A new analysis of the major party candidates’ tax and spending plans by the Committee for a Responsible Federal Budget shows that Republican Donald Trump and Hillary Clinton are both advocating policies that would drive the federal budget off a cliff.

The difference is that Trump would get the country there in a hurry -- think about a limousine with the accelerator pressed to the floor. By contrast, Clinton would take us toward our fiscal doom in a sensible family minivan, obeying the speed limit all the way.

Related: Trump’s Tax Plan Would Benefit the Wealthy Most, Study Finds

The CRFB, a non-partisan group that advocates fiscally sound budgeting, ran the numbers on the most recent version of each candidate’s economic policy proposals, and in a conference call on Friday, Senior Vice President and Senior Policy Director Marc Goldwein provided some analysis.

“I have to say, the candidates could not really be more different,” he said. “Hillary Clinton’s basic economic philosophy is to increase government spending substantially, mostly for young adults and parents, and pay for it with large tax increases on mostly the very reach and to some degree on businesses.”

He continued, “Donald Trump is...the opposite. He has gigantic cuts in taxes, both corporate and individual taxes,” Goldwein said. And on the spending side, he said, Trump is a “mixed bag,” combining some spending cuts with multiple large increases in outlays.”

While Goldwein didn’t come out and say it, it was plain that according to the CRFB analysis, Trump doesn’t pay for it at all.

Related: Conservative Economists Mock Trump Campaign’s Trade Proposals

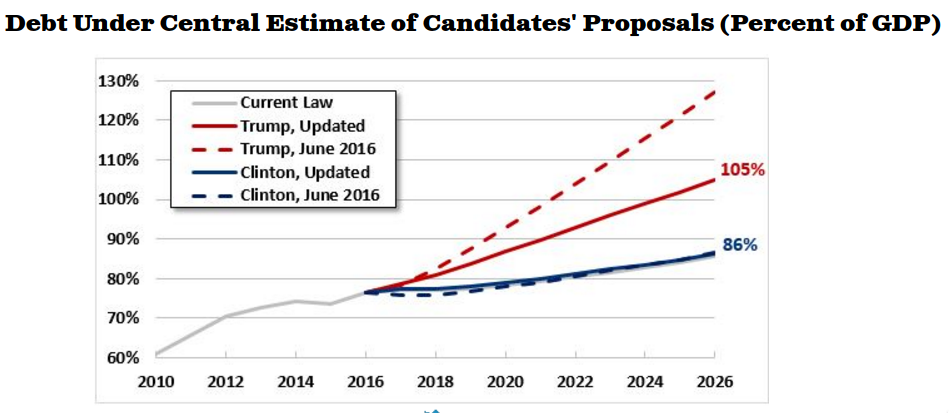

CRFB has long been concerned about the rising level of national debt as a percentage of the country’s Gross Domestic Product. Right now the debt is 77 percent of GDP. At the end of the traditional 10-year budget window, at least under current law, that would rise to 86 percent by 2026, and would keep increasing.

According to CRFB, both candidates’ economic plans, in the unlikely event they were to be enacted as currently proposed, would add to the national debt. But the difference in how much they would add is striking. Clinton would add about $200 billion to the debt over 10 years. Trump, though, would add $5.3 trillion -- more than 26 times as much as his Democratic challenger.

The calculations do not account for the economic growth in Trump’s plan that he claims would ameliorate the debt by providing more revenue.

At the end of the 10-year window, Clinton’s plan would leave us almost exactly where current law has us headed now: an 86 percent debt-to-GDP ratio. Trump would take the country to 106 percent debt-to-GDP, and would leave debt growth on a much steeper trajectory.

“There’s no question if you enacted Donald Trump’s plan as it is today, it would add tremendously to the debt,” Goldwein said. “It would bring our debt from post-War record high levels to absolute record high levels. That can be really dangerous to the economy. It can be dangerous especially if we have the next recession and we’re totally unprepared for it.”

Related: More Americans Want a One-Party Government That Can Ram Through Policy

By contrast, he said, “Hillary Clinton’s plan keeps the debt where it is, which is unsustainable and needs to be addressed. But it’s kind of a slow unsustainable growth of the debt, which means there is still more opportunity to turn it around.

“So I think Hillary Clinton gets it right in the sense that she paid for her new policies, but even that falls far short of what is necessary, and I think even under that scenario we would get slower economic growth.”

For much of this general election season, voters have been complaining that they don’t like either of their choices. The CRFB analysis shows that they could make the same objection on the narrower grounds of fiscal policy. But it also shows that while neither candidate’s policies will fix the nation’s debt problems, there is a substantial difference between the two of them.