One way or another, Senate Majority Leader Mitch McConnell (R-KY) and House Speaker Paul Ryan (R-WI) appear determined to clear the decks of the health care controversy in the coming week or two before turning their attention to tax relief this fall.

McConnell’s effort to muster at least 50 Republican votes to pass his GOP leadership plan to repeal and replace the Affordable Care Act looks increasingly looks like a losing hand, with moderates complaining that it goes too far in gutting Obamacare and Medicaid while conservatives complain that it doesn’t go far enough.

Related: McConnell Tries Business as Usual Amid a Trump Team Disaster

The White House and GOP congressional leaders expect much smoother sailing this fall when they seek to enact the centerpiece of their agenda -- the first major reform of the federal tax code since 1986, including deep cuts in corporate and individual rates.

But there still is the matter of Republicans finally resolving their differences over a controversial border tax proposal favored by Ryan and House Ways and Means Committee Chair Kevin Brady of Texas but vigorously opposed by Trump and Treasury Secretary Steven Mnuchin.

And just as the health care debate will ultimately turn on questions of cost and the distributional effects of reducing health care benefits and repealing an array of Obamacare taxes, the fight over tax policy this fall will largely come down to a bare-knuckle brawl among special interests to determine economic winners and losers.

In the latest independent analysis of Trump’s emerging tax plan, the Urban Institute & Brookings Institution Tax Policy Center projected that the president’s proposals could reduce federal revenues by as much as $7.8 trillion over the next decade. Much of that would be due to sharp reductions in tax rates and elimination of a slew of long-standing, onerous tax measures like the Alternative Minimum Tax

Related: How Trump’s Tax Cut Plan Would Blow Up the Deficit

Trump has floated ideas for offsetting as much as half of his individual and business tax cuts by closing many loopholes and eliminating deductions. Even then, however, the Trump plan would add $3.5 trillion to the federal debt over the coming decade, according to the new Tax Policy Center analysis.

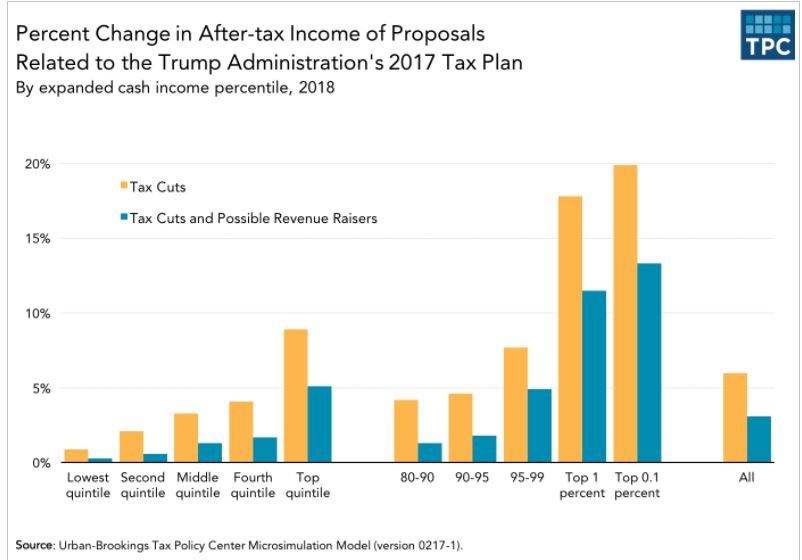

Without those revenue-raisers to blunt the effect of Trump’s proposed tax cut, nearly all U.S. households would receive a tax reduction that averages about $4,400, according to the new report written by economist Howard Gleckman of the Urban Institute. However, the tax cuts would be “highly regressive,” according to the analysis, with high-income people getting far more than those with low or middle incomes.

“While we don’t know [precisely] what tax plan the president will propose in the coming months, it would have to look very different from what we’ve seen so far to avoid adding trillions of dollars to the debt and heavily skewing its benefits to the highest-income households,” the report states.

The Tax Policy Center experts didn’t set out to analyze an actual Trump tax plan since there still isn’t a fully-formed proposal to assess. Rather, the analysis attempts to provide “perspective” on what such a proposal might look like—with and without revenue raisers.

Related: The Best and Worst States for Taxes in 2017

First, the center analyzed the tax cuts that Mnuchin and National Economic Council Director Gary Cohn outlined in April on a single piece of paper, and plugged in key assumptions to fill in unspecified details. For example, the think tank assigned income ranges to the proposed tax brackets – something the administration failed to do.

- If the tax cuts were implemented with no offsetting measures, the lowest-income 20 percent of households earning $25,000 or less would see their average after-tax income increase by a mere $130 – or about one percent.

- Those in the middle-class making between $50,000 and $86,000 would see their after-tax income rise an average of about $1,900 a year, or about three percent.

- However, those Americans in the top 1 percent – the elites making more than $732,000 a year – would realize an average tax cut of $270,000 or nearly 18 percent of their after-tax income.

“Those in the top 0.1 percent would see their after-tax incomes go up by an average of $1.4 million or nearly 20 percent,” according to the analysis. “Forty percent of the benefits would go to the top 1 percent.” That stands to reason since data from US income tax returns show that households making $250,000 or more a year pay 51 percent of all income taxes annually.

In a nutshell, this is what the Trump administration’s plan would do:

For individuals, the plan would consolidate the tax rates into three levels of 10 percent, 25 percent, and 35 percent. It would also repeal the Alternative Minimum Tax, the estate tax, and the Obamacare 3.8 percent net investment income tax.

Finally, the plan would double the standard deduction, and provide tax relief for families with child and dependent care expenses.

Related: Here’s What a Bipartisan Health Care Deal Might Look Like

Meanwhile, for businesses, Trump would lower the top income tax rate from 35 percent to 15 percent for both corporations and so-called “pass-throughs,” such as partnerships and sole proprietorships. It would also create a territorial system of taxing foreign income along with a one-time tax on un-repatriated foreign earnings.

In striving for new tax reforms that are “revenue neutral,” Trump and his advisers are also proposing to repeal all itemized deductions except those for charitable giving and mortgage interest; and repeal personal exemptions and certain business tax preferences.

A lot of the administration’s upbeat projections of the long-term effects of its proposals involve rosy economic scenarios. For instance, Trump’s proposed fiscal 2018 budget optimistically projects that his tax and spending policies will wipe out the deficit in ten years by generating $2.1 trillion in additional revenue through stronger economic growth of 3 percent or more of GDP.

But critics insist that the administration is double-counting their projected savings. And the Committee for a Responsible Federal Budget, a prominent government watchdog, has estimated that Trump’s plan to slash corporate and individual tax rates would cost the federal government about $5.5 trillion over ten years.