What happens when a major drug maker that does business with the government has been caught price gouging consumers? Executives at Health and Human Services sift through their records to see if Medicare and Medicaid were also targeted. In the case of Mylan Pharmaceutical, maker of the EpiPen, everyone was fair game.

Just a few weeks after Mylan’s CEO testified before Congress and understated the amount of money her company makes from a device that treats severe allergic reactions, the company is under fire again. This time, the Centers for Medicare and Medicaid Services has accused Mylan of misclassifying the drug in order to charge the government higher prices.

Despite warnings from CMS, a letter from Acting Director Andrew M. Slavitt accuses Mylan of continuing to list its EpiPen, an auto-injector that delivers a dose of epinephrine, as a generic drug despite the fact that the company enjoys Food and Drug Administration-mandated patent protection on the device. The incorrect classification appears to have cost the federal government more than $100 million in the last five years alone.

Related: How Mylan Soaked Medicare and Taxpayers for EpiPen Profits

“The Center for Medicaid and [Children’s Health Insurance Plan] Services in CMS has, on multiple occasions, provided guidance to the industry and Mylan on the proper classification of drugs and has expressly told Mylan that the product is incorrectly classified,” Slavitt wrote to Oregon Sen. Ron Wyden, the ranking Democrat on the Senate Finance Committee. “This incorrect classification has financial consequences for the amount that federal and state governments spend because it reduces the amount of quarterly rebates Mylan owes for EpiPen.”

Those consequences are significant, because Mylan should be giving a 23.1 percent discount to CMS on the drug, but has instead only delivered a 13 percent discount. The miscategorization appears to date to 1997.

The financial impact of incorrectly classifying the EpiPen as generic has increased dramatically in recent years, with Mylan’s controversial decision to drastically increase the price of the life-saving device. In 2011, according to CMS, a two-pack of the auto-injectors cost $170. By last year, Mylan had increased that price to $466. (That only reflects the price the company charges the federal government. Individual patients purchasing the device have seen price leap from around $100 in 2007 to $600 today.)

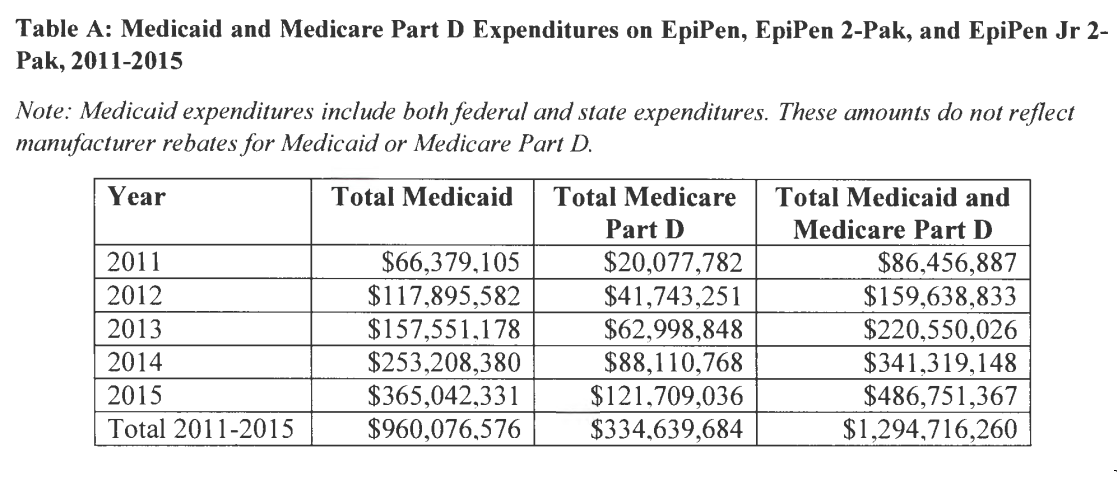

Data in the Slavitt letter show that in the last five years alone, Medicare and Medicaid have shelled out $1.3 billion on EpiPens, and the amount has grown enormously. The $487 million the government paid Mylan in 2015 is more than five and a half times as much as it paid the company in 2011.

Related: Mylan Admits It Makes Far More on EpiPens Than It Originally Reported to Congress

Wyden and Rep. Frank Pallone, Jr., the New Jersey Democrat who is the ranking member of the House Energy and Commerce Committee, released a joint statement about the CMS letter on Wednesday.

“Today’s letter is more evidence that while Mylan irresponsibly raised the price of EpiPen; they were also bilking taxpayers out of millions of dollars,” they said. “Essential medicines like EpiPen are increasingly out of reach for families across the nation due to unjustified price hikes, and it’s high time for drug companies to take responsibility for their actions. We will ensure taxpayers get their due.”

How, exactly, the two lawmakers expect taxpayers to be made whole is unclear, but in his letter to lawmakers, CMS Acting Director Slavitt provided one possible avenue.

Related: Here’s How to Stop Price Gouging by Drugmakers Like Mylan

“When it comes to CMS' s attention that the manufacturer's categorization is incorrect, CMS notifies the manufacturer and tries to reach an agreement,” he wrote. “Manufacturers that fail to accurately report product and pricing data to the rebate program and pay insufficient rebates may be subject to liability under the False Claims Act, a penalty of up to $100,000 per item of false information under the Rebate Agreement, or other government actions or claims.”

Mylan shares, which trade on the Nasdaq stock exchange, have taken a beating since mid-August when the company came under fire for its pricing practices, and they were down again Thursday morning, to below $37 a share, their lowest level in three years.