The surge in Obamacare premium costs will put added strain on the federal budget next year, with the government spending an additional $10 billion or more in 2017 on Obamacare subsidies, according to a new study.

More than eight in 10 people who currently purchase private health insurance on Obamacare exchanges receive tax credits to help defray the cost of their premiums.

Related: Here’s How Much Obamacare Premiums Are Rising in All 50 States

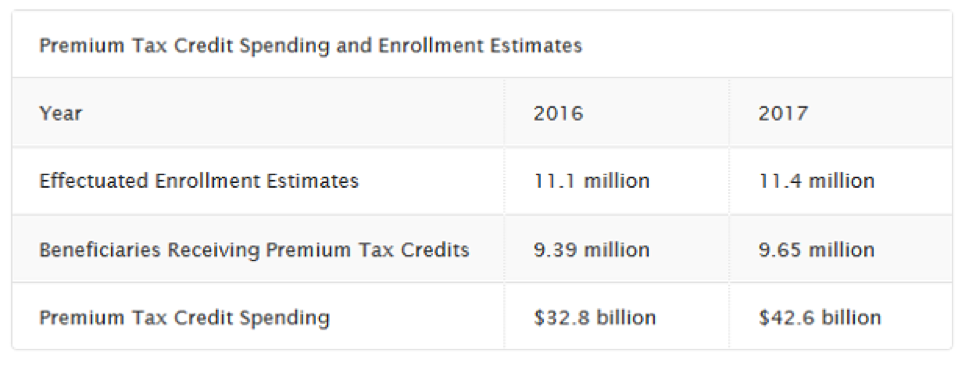

According to a report by the Center for Health and Economy, a non-partisan research organization, the government’s subsidy costs will increase from $32.8 billion this year to $42 billion in 2017 – a 28 percent increase that mirrors the average projected cost of Obamacare premiums in the coming year. That means that the average monthly subsidy will increase from $291 this year to $367 in 2017, a 26 percent increase.

The report is based on Centers for Medicare and Medicaid Services data on projected premium estimates for 2016 and 2017 and related studies. It comes at a critical moment for Obamacare as the outgoing administration struggles to defend the controversial health insurance that has served 20 million Americans while President-elect Donald Trump and congressional GOP leaders plan for its demise.

The Republicans have vowed to push through a budget “reconciliation” package next month that would repeal major elements of the Affordable Care Act, including the federal tax credits provided to lower-income people to help cover their premium costs. The GOP leaders writing the repeal legislation are almost certain to delay the effective date for two or more years, to give them sufficient time to negotiate a replacement program and recruit some Democrats to help enact it.

While House and Senate Democrats likely will be united in opposing legislation to dismantle Obamacare, a handful of Democrats told Politico that they likely would support a reasonable replacement down the line. Some 25 Democrats will be up for reelection in 2018, and the question of how to go about replacing the Affordable Care Act is certain to be a major issue in the campaign -- especially if millions of Americans still reliant on Obamacare begin losing their coverage.

Related: 8 Big Changes Under Tom Price’s Obamacare Replacement Plan

Sen. Claire McCaskill (D-Mo), one of a half-dozen Democrats interviewed by Politico, said that “If [a GOP replacement plan] makes sense, I think there’ll be a lot of Democrats who would be for it.”

Trump and House Republican leaders have been looking at a number of more market-based ideas for replacing the current system. However, their party is nowhere near agreement on how best to proceed without stripping millions of Americans of their health care insurance or eliminating expanded Medicaid coverage for millions of other low-income people.

In attacking Obamacare, the GOP has been highly critical of what it has deemed soaring premium costs for consumers and excessive government spending to subsidize consumers and prop up private insurance companies that have suffered major losses since entering the Obamacare market. The way the program is currently constituted, experts say, rising premiums automatically require the government to pour more money into subsidies.

Under a plan being promoted by House Budget Committee Chair Tom Price (R-GA), Trump’s choice to head the Department of Health and Human Services, Obamacare would be scrapped, including the government-run insurance markets in every state and federal tax credits to subsidize the insurance of lower income Americans. Price’s plan would offer fixed tax credits – pegged to a person’s age rather than their income -- so that they can buy their insurance policies in the private market.

Related: Trump’s Dilemma: Can He Repeal Obamacare Without Killing Medicare?

According to the Department of Health and Human Services, “effectuated” or paid enrollment in Obamacare in 2016 is roughly 11.1 million. That includes 9.4 million people who received premium tax credits.

Source: Center for Health and Economy

Of those who received the subsidies, the average monthly tax credit was $291. Assuming the effectuated enrollment and premium tax credit remains constant throughout 2016, “then about $32.8 billion was spent on premium tax credits alone,” according to the study.

As the government previously announced, the 2017 Silver benchmark Obamacare insurance plan will be an estimated 22 percent more expensive, on average, than the 2016 benchmark plans.

“However, because of the distributions of the population in the marketplace and the lack of household income growth to match premiums, we expect the average monthly tax credit to increase by 26 percent to $367,” the report states. “If we assume that the proportion of enrollees receiving premium tax credits remains the same from 2016 to 2017, then the expected federal spending on premium tax credits for 2017 would be $42.6 billion.”

Related: A ‘Full Repeal’ of Obamacare Could Spur Medicare’s Bankruptcy

The government announced on Wednesday that the number of Americans signing up for the 2017 health plans through HealthCare.gov is running slightly ahead of last year’s enrollment, The Washington Post reported.

The Obama administration is attempting to demonstrate that consumer interest in the program hasn’t flagged, despite all the uncertainty over the future of Obamacare. However, first-time enrollees account for only 25 percent of the total enrollment so far, the newspaper noted. By comparison, almost 40 percent of the enrollees last year were new to the program at this point.