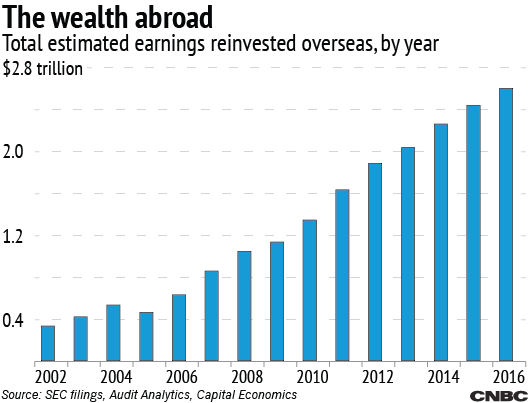

American companies looking to avoid paying domestic tax rates are holding about $2.6 trillion in overseas earnings, a number that has been rising steadily for years, according to new research from Capital Economics.

Part of President Donald Trump's tax plan calls for a "holiday" that would lower the U.S. rate to incentivize companies to repatriate — bring home — that money.

Related: No Signs of a Trump Bump as Economic Growth Disappoints

At 35 percent, the U.S. corporate tax rate is the highest in the world. That's caused many multinationals to keep their overseas earnings abroad in tax shelter countries like Ireland and Luxembourg.

However, approval of the broader plan that entails the tax holiday is unlikely, according to Andrew Hunter, U.S. economist for Capital Economics.

"With the deep cuts to individual income and corporate tax rates estimated to increase the federal budget deficit by $7 trillion over a decade," he wrote, "there is next to no chance of the plan ever being approved by Congress in its current form."

The main obstacles for the Trump tax plan are Senate rules. While reconciliation bills need only a majority in the Senate, they cannot increase the deficit beyond a 10-year horizon, which the tax plan is estimated to do. The alternative is to garner 60 votes in the Senate and be signed into permanent law.

Related: 3 Ways Trump’s Tax Proposal Could Change the Economy

"The chances of the latter happening are close to zero," Hunter wrote.

Trump's tax plan is likely to run into resistance from fiscal hawks among the GOP. The White House said that economic gains resulting from the tax cuts would make up the long-term deficit overrun, but economists disagreed.

One of the few parts of the tax plan that could generate additional revenue is potential repatriation of that $2.6 trillion held overseas. That's about 14 percent of the nation's gross domestic product and could spur economic growth.

The funds held overseas could have an effect on U.S. productivity growth, a recent working paper suggested.

Bringing it all back home

One of the 12 bullet points in the tax reform plan released Wednesday calls for a "one-time tax on trillions of dollars held overseas." It was unclear what that reduced rate would be, but the last tax holiday allowed companies to repatriate overseas earnings at a tax rate of 5.25 percent. That was enacted by President George W. Bush in 2004 in another attempt to stimulate the economy.

According to Hunter's note, around two-thirds of overseas earnings were repatriated during the previous tax holiday. That was about $362 billion, according to the IRS.

If Congress enacts a similar tax holiday, the prior example suggests that up to $1.7 trillion could be repatriated by U.S. companies. The trouble is, it's unknown how much of the funds are in foreign bank accounts or short-term investments, though estimates suggest that around half of the $2.6 trillion is held in cash. The rest is likely held in other, more illiquid assets like factories and equipment, the note said. Earnings on those resources would be much harder to repatriate.

At a 5.25 percent tax rate, that $1.3 trillion would raise only about $60 billion or $70 billion in tax revenue. Hunter notes that a tax holiday could actually reduce the amount of revenue collected, since companies could take advantage of the lower tax rate on funds they would have repatriated anyway.

A further concern is the suggestion made in the tax plan of shifting to a territorial tax system. That would end the country's taxation of profits from abroad and bring the U.S. closer to other nations, Hunter wrote.

"The upshot is that a tax on reinvested foreign earnings won't come close to paying for the $6 trillion to $7 trillion cost of the massive cuts to individual income and corporate taxes that Trump is proposing," Hunter wrote. "Accordingly, this doesn't change our view that Trump's plan will never make it through Congress in its current form."

The top companies in terms of overseas holdings are Apple, Pfizer and Microsoft, according to a report from the Institute on Taxation and Economic Policy. General Electric and IBM round out the top five.

This article originally appeared on CNBC. Read more from CNBC:

What it's like working for Warren Buffett: 'It's literally just reading about 12 hours a day'

Wall Street now predicts both Amazon and Alphabet will hit $1,000 in the next year

Tech CEOs may have bashed Trump — but their stocks performed best in his first 100 days