In the Washington Post this morning, former Treasury Secretary Lawrence Summers flags a working paper published earlier this summer by the International Monetary Fund that detects a massive downturn in consumer spending in the US in recent decades and ties it directly to the declining incomes of the middle class.

Written by Ali Alichi, Kory Kantenga, and Juan Solé, the paper didn’t receive very much attention when it was released, but Summers, who has been pushing the idea that the US economy has entered a period of “secular stagnation” says that’s a mistake.

Related: US Economic Freedom Is in Decline, Libertarians Warn

The idea of secular stagnation, in brief, is that a combination of factors including slower population growth and the reduced impact of innovation on productivity has created a persistent economic state in which demand is too low to support robust economic growth, and can’t be stimulated even by low-interest rates.

It’s a narrative that roughly fits the state of the US economy in the post-Great Recession era, and Summers argues that Alichi, Kantenga and Solé have made an “important contribution” to the debate and that, “If these findings stand up to scrutiny, they deserve to have a policy impact.”

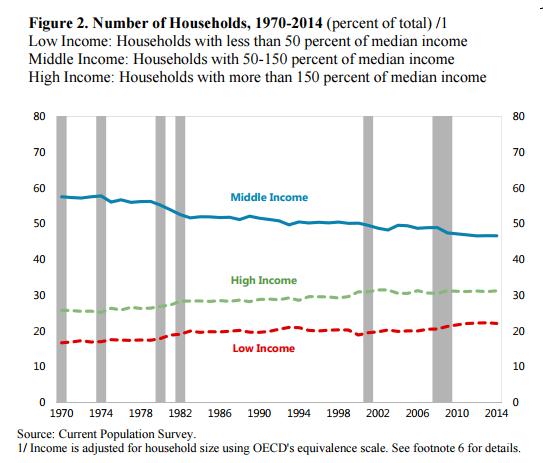

The paper finds a strong link between income polarization -- the shrinking percentage of US households defined as “middle income” while the ranks of both the very wealthy and the very poor swell -- and a significant decline in consumer spending.

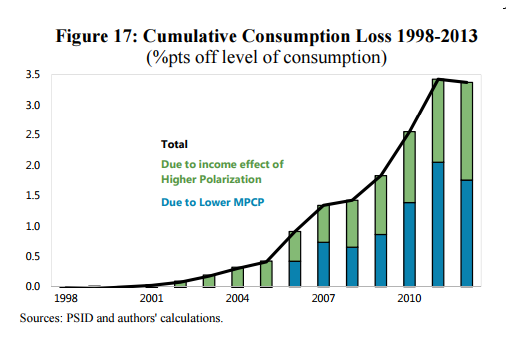

According to the paper’s findings, the reduced income of the middle class has led to reduced spending that, in the 15 years after 1998, had the cumulative effective of removing an entire year’s worth of consumption from the US economy.

Related: To Save Obamacare Exchanges, Drive Competition from the Bottom Up

In annual terms, that’s about $400 billion dollars. As Summers points out, that’s more money than even the largest economic stimulus program enacted during the Great Recession pumped into the economy in a given year.

In other words, it’s an amount of money that would have a huge impact on both employment, income, interest rates, and economic growth.

“What is the policy implication?” Summers asks. “Principally, it is the macroeconomic importance of supporting middle-class incomes. This can be done in a range of ways from promoting workers right to collectively bargain to raising spending on infrastructure to making the tax system more progressive. These are hardly new ideas. And I supported them before seeing this new research. But there is now another powerful argument in terms of mitigating secular stagnation in their favor.”