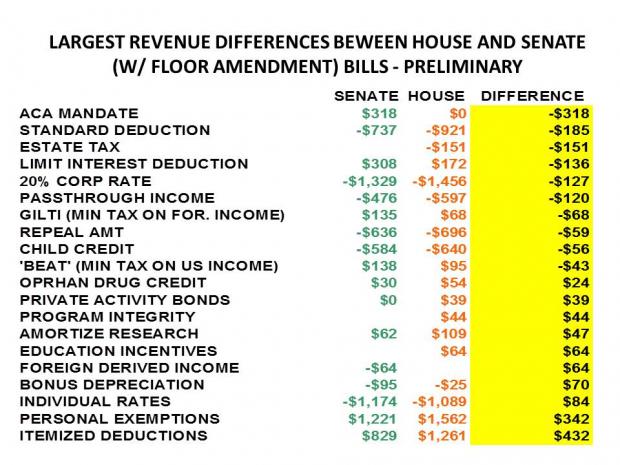

This chart from Martin Sullivan of Tax Analysts provides an overview of the differences between the two bills and the money at stake: