The debate over the future of Social Security typically focuses on the 60 million seniors and disabled Americans who receive roughly $55.7 billion in monthly benefits.

When the AARP, for example, calls for reforms to well past 2034 – when Social Security is currently projected to begin running out of money – the advocacy group’s major concern is how aging baby boomers will place budgetary pressures on the program in the coming years.

Related: Trump and Clinton Square Off On Saving Social Security

“For too long in this campaign cycle and many others, it seems like the candidates want to kick the can down the road,” Pete Jeffries, AARP’s national engagement director, said in a statement during last month’s Republican and Democratic National Conventions. “There’s no longer time for that. We need our nation’s leaders to take action and update Social Security.”

Democratic presidential nominee Hillary Clinton favors raising taxes to finance expanded benefits, along the lines of what was advocated by her former Democratic rival, Sen. Bernie Sanders of Vermont. Meanwhile, Republican presidential nominee Donald Trump appears to be backtracking on a previous pledge to leave Social Security and Medicare unscathed and use an expanding economy to generate additional revenues for retirees.

The next president will be faced with a major controversy that will pit Social Security advocates and liberal groups favoring expanded financial resources and benefits against conservative groups and fiscal watchdogs such as the Committee for a Responsible Federal Budget and the Concord Coalition who are advocating spending cuts to avoid adding to the $19 trillion national debt.

“Social Security just turned 81, but without reform its trust fund won’t make it to 100,” Marc Goldwein, CRFP’s senior vice president, said in a statement late last week. “If Washington doesn’t act to reform Social Security soon, benefits will be cut abruptly for today’s workers as well as many current retirees.” The organization just posted a new interactive tool to show how old you will be when the trust fund runs out, and just how much money you stand to lose.

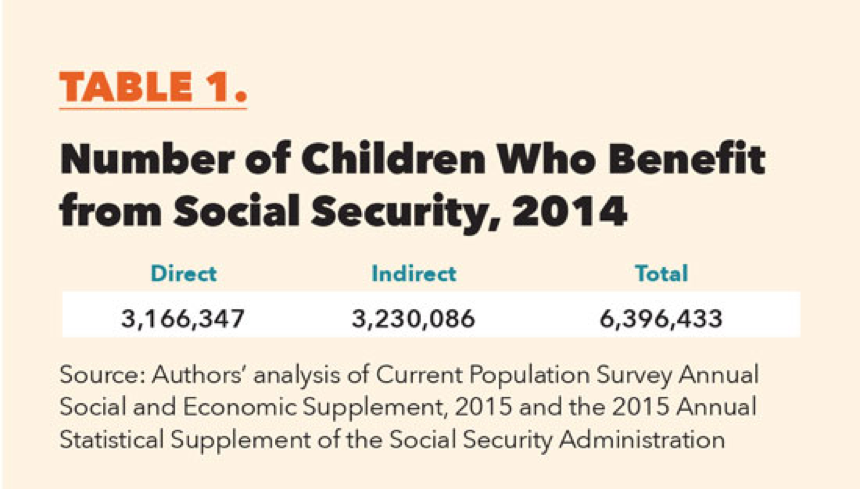

One thing lost in the debate is that it’s not just retirees and the disabled who have a major stake in the outcome. Roughly 6.4 million children – or nearly one in 10 -- currently benefit directly or indirectly from Social Security payments. While it gets scant attention, Social Security is one of the federal government’s largest anti-poverty programs for children, serving more kids than other discretionary programs like Supplemental Security Income (SSI) and Temporary Assistance for Needy Families (TANF), the major welfare program approved during the Democratic administration of President Bill Clinton.

Related: Record Number of Americans Living With Parents and Grandparents

Without Social Security, the poverty rate for the nation’s youngsters would soar to nearly 43 percent overall and roughly 60 percent among black children, according to a new report. While Social Security, the so-called “Third Rail of Politics,” is largely immune from draconian cuts because of the power of the seniors’ lobby, some experts worry that millions of children could be hurt by tight restrictions on growth in spending over the coming years.

