Don’t Feel Like a Chump When You Close on Your New Mortgage

Mortgage closing costs dropped 7 percent over the past year, falling to $1,847 on a $200,000 loan, according to a new analysis by Bankrate.

Typical closing costs varied by state, ranging from $2,163 in Hawaii to $1,613 in Ohio. You can find the average rate for your state in the table below.

Lenders compete for business, so shopping around with at least three mortgage providers can help you reduce the fees associated with your loan. “Homebuyers have more say over closing costs than they think,” Bankrate Senior Mortgage Analyst Holden Lewis said in a statement.

Even as banks lower their mortgage fees, they’re increasing fees in most other categories, according to MoneyRates.com.

While lower mortgage fees are good news for homebuyers and those refinancing their loans, the average saving amount to just $140. That’s not much relative to the total costs associated with buying a house. The average down payment for homebuyers in the first quarter of 2015 was $57,710, for example.

Related: Want Your Own Home? Here’s How to Do the Math

The costs don’t stop once the buyers move in. On top of mortgage payments, homeowners face an average of more than $6,000 in additional costs related to their house, including homeowners insurance, property taxes and utilities.

The National Association of Realtors expects home prices to increase 6.5 percent this year to a median $221,900, which would put them at the same level as their 2006 record high.

For buyers, better news than the lower mortgage fees is that rates remain relatively low, falling to 3.98 percent last week, per Freddie Mac.

Closing costs | |||

|---|---|---|---|

| State | Average origination fees | Average third-party fees | Average origination plus third-party fees |

| Alabama | $1,066 | $776 | $1,842 |

| Alaska | $935 | $922 | $1,857 |

| Arizona | $1,208 | $761 | $1,969 |

| Arkansas | $1,057 | $760 | $1,817 |

| California | $937 | $896 | $1,834 |

| Colorado | $1,192 | $719 | $1,910 |

| Connecticut | $1,074 | $960 | $2,033 |

| Delaware | $904 | $924 | $1,828 |

| District of Columbia | $1,077 | $718 | $1,794 |

| Florida | $1,028 | $778 | $1,806 |

| Georgia | $1,058 | $821 | $1,879 |

| Hawaii | $1,033 | $1,130 | $2,163 |

| Idaho | $894 | $788 | $1,682 |

| Illinois | $1,080 | $767 | $1,847 |

| Indiana | $1,067 | $770 | $1,837 |

| Iowa | $1,161 | $762 | $1,923 |

| Kansas | $1,047 | $753 | $1,800 |

| Kentucky | $1,060 | $737 | $1,797 |

| Louisiana | $1,060 | $817 | $1,877 |

| Maine | $897 | $830 | $1,727 |

| Maryland | $1,093 | $742 | $1,835 |

| Massachusetts | $905 | $851 | $1,756 |

| Michigan | $1,072 | $746 | $1,818 |

| Minnesota | $1,067 | $689 | $1,757 |

| Mississippi | $1,046 | $837 | $1,884 |

| Missouri | $1,040 | $792 | $1,833 |

| Montana | $1,062 | $855 | $1,917 |

| Nebraska | $1,047 | $770 | $1,817 |

| Nevada | $1,002 | $848 | $1,850 |

| New Hampshire | $1,084 | $750 | $1,835 |

| New Jersey | $1,181 | $913 | $2,094 |

| New Mexico | $1,076 | $876 | $1,952 |

| New York | $1,032 | $879 | $1,911 |

| North Carolina | $1,036 | $875 | $1,911 |

| North Dakota | $1,045 | $791 | $1,836 |

| Ohio | $933 | $681 | $1,613 |

| Oklahoma | $1,027 | $734 | $1,761 |

| Oregon | $1,080 | $785 | $1,864 |

| Pennsylvania | $1,055 | $678 | $1,733 |

| Rhode Island | $1,093 | $802 | $1,896 |

| South Carolina | $1,058 | $837 | $1,895 |

| South Dakota | $1,055 | $704 | $1,759 |

| Tennessee | $1,033 | $773 | $1,806 |

| Texas | $1,031 | $833 | $1,864 |

| Utah | $909 | $788 | $1,697 |

| Vermont | $1,074 | $862 | $1,936 |

| Virginia | $1,050 | $787 | $1,837 |

| Washington | $1,077 | $824 | $1,901 |

| West Virginia | $1,067 | $904 | $1,971 |

| Wisconsin | $1,047 | $723 | $1,770 |

| Wyoming | $874 | $814 | $1,689 |

| Average | $1,041 | $807 | $1,847 |

Bankrate.com surveyed up to 10 lenders in each state in June 2015 and obtained online Good Faith Estimates for a $200,000 mortgage to buy a single-family home with a 20 percent down payment in a prominent city. Costs include fees charged by lenders, as well as third-party fees for services such as appraisals and credit reports. The survey excludes title insurance, title search, taxes, property insurance, association fees, interest and other prepaid items.

Top Reads from The Fiscal Times:

- You’re Richer Than You Think. Really.

- The 10 Fastest-Growing Jobs Right Now

- The 5 Worst Cities to Raise a Family

Coming Soon: Deductible Relief Day!

