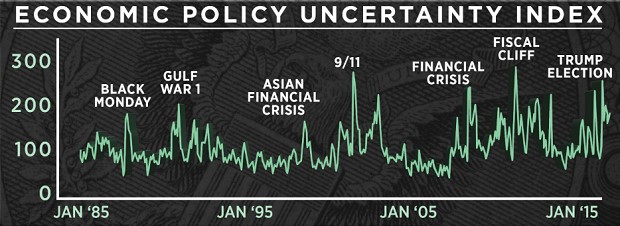

From the standpoint of creating economic uncertainty, the election of Donald Trump has been more tumultuous than the 1987 stock market crash and the 2008 financial crisis.

Judged by the Economic Policy Uncertainty Index — devised by economists from Stanford, the University of Chicago, and Northwestern — the election of President Trump stands as the third-biggest source of uncertainty in the index's 30-plus-year history. It is eclipsed only by the 9/11 terrorist attack and the battle over the fiscal cliff in 2011 in terms of generating doubt about future economic policy.

Related: How Far Could Stocks Fall Amid Trump Turmoil?

While the EPU index has come off its high from the November election, it remains elevated, coming in month after month of the Trump presidency well above its long-run average.

Increases "in policy uncertainty foreshadow declines in investment, output, and employment in the United States," the three professors who created the index wrote in a 2016 paper. The index was created in 2011 by Scott R. Baker of Northwestern University, Nicholas Bloom from Stanford University and Steven J. Davis, of the University of Chicago.

The index measures the occurrence in newspaper articles of words related to economic uncertainty and politics, including the Federal Reserve, Congress and the White House. It also gauges the number of expiring tax laws and the spread among economic forecasts, suggesting that a greater dispersion of forecasts suggests more uncertainty. If nothing else, it has accurately pointed out the moments of major economic turmoil of the past three decades.

The index's creators do not argue that it means recession necessarily follows. They only say there is a measurable economic effect from uncertainty and urge lawmakers to keep that in mind as they make decisions, for example, to shut down the government over deficit battles.

The trouble for the president is not that the index spiked from his election. It's that uncertainty has remained elevated since then and shows little sign of abating. The latest data from April shows the EPU at 183, up from 161 in March. That's above the index's long-run average of 110 and the 134 average of the Obama presidency.

Related: Why Trump and the GOP Are Headed for a Health Care Meltdown

To be sure, the three-month average for the Trump presidency is just somewhat above the average of the first three months of Obama, except that also coincided with a major financial panic. And while the index has run at or above the level of uncertainty created by the 1987 stock market for most of Trump's presidency, the stock market itself rallied strongly with his election, though it has traded mostly sideways since last February.

The difficulty for the president appears to be that the economic uncertainty surrounding his presidency comes from several sources. The daily index spiked twice in the past week with allegations the president had divulged secrets to the Russians and allegations that he may have interfered with an FBI investigation. Interestingly, the firing of FBI Director James Comey barely registered in the index.

But a second source of uncertainty appears to be the extent of the president's economic policy agenda and how he has gone about it. Reforming the tax code, even if it's for the better, is no easy task and is bound to come along with heightened economic uncertainty. But it's been wrapped inside a chaotic process of health-care reform and a major effort to rework the nation's principal trade agreements. So far, the president has only released a single page detailing his tax plan.

By contrast, the index remained relatively muted in 2001 as President Bush gained passage of his sweeping tax reform just a few months after taking office in a bitterly contested election.

Related: The Trump-Russia Investigation Could Clog Up DC for Years

The latest word from the Trump administration is that tax reform may not be proposed until August, and many on Wall Street don't see it happening until early next year — promising many more months of tax policy uncertainty.

If there's a message from the EPU it is not that the president shouldn't do tax reform. It's that he should do it in a way to minimize economic uncertainty. That could mean getting it done as quickly as possible, but it could also mean doing so in as bipartisan a way as possible.

Short-term, Democrats could help speed passage if given incentive to come to the table. Longer-term, a bipartisan tax reform bill is more likely to help the economy most because it makes it less likely that Democrats, should they come back to power, would be prompted to once again launch another uncertainty-filled effort to … reform the tax code.

This article originally appeared on CNBC. Read more from CNBC:

This sell-off will only turn into a correction if Trump's scandals put tax reform at risk

Alphabet hires Obama's FDA chief to help run huge health study

Amazon is the most disruption-proof big tech company, venture capitalist Fred Wilson says