The disclosure Monday that insurance giant Aetna will pull out of the Obamacare market next year in 11 of the 15 states it now serves poses a serious threat to the future of the program and raises anew the need for major reforms.

While President Obama’s signature health care plan has weathered two major court challenges and scores of votes in the Republican-controlled Congress to dismantle it, an even larger challenge for advocates may be preventing Obamacare from simply collapsing of its own weight.

Related: Obamacare Suffers Another Big Blow as Aetna Pulls Out of 11 States

Larry Levitt, a senior vice president of the Kaiser Family Foundation and a strong champion of the Affordable Care Act, said in a tweet today that the next Obamacare open enrollment period for 2017 will be key in determining the importance of Aetna’s stunning withdrawal from the program’s exchanges.

“If signups grow, concerns [about Aetna] will fade,” he wrote. “If not, expect a debate on fixes.”

Millions of Americans have received coverage under the government-subsidized program that offers a wide range of policies and premiums to consumers of all ages and income levels regardless of any pre-existing medical condition. As an incentive to insurers to participate in the program, the law enacted in 2010 requires uninsured people to purchase coverage or face a penalty – the so-called “individual mandate” that many GOP critics roundly oppose.

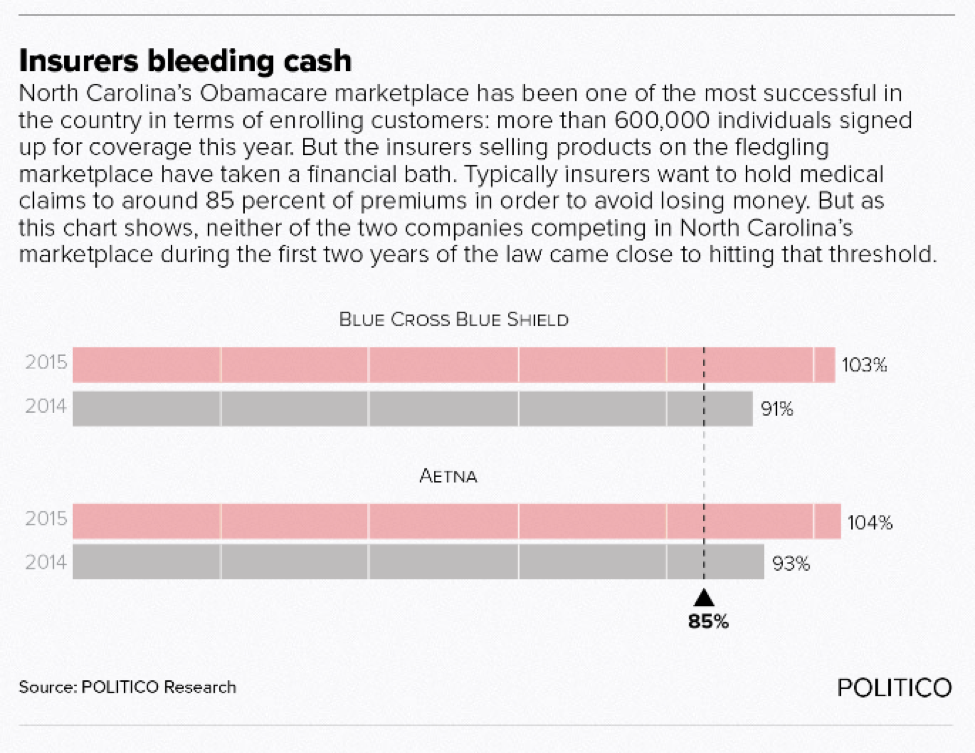

However, Obamacare has proved to be a financial nightmare for Aetna and other private insurers – including United Healthcare and Humana. Those companies have miscalculated the cost of providing coverage to primarily older and sicker beneficiaries even after substantially raising their premiums and co-payments last year.

Related: Obamacare Insurers Are Looking for a Taxpayer Bailout

United Healthcare, the nation's largest insurer, reportedly expects to lose about $1 billion on Obamacare policies in 2015 and 2016 and plans to leave most of the Obamacare exchanges early next year. Humana recently announced that it was pulling out of roughly 1,200 counties in eight states next year.

Nearly half of Obamacare’s 23 non-profit insurance co-ops went out of business over the past year or so because of poor management and unexpectedly high coverage costs. Aetna, which earlier this month signaled that it was canceling its Obamacare exchange expansion plans for 2017, revealed yesterday that it had lost $430 million issuing individual policies since Obamacare was formally launched in January 2014. It currently serves 838,000 customers on Obamacare exchanges.

Aetna explained in a statement yesterday that its policyholders turned out to have costlier medical problems than the company anticipated while far fewer younger and healthier consumers have been drawn to the program. In short, the pool of beneficiaries is badly skewed toward older, sicker Americans.