“For the last decade we have been having this debate about the future of Social Security, and in all of these discussions not a single portion of it has really been dedicated to the number of children who actually rely on Social Security for their income and support in childhood. And that’s a mistake” said Maya Rockeymoore, president and CEO of the Center for Global Policy Solutions and chief author of a new report on the subject.

Rockeymoore complained that Clinton and Trump have said little, if anything, about the importance of Social Security to young Americans, although Clinton has long-championed children’s health benefits, education and other social services. Rockeymoore’s report, “Overlooked But Not Forgotten: Social Security Lifts Millions More Children Out Of Poverty,” claims there are 3.2 million children under the age of 18 who directly receive Social Security income benefits “either as the surviving dependents of a parent or guardian who had died, the dependent of a disabled worker, or the dependent of a retiree.”

“Americans need to understand that Social Security supports people at all stages in life,” Rockeymoore said. “It’s a mistake not to understand that it has a significant role in lifting children and their families out of poverty.”

But fiscal conservatives also point to the massive number of alternative poverty programs that serve children and families that cost taxpayers nearly $1 trillion in 2013. Of the 12 federal food programs costing $116 billion in 2013, 8 are targeted to children. Children’s medical care is covered by Medicaid; housing subsidies and assistance costing about $50 billion a year as well as low-income energy assistance are also available. Finally, there are federal cash payments through the Earned Income Tax Credit, TANF (Temporary Assistance for Needy Families), and the Refundable Child Credit, a total of about $200 billion all in.

Related: Social Security Trustees Project Trust Fund Will Be Tapped Out by 2034

The issue is complex because there are many competing interests in the Social Security debate. Many of the advocacy groups including AARP unavoidably focus their efforts on protecting the benefits of retired Americans because seniors make up the bulk of their 37 million membership. Polling suggests that the millennials and other younger Americans who are many decades away from retirement are highly suspicious of the Social Security system and question whether there will be any money left in the trust fund by the time they retire.

Conservatives have sought to leverage the inter-generational tension over Social Security in pressing for major reforms. Those have included proposals to privatize a portion of the system to allow younger people to take risks to maximize their retirement nest egg while allowing the elderly to remain in the existing program of guaranteed monthly payments and cost of living adjustments.

John Rother, a former top official of AARP, said in an interview last week that the perception of generational conflict around Social Security “has been fed mostly by the right/privatizers looking for a way to justify benefit cuts.” He said that to combat this, he helped found an organization called Generations United, to bring senior and children's advocates together.

Related: Democrats Promise to Expand Social Security Regardless of the Risk

Rockeymoore noted that many of these children are products of the country’s most economically vulnerable household. As a result, Social Security “is often the only financial safeguard protecting them from the harmful effects of poverty.”

Even the 3.2 million official government number of children directly benefitting from Social Security is vastly understated, according to the report. Based on data from the U.S. Census Bureau and the Social Security Administration, the report found that the actual number is double that amount -- or 6.4 million – when adding in children who are not direct beneficiaries, yet live in extended families that receive Social Security.

That’s the equivalent of nine percent of all children in this country under the age of 19 and 11 percent of all Social Security beneficiaries, according to the report.

Among other findings in the report:

- While there has been some growth in the number of direct Social Security beneficiaries under age 18, the majority of the increase is due to the growing number of children who are indirect Social Security beneficiaries. Social Security substantially reduces poverty rates among all children in families that receive it by 17.3 percent.

- White children continue to represent the biggest number of direct or indirect child beneficiaries, although the number of blacks and Hispanics is on the rise.

Related: The Social Security Mistake That Can Cost You Thousands a Year

- About two-thirds of indirect child beneficiaries reside in multi-generational families consisting of three or more generations or in “skipped-generation” households that include families of grandparents and grandchildren only.

- The annual rate of growth of children benefiting indirectly from Social Security is 3.5 percent. That accounts for practically the entire 1.7 percent annual rate of growth in the number of kids who have benefited either directly or indirectly from the retirement program during the past 14 years.

“In sum, as U.S. childhood poverty increased during the 2000s, Social Security played a crucial role in offsetting increased poverty rates across all racial and ethnic groups,” the report concludes. “When families needed it most, Social Security strengthened child economic security and helped to provide the critical necessities such as food, shelter, and clothing that children need to survive and thrive.”