Should President-elect Donald Trump and congressional Republicans make good on their pledge to dismantle the Affordable Care Act, the repeal of a handful of tax increases on individuals and businesses and the elimination of a federal tax credit that subsidizes health insurance premiums likely would result in a massive windfall for wealthy households and a financial setback for low and moderate-income people, according to a new study.

Indeed, the 400 highest income taxpayers in the country could receive millions of dollars in tax relief next year while middle and lower income Americans would come up empty or in the hole, according to the report by the liberal-leaning Center on Budget and Policy Priorities.

Related: Trump Promises To Repeal and Replace Obamacare Together, But Can It Be Done?

Obamacare is financed by a combination of tax increases on individuals and businesses, Medicare tax increases and cost savings measures, among others. Those taxes – which have long been criticized by Republican lawmakers and special interest groups – potentially could be wiped away if the Republican-controlled Congress moves ahead with plans to repeal Obamacare in the coming month or two, without a clear replacement plan.

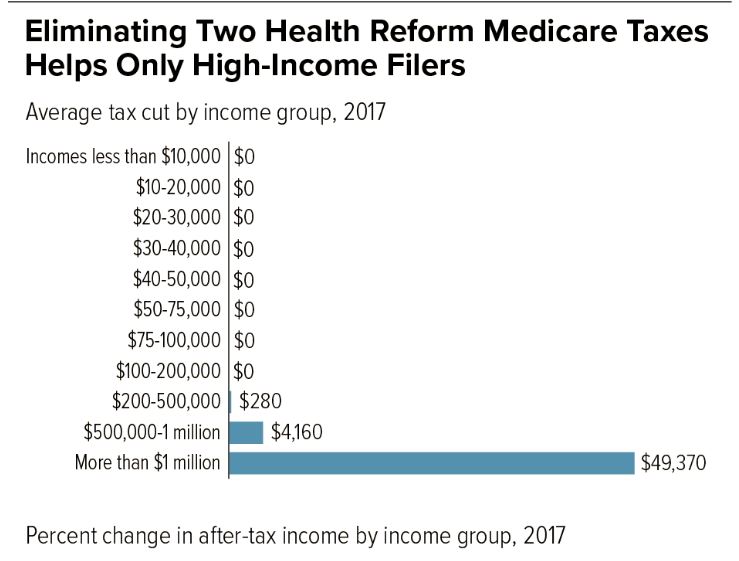

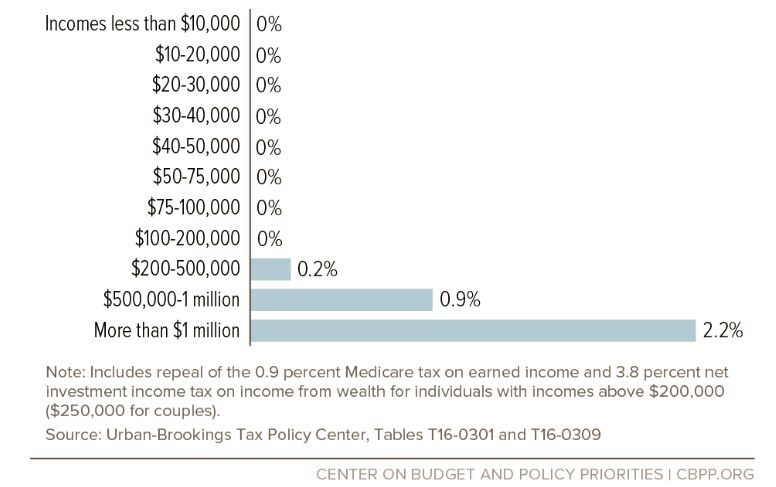

The study released on Thursday focused on two Obamacare taxes that target the wealthiest households in the country but have virtually no effect on middle and lower-income Americans. One is a 0.9 percent federal Hospital Insurance tax increase on individuals with incomes above $200,000 and couples with incomes above $250,000. The other is a 3.8 percent Medicare tax on “unearned income” that wealthy Americans derive from capital gains, dividends and royalties.

The top 400 highest-income taxpayers -- with average annual incomes of more than $300 million each -- would receive an estimated average annual tax cut of $7 million as part of the repeal, according to the study of Internal Revenue Service data.That would result in a $2.8 billion a year loss in tax revenue to the Treasury.

Roughly 160 million households with incomes below $200,000 would get nothing from the repeal of these two taxes, according to the report.

Related: Why Republicans Are Hitting the Brakes on Obamacare Repeal

Meanwhile, the repeal of Obamacare would effectively raise taxes on about seven million low-and-moderate income families that currently qualify for health insurance premium tax credits under the federal tax code. Those credits, which can be used to purchase private health insurance policies through government-run marketplaces, will be worth on average $4,800 this year.

“The $2.8 billion a year total tax cut for the top 400 . . . is roughly the value of premium tax credits that 813,000 people in the 20 smallest states and Washington, D.C. would lose combined if the ACA is repealed without a replacement,” the study notes.

Before the advent of the 2010 health reform law, Medicare taxes applied only to wage and salary and self-employment income, and not to unearned income from wealth, according to the study. That meant that low and moderate income families with little if any unearned income felt the brunt of the tax on practically all of their income, while the wealthiest taxpayers owed no Medicare taxes on their hefty dividends and capital gains -- which frequently accounted for a significant share of their total income.

“Repealing the two ACA Medicare taxes, particularly the 3.8 percent tax on investment and other unearned income, delivers tax cuts that are extremely tilted to the top,” the report states. “In fact, the 0.4 percent of households with income of over $1million a year would reap 80 percent of the benefits of repealing these two provisions in 2017.

Related: 8 Big Changes Under Tom Price’s Obamacare Replacement

Similarly, the Urban Institute last December published an analysis of the effects of Obamacare repeal suggesting that doing away with the law would be a de facto tax cut in and of itself, with the benefits disproportionately going to the wealthy and very wealthy.

“Repealing the Affordable Care Act would cut taxes significantly for the highest income one percent of US households,” wrote Howard Gleckman of the Urban-Brookings Tax Policy Center in Washington. “At the same time, it would raise taxes on average for low- and moderate-income households.”

The reports are speculative in part because there is no way of knowing at this point the fate of these tax increases which have been vital in operating the Obamacare program and providing subsidies to many of the 20 million people who take part in the program.

As The Fiscal Times has reported, it is now dawning on GOP leaders that repealing the dozen or so major Obamacare tax increases along with the premium subsidies for low and middle-income Americans would seriously crimp their effort to devise and finance a substitute health insurance program down the road.