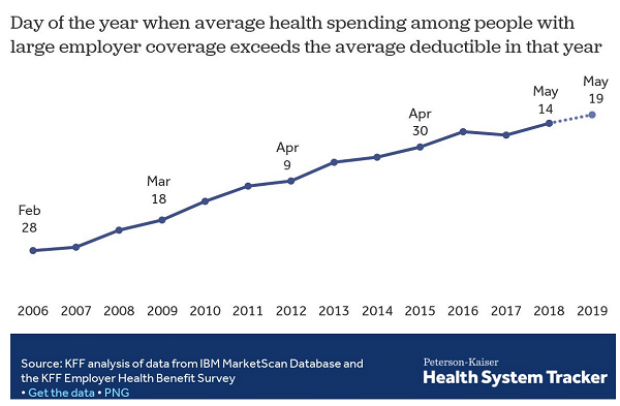

You may be familiar with the concept of Tax Freedom Day – the date on which you have earned enough to pay all of your taxes for the year. Focusing on a different kind of financial burden, analysts at the Kaiser Family Foundation have created Deductible Relief Day – the date on which people in employer-sponsored insurance plans have spent enough on health care to meet the average annual deductible.

Average deductibles have more than tripled over the last decade, forcing people to spend more out of pocket each year. As a result, Deductible Relief Day is “getting later and later in the year,” Kaiser’s Larry Levitt said in a tweet Thursday.

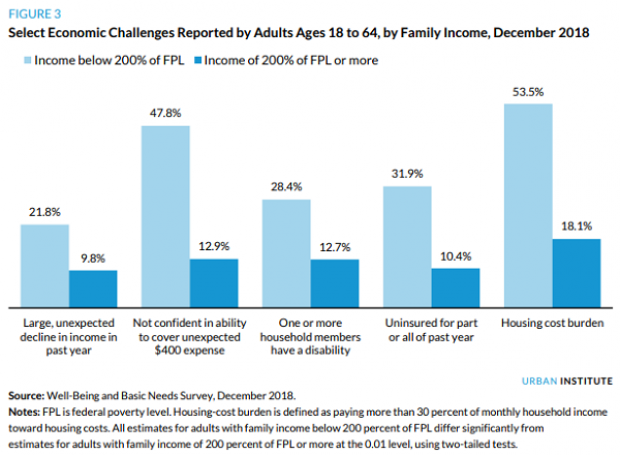

Chart of the Day: Families Still Struggling

Ten years into what will soon be the longest economic expansion in U.S. history, 40% of families say they are still struggling, according to a new report from the Urban Institute. “Nearly 4 in 10 nonelderly adults reported that in 2018, their families experienced material hardship—defined as trouble paying or being unable to pay for housing, utilities, food, or medical care at some point during the year—which was not significantly different from the share reporting these difficulties for the previous year,” the report says. “Among adults in families with incomes below twice the federal poverty level (FPL), over 60 percent reported at least one type of material hardship in 2018.”

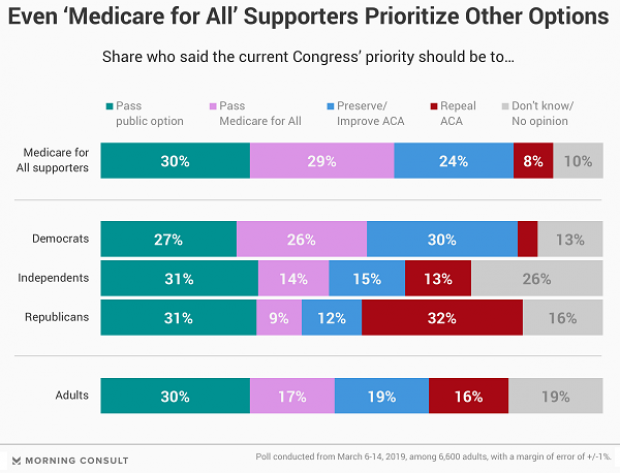

Chart of the Day: Pragmatism on a Public Option

A recent Morning Consult poll 3,073 U.S. adults who say they support Medicare for All shows that they are just as likely to back a public option that would allow Americans to buy into Medicare or Medicaid without eliminating private health insurance. “The data suggests that, in spite of the fervor for expanding health coverage, a majority of Medicare for All supporters, like all Americans, are leaning into their pragmatism in response to the current political climate — one which has left many skeptical that Capitol Hill can jolt into action on an ambitious proposal like Medicare for All quickly enough to wrangle the soaring costs of health care,” Morning Consult said.

Chart of the Day: The Explosive Growth of the EITC

The Earned Income Tax Credit, a refundable tax credit for low- to moderate-income workers, was established in 1975, with nominal claims of about $1.2 billion ($5.6 billion in 2016 dollars) in its first year. According to the Tax Policy Center, by 2016 “the total was $66.7 billion, almost 12 times larger in real terms.”

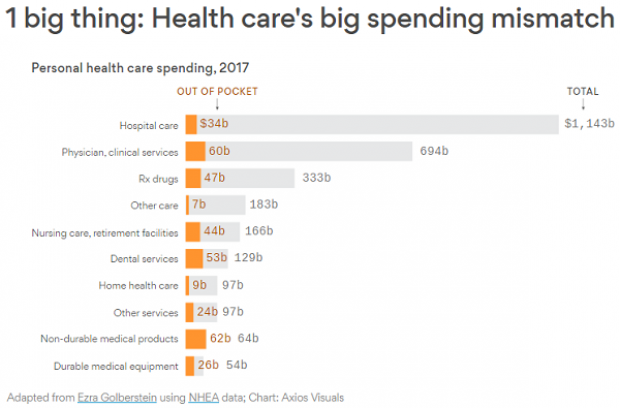

Chart of the Day: The Big Picture on Health Care Costs

“The health care services that rack up the highest out-of-pocket costs for patients aren't the same ones that cost the most to the health care system overall,” says Axios’s Caitlin Owens. That may distort our view of how the system works and how best to fix it. For example, Americans spend more out-of-pocket on dental services ($53 billion) than they do on hospital care ($34 billion), but the latter is a much larger part of national health care spending as a whole.