How Good Is Your Insurance? ‘Cadillac Tax’ Looms for Large Employer Health Plans

While most companies expect health care cost increases to hold steady next year, nearly half of large employers say that if they can’t find new ways to cut costs, they’re going to cross the “Cadillac tax” threshold in 2018, according to a new study by the National Business Group on Health.

Passed as part of the Affordable Care Act and going into effect in 2018, the Cadillac tax will hit employers whose plans cost more than $10,200 for an individual or $27,500 for a family. The employer will have to pay a 40 percent tax on the cost of each plan above those levels.

Among the companies surveyed, 48 percent said that at least one of their benefit plans would trigger the Cadillac Tax. By 2020, 72 percent of employers say one of their plans will trigger the tax, and 51 percent say their most popular plan will be subject to the tax.

Related: Obamacare’s Cadillac Tax Hits the College Campus

“The need to control rising health care benefits costs has never been greater,” NGBH President and CEO Brian Marcotte said in a statement. “Rising costs have plagued employers for many years and now the looming excise tax is adding pressure.”

Employers expect keep benefit costs increases to 5 percent this year by pushing more costs onto workers via consumer-directed health plans (76 percent) and expanding wellness initiatives (70 percent).

None of the 425 employers surveyed said they planned to eliminate their health care coverage, but nearly a quarter said they’d consider offering employees a private exchange.

Top Reads from the Fiscal Times:

- How ‘King Coal’ Could Swing the 2016 Election

- Kerry to Congress: Sign the Iran Deal or the Dollar Gets Hit

- China’s Currency Devaluation Brings Stocks to a 'Death Cross'

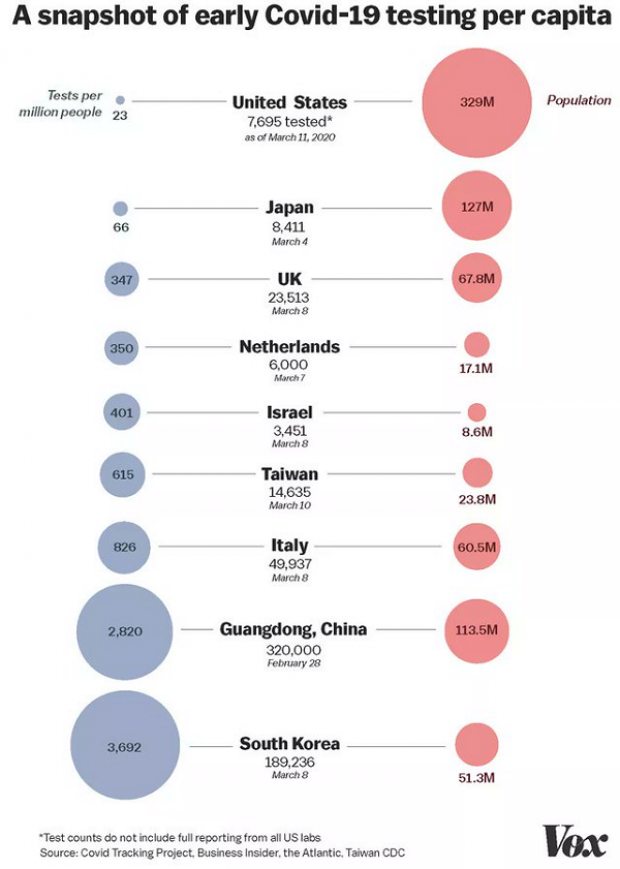

Chart of the Day: Long Way to Go on Coronavirus Testing

The White House on Friday unveiled plans for a new effort to ramp up testing for Covid-19, which experts say is an essential part of limiting the spread of the virus. This chart from Vox gives a sense of just how far the U.S. has to go to catch up to other countries that are dealing with the pandemic, including South Korea, the leading virus screener with 3,692 tests per million people. The U.S., by comparison, has done about 23 tests per million people as of March 12.

After Spending $2 Billion, Air Force Bails Out on Planned Upgrades of B-2 Bombers

The Air Force has scrapped a planned upgrade of its B-2 stealth bomber fleet — even after spending $2 billion on the effort — because defense contractor Northrup Grumman didn’t have the necessary software expertise to complete the project on time and on budget, Bloomberg’s Anthony Capaccio reports, citing the Pentagon’s chief weapons buyer.

Ellen Lord, the undersecretary of defense for acquisition and sustainment, told reporters that the nearly $2 billion that had already been spent on the program wasn’t wasted because “we are still going to get upgraded electronic displays.”

Big Hurdle for Sanders’ Plan to Cancel Student Debt

Bernie Sanders wants to eliminate $1.6 trillion in student debt, to be paid for by a tax on financial transactions, but doing so won’t be easy, says Josh Mitchell of The Wall Street Journal.

The main problem for Sanders is that most Americans don’t support the plan, with 57% of respondents in a poll last fall saying they oppose the idea of canceling all student debt. And the politics are particularly thorny for Sanders as he prepares for a likely general election run, Mitchell says: “Among the strongest opponents are groups Democrats hope to peel away from President Trump: Rust Belt voters, independents, whites, men and voters in rural areas.”

Number of the Day: $7 Million

That’s how much Michael Bloomberg is spending per day in his pursuit of the Democratic presidential nomination, according to new monthly filings with the Federal Election Commission. “In January alone, Bloomberg dropped more than $220 million on his free-spending presidential campaign,” The Hill says. “That breaks down to about $7.1 million a day, $300,000 an hour or $5,000 per minute.”