By one estimate, state and local governments spend at least $45 billion a year on tax breaks and other incentives to lure or keep job-producing businesses and plants in their jurisdictions.

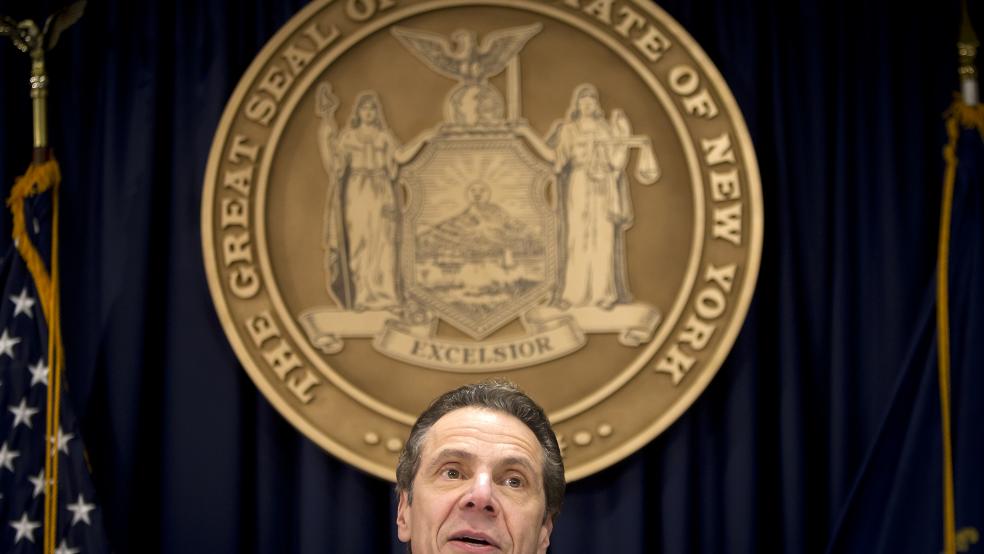

New York, for example, plows billions of dollars into the Empire State Development Corp. and Democratic Gov. Andrew Cuomo’s signature Start-Up NY program. For more than three decades, Florida has offered an array of tax incentives to businesses that locate, invest, and hire in the state’s distressed areas through an initiative called the Enterprise Zone Program.

Related: The Growing Funding Gap for State Pensions Puts Millions at Risk

Colorado provides as much as $4 billion a year in economic incentives and deals to enhance the state’s economy. And Michigan once dangled highly lucrative incentives to attract major Hollywood stars and top directors to make such movies as “Batman v. Superman” and “Red Dawn” before GOP Gov. Rick Snyder pulled the plug on the venture in 2015.

But while these tax credits, exemptions, and property tax abatements are popular tools to create jobs, attract new businesses and strengthen the local economy, they also constitute high-risk investments that can squander billions in tax dollars without always paying off.

A new study by the Pew Charitable Trusts offers provides a wide-ranging look at the way many state officials handle these costly programs in recent years. While the ultimate success of these incentives often hinges on good planning by state officials and follow-up measurements of the impact and efficacy of the programs, Pew researchers found that many states have fallen well short of what was needed.

Indeed, the study found that 23 states either lack a smart evaluation policy or have had a policy in place for five or more years that has not proven effective in measuring impact or adequately informing state lawmakers and other policy makers of what needed to be done.

Related: States Face a $1 Trillion Pension Problem: Here Are the Worst 10

The report, for example, targeted Empire State Development Corp. and Start-Up NY as needing a more vigorous and transparent review process. Start-Up NY, launched by Cuomo and New York lawmakers in 2013, promised tax exemptions for up to 10 years to convince start-up companies to relocate in New York designated zones or near university campuses.

Yet the program until now has produced only a modest number of jobs and has been behind schedule in reporting some of its evaluations. Last week, Jason Conwall, a spokesperson for ESD, defended what he described as the agency’s “cost-effective” programs that generate a “positive return on investment” while spurring the creation of thousands of new jobs, according to the Albany Times-Union.

Meanwhile, California is trailing other states in carrying out its economic incentive strategy because it has not adopted a plan for regular evaluation of tax incentives. The state studies some incentives but not others, such as the $1.5 billion-a-year Research and Development (R&D) Credit.

By contrast, 10 states received high marks in the Pew study for shrewdly implementing and following up on their economic development effort. Those states include Florida, Indiana, Iowa, Maine, Maryland, Minnesota, Mississippi, Nebraska, Oklahoma and Washington State.

Related: Nearly a Dozen States Are Suffering From ‘Chronic Budget Stress’

Florida, for instance, is in the vanguard of the states because of its well-designed plan to regularly evaluate tax incentives and a process for helping lawmakers to make better-informed choices. Lawmakers allowed the state’s Enterprise Zone Program to expire in 2015, “a decision that was consistent with the findings of evaluations and will save the state tens of millions of dollars in coming years,” Pew says.

Maryland lawmakers decided in 2016 to continue and improve a tax credit for rehabilitating historic buildings, based on a thorough review by state officials. It was a model program in which lawmakers had put in place key protections to ensure that the cost would be predictable from year to year.

“Taken as a whole, more states are evaluating incentives, with far more rigor and policy impact, than were doing so just a few years ago,” the report stated. “In 2015 and 2016, 13 states approved laws requiring regular evaluations. But all states still have room to improve.”

Related: Illinois Is Not Alone: States Facing $1 Trillion Pension Shortfall

Kil Huh, the senior director of the Pew project team that produced the study, said that his research organization did an initial study of states’ handling of their tax incentive programs back in 2010 and now has done a follow-up progress report.

“In 2010, very few states were evaluating the sort of efficacy and return on the taxpayer investment, which is a very key economic development tool,” he said.

“Seven years later there are a number of states that have made significant progress in producing high-quality evaluations that help them better understand the value they are getting.”

Another new report by Timothy Bartik, a senior economist at the Upjohn Institute for Employment Research, state and local governments more than tripled the amount of tax credits and incentives they offered businesses in hopes of sparking economic development between 1990 and 2015.

Those incentives totaled $45 billion in 2015, and the average incentive package had a yearly value of over $2,400 per job.

However, while investment in these types of incentives has risen exponentially over time, Bartik discovered, state policymakers have been “largely in the dark” when it comes to understanding the return on investment.

Related: States Keep Using Gimmicks to ‘Balance’ Their Budgets

What’s more, he wrote: “Preliminary work suggests that a state’s incentives are not highly correlated with a state’s fortunes. Incentives do not have a large correlation with a state’s current or past unemployment or income levels, or with future economic growth.”