The question of whether you'll be paying more in taxes under President Donald Trump may hinge on how much you use tax deductions now.

Trump has said he will unveil on Wednesday the outlines of his campaign promise to overhaul the sprawling U.S. tax code with a simpler system that lowers tax rates. But even as those rates come down, closing loopholes and eliminating popular deductions will expose more of the average household's income to taxes.

Related: The Basic Problem With Trump's Huge Tax Cut

It remains to be seen how deeply the plan cuts into the most widely used deductions, which cost the government hundreds of billions of dollars in lower taxes.

Administration officials have acknowledged that some deductions will have to be eliminated to make up for the revenue that's lost to lower tax rates.

"Some of the lowering in (tax) rates is going to be offset by less deductions and simpler taxes," Treasury Secretary Mnuchin said last week at a meeting of the International Monetary Fund and World Bank in Washington.

But Mnuchin said most of the revenue lost in the short run from cutting tax rates will be made up over time as the economy grows and the tax base widens.

Related: Here’s One Major Hurdle Facing Trump’s Tax Plan

During last year's campaign, Trump announced broad outlines of a tax plan that calls for cutting the number of personal income tax rates from seven to just three brackets: 12 percent, 25 percent and 33 percent.

The plan also proposed increasing the standard deduction to $15,000, up from $6,300 for single filers, and to $30,000 for married couples filing jointly, up from $12,600. But it would also cap itemized deductions at $100,000 for single filers and $200,000 for married couples filing jointly.

Those deductions include some of the most popular provisions of the tax code, because they allow households to cut their tax bills by writing off expenses like home mortgage interest and taxes paid to state and local governments.

Curbing those deductions could help simplify the process of filing a tax return, but would also raise the amount of income subject to taxes. That impact would also vary widely from one household to another, regardless of their current tax bracket.

Most households aren't even aware of the biggest break for individuals that many of them get when they file their return.

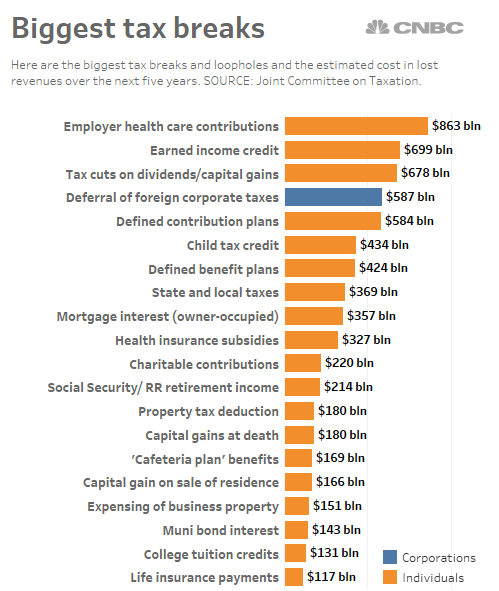

That one currently goes to households whose employer pays their health insurance premium. If those payments were counted as income, they would raise an estimated $863 billion over the next five years, according to a report from the Congressional Joint Committee on Taxation.

Most of the biggest tax breaks currently go to individuals, according to the report, including the earned income tax credit for low-income households ($699 billion over five years), tax cuts on capital gains and dividends ($678 billion), 401(k) and other defined contribution retirement plans ($584 billion) and the child tax credit ($584 billion.)

Though the current tax code is full of tax loopholes for corporations, the biggest single tax break applies to deferred foreign income, which will cost an estimated $587 billion over five years.

This article originally appeared on CNBC. Read more from CNBC:

These companies have the most to gain from Trump's tax-cut plan

Cramer to Trump: Your 15% corporate tax rate won't make us any richer