For a while this year, President Obama and many lawmakers pushed for reforms to the corporate tax code, seeking to lower rates while closing overly generous loopholes. But they ran into a stone wall. The two parties are so far apart in this highly charged political season that any sort of tax reform may be impossible to achieve until well after the 2016 election.

But House Ways and Means Committee Chair Paul Ryan (R-WI) shrewdly noted another more practical reason – that reforming the corporate tax code will be virtually impossible these days without tossing individual income tax rates into the mix. Although the business community has long complained that the 35 percent top corporate tax is the highest in the world and places them at a competitive disadvantage, many companies have sharply reduced their tax liabilities by changing their corporate structure to become “pass through” entities subject to a much lower tax rate.

Related: Smart Tax Reform Has to Account for This Massive Change

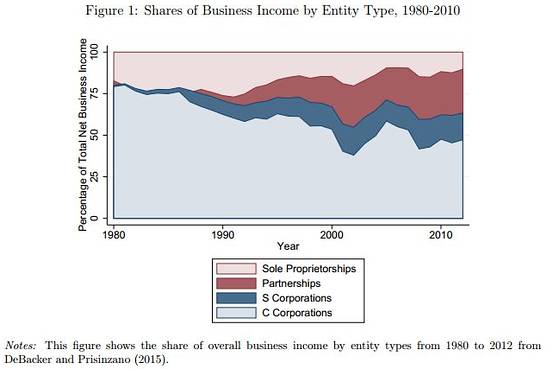

The shift towards pass-throughs, such as sole proprietorships, partnerships, LLCs and S-corporations, has been overwhelming in the past decade, as The Fiscal Times reported earlier this year. For instance, 1.6 million U.S. corporate tax returns were filed in 2012, down 25 percent from the 2.18 million filed in 2000. By comparison, there were 23.5 million returns from owners of sole proprietorships, an increase of 31 percent from 17.9 million in 2000.

Today, a remarkable 93 percent of all business ventures file taxes as individuals, according to the Tax Foundation, and the revenue implications are enormous. Revenues from individual taxes constitute nearly half of all money in the federal coffers. By comparison, corporate tax revenues contribute only 10.6 percent of overall revenues, while Social Security payroll taxes make up another third.

“It’s really kind of changed the landscape, and it’s made the whole issue of what is the composition of individual taxes very different,” Howard Gleckman, a Resident Fellow at the Urban Institute and an authority on tax policy, told The Fiscal Times earlier this year.

Now comes a new paper presented by economists at the Treasury Department and the National Bureau of Economic Research warning that partnerships and other pass-throughs have done more than anything else to exacerbate income inequality in the country. They have done this by bestowing overly generous tax breaks on the wealthiest 1 percent of Americans – helping them to nearly double their share of overall income between 1980 and 2013.

“The rise of pass-throughs accounts for much of the rise in income inequality over the last three decades,” the report declares.

Related: How Tax Reform Could Help Save U.S. Infrastructure

The average income tax rate on U.S. pass-through businesses today is just 19 percent, according to the study, much lower than the average rate for traditional corporations. Across all forms of businesses -- with the exception of sole proprietorships -- the average tax rate on businesses in 2011 was 24.3 percent.

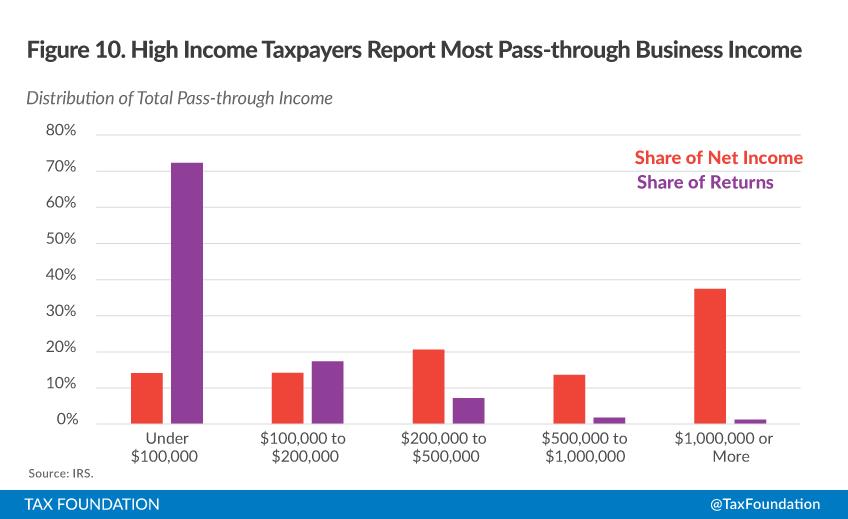

Moreover, compared to traditional business income, pass-through business income is “substantially more concentrated” among high earners, according to the report. “Overall, 69 percent of pass-through income earned by individuals accrues to the top 1 percent,” the report found. By comparison, only 45 percent of C-corporate income accrues to the wealthiest one percent of Americans.

Even though only 1.2 percent of all pass-through corporations account for close to 70 percent of the income, 90 percent of all pass-throughs entities are filed by people with incomes of $200,000 or less. If those middle-income people are paying only 19 percent in federal income taxes, then they, too, are benefiting from massive tax breaks, albeit at a much lower level than the doctors, lawyers, and hedge fund partner that are part of the 1.2 percent.

The surge in pass-throughs has cost the Treasury at least $100 billion in foregone revenue between the 1980s and 2011 – the latest data used for the study. Moreover, the government isn’t even sure who precisely is reaping these huge tax breaks. According to the researchers, 30 percent of income earned by partnerships – the most prevalent form of pass-throughs – cannot be traced with certainty to their owners.

“Despite this profound change in the organization of U.S. business activity, we lack clean, clear facts about the consequences of this change for the distribution and taxation of business income, the report states. “This problem is especially severe for partnerships, which constitute the largest, most opaque, and fastest growing type of pass-through.”

Related: 2015 Will Be a Landmark Year for State Tax Reform

David Wessel, writing for the Brookings Institution website last week, said that the findings of the new report clearly show “why corporate tax reform is so tricky.”

“A narrow focus on traditional corporations will be tough and counterproductive because so much business income now goes to these pass-through entities,” wrote Wessel, the director of the Hutchins Center on Fiscal and Monetary Policy. “But any tax reform that essentially seeks to lighten the burden on big corporations by raising the tax rates paid by partnership and other pass-throughs is sure to prompt a huge political fight, led by the well-paid Americans who are enjoying very low tax rates on their business income.”