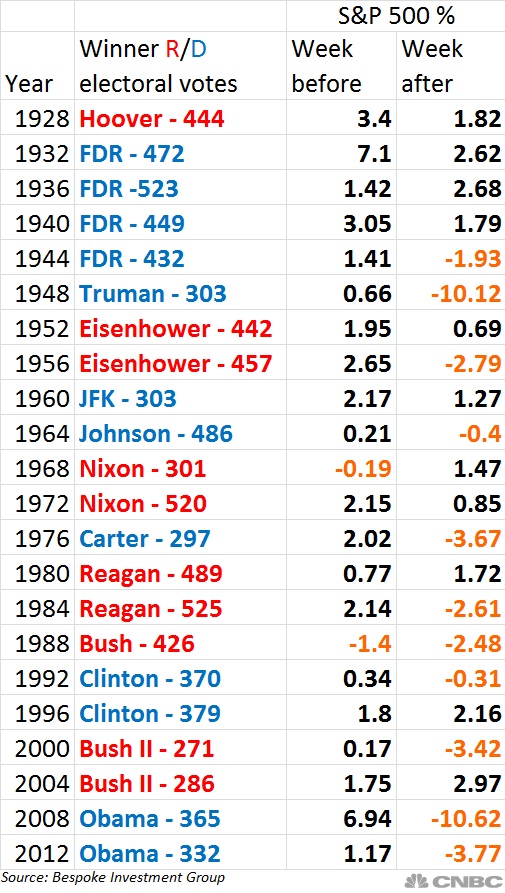

Typically, in the week before a presidential election, there's a stock market rally. Those rallies have resulted in an average gain of 1.8 percent for the S&P 500 in the week before all presidential elections, going back to 1928, according to a study by Bespoke.

Related: It Looks Like Investors Have a Clear Favorite in the Election

While it's early to say, if the S&P 500 continues its weak performance and is lower after next Tuesday's close, it would be only the third time in 23 presidential elections that the stock market fell in the week before a president was elected. As of midday Thursday, the S&P is tracking a 1.5 percent loss since Tuesday's closing bell.

"There's still Friday, Monday and Tuesday, so you never know," said Paul Hickey, co-founder of Bespoke.

The only two times the market sold off in the week before the election was in 1968, when the S&P 500 fell 0.2 percent after Richard Nixon defeated Democrat Hubert Humphrey, Bespoke data shows. The second time was the 1.4 percent sell-off in 1988 when George H.W. Bush beat Michael Dukakis. The best gain in that period was the 6.9 percent jump in the S&P in 2008 when Barack Obama was elected over John McCain.

Some analysts say, however, there could be a relief rally after Election Day — a post-election bounce. But that conventional wisdom does not ring true, according to the market performance for the first week following the last 22 presidential elections.

Related: $270 Million in Wall Street Money Is Sloshing Through This Election

The S&P 500 averaged a 1 percent decline in those weeks, and when only the last 10 elections are considered, the results are even worse. Going back to Jimmy Carter's election, seven of the first weeks post-election were negative, with an average 2 percent decline, meaning any rally was short-lived.

The worst performance was when the market fell 10.6 percent in 2008, a week after it gained 6.9 percent. The best performance in the week after an election was the near 3 percent gain in the S&P after George W. Bush defeated John Kerry in 2004.

Hickey said it's difficult to handicap the market post-election. "On both sides, even if they came close to half their rhetoric, it wouldn't be a very business friendly environment," he said. Hickey said a lot of investors are on the sidelines or in cash, awaiting the outcome.

"The polls were close between Kerry and Bush, and on Election Day, the market started rallying. History shows the opposite. If we stay in this funk until Tuesday, you could see the market get a little bit of a lift no matter who wins," said Hickey.

He said most times, the winner is clear before the election. "Even in the close elections 2000 and 2004, the market went up the week before the election," Hickey said.

"There's a lot of variables. Is it going to be a really close election, where we have a rehash of 2000? Or is it going to be a clear-cut winner, and if it's a clear-cut winner, who is it going to be? It's hard to extrapolate," Hickey said.

The market has long anticipated a win by Clinton, but thestock market has sold off in the last several days as Trump has gained in the polls. Since the market is already selling off, if Trump wins, a selloff could be more shallow than it might have been otherwise, analysts say. The market's view is that Clinton's positions are known, but that Trump is not well known. He's volatile and brings more uncertainty.

The election in "2000 was close, and the market went down in the week after because it was contested," he said. The one-week decline that year was 3.4 percent, while Al Gore challenged George W. Bush's narrow victory.

This article originally appeared on CNBC. Read more at CNBC:

'Fool's' monetary policy helped create Donald Trump, says ex-Fed president Fisher

The billion-dollar gold rush to tap into Iranian oil

Billionaires Warren Buffett and Bill Gates agree on the best business book ever written