Moreover, Aetna and other health care insurers complain that the federal programs designed to mitigate insurers’ economic risks have proved to be woefully inadequate – and will soon be expiring. Under what is known as “risk corridors,” more profitable insurers and the federal government pay into a fund each year while less profitable companies are entitled to withdraw money from the pot. Because of budget cutbacks ordered by congressional Republicans, there never has been enough money in the pot to satisfy companies struggling to make ends meet.

"Providing affordable, high-quality health care options to consumers is not possible without a balanced risk pool," Aetna’s CEO Mark Bertolini said in a statement yesterday, adding that “individuals in need of high-cost care represent an even larger share of our on-exchange population” than originally anticipated.

Related: How Donald Trump Just Single-Handedly Saved Obamacare

The Obama administration sought to downplay the significance of Aetna’s planned withdrawal from Affordable Care Act exchanges that currently serve 10 million people. Kevin Counihan, the chief executive officer of the Obamacare exchanges, said in a statement that “Aetna’s decision to alter its marketplace participation does not challenge the fundamental fact that the health insurance marketplace will continue to bring quality coverage to millions of Americans next year and every year after that,” according to Bloomberg.

Critics say that administration officials and their Democratic allies on Capitol Hill are kidding themselves if they continue to ignore glaring fundamental problems with the structure and rules of Obamacare.

“You really are in the early stages of a death spiral here,” said Robert Laszewski, a health care industry consultant and blogger who frequently writes about significant shortcomings in the program. “The more you raise the rates, the worse it gets. You can’t raise the rates high enough when you have too many sick people in the pool. You need healthier people. And the subsidies keep the poorest people in the pool no matter what it costs.”

In assessing what needs to be done to preserve Obamacare in the coming years, Laszewski stresses strengthening the underlying market by providing consumers with a much wider array of coverage options and premiums than currently exists.

Related: Here’s Proof that a Single Payer Health System Could Break the Bank

“The fundamental problem is the health plans are so unattractive that only 40 percent of the eligible have signed up,” he said in an interview today. “The classic rule is that you need 75 percent of the population to get a balanced risk pool. We don’t know whether that’s exactly true of Obamacare or not, but obviously 40 percent isn’t working. So the fundamental problem is the Obamacare plans are unattractive. So to fix this, you have to make the Obamacare plans attractive.”

“Maybe finally we can have a discussion about how to fix Obamacare,” he added. “And maybe all of these people that say it’s not broken, and it’s just fine and 83 percent of the people are subsidized and all of that, finally are going to be willing to have a conversation with the rest of us about how you fix this.”

The Obama administration has used its executive powers to make numerous tweaks and revisions in the law since it was first enacted. However, Democrats have refused to allow Congress to reopen the legislation for changes – even in areas where there is some unanimity – for fear that Republicans would use that as an opportunity to gut or dismantle the program.

Hillary Clinton, the Democratic presidential nominee and a prime advocate of Obamacare, has signaled a willingness to make changes in the federal health insurance program if she is elected president in November.

Related: If Clinton Is Elected, Get Ready for Taxpayer Funded Nationalized Health Care

Among the ideas she has advanced is creating a new “government option” for health care coverage to compete with private insurers now taking part in Obamacare. Obama originally favored such an approach but was forced by conservatives to drop it from his plan. Clinton has also proposed a tax credit to help lower-income people afford their insurance deductibles and copayments.

Finally, in a move designed to woo many liberal supporters of Sen. Bernie Sanders of Vermont, Clinton has proposed expanding health care coverage by lowering the eligibility age for Medicare from 65 to 55.

Much will depend on the outcome of the election, in which Clinton currently holds a substantial lead over Republican nominee Donald Trump – a staunch opponent of Obamacare. The Democrats are also attempting to regain control of the Senate and cut into a sizeable GOP majority in the House.

“In the end, nothing is going to pass without bipartisan consent, if not enthusiasm,” said Henry Aaron, a health care expert and scholar at the Brookings Institution. “So the critics of Obamacare will have to get something. What exactly that might be is not entirely clear to me, but it might be the elimination of the employer mandate.”

In discussing what needs to be done to fix the Affordable Care Act, Aaron cited the so-called “family glitch.” Under the ACA, a worker isn’t eligible for government subsidies if he or she is offered affordable health insurance by an employer. However, through a drafting error or faulty rulemaking, that ineligibility extends to other members of the worker’s family, regardless of whether they qualify for affordable employer-provided insurance.

Related: Here’s Why Obamacare Is So Important to Hillary Clinton

Timothy Jost, a professor emeritus at Washington and Lee University School of Law, told CNN Money the biggest problem to overcome is the highly flawed and underfunded “risk mitigation efforts” that are essential to keeping many insurers in the Obamacare game.

"I think the market will stabilize, and perhaps Aetna and United will come back," Jost told CNN Money. "But the market really needs support for another few years until it does, and since the majority in Congress is rooting for [the Affordable Care Act] to fail, it seems unlikely that the support will be forthcoming."