Don’t Feel Like a Chump When You Close on Your New Mortgage

Mortgage closing costs dropped 7 percent over the past year, falling to $1,847 on a $200,000 loan, according to a new analysis by Bankrate.

Typical closing costs varied by state, ranging from $2,163 in Hawaii to $1,613 in Ohio. You can find the average rate for your state in the table below.

Lenders compete for business, so shopping around with at least three mortgage providers can help you reduce the fees associated with your loan. “Homebuyers have more say over closing costs than they think,” Bankrate Senior Mortgage Analyst Holden Lewis said in a statement.

Even as banks lower their mortgage fees, they’re increasing fees in most other categories, according to MoneyRates.com.

While lower mortgage fees are good news for homebuyers and those refinancing their loans, the average saving amount to just $140. That’s not much relative to the total costs associated with buying a house. The average down payment for homebuyers in the first quarter of 2015 was $57,710, for example.

Related: Want Your Own Home? Here’s How to Do the Math

The costs don’t stop once the buyers move in. On top of mortgage payments, homeowners face an average of more than $6,000 in additional costs related to their house, including homeowners insurance, property taxes and utilities.

The National Association of Realtors expects home prices to increase 6.5 percent this year to a median $221,900, which would put them at the same level as their 2006 record high.

For buyers, better news than the lower mortgage fees is that rates remain relatively low, falling to 3.98 percent last week, per Freddie Mac.

Closing costs | |||

|---|---|---|---|

| State | Average origination fees | Average third-party fees | Average origination plus third-party fees |

| Alabama | $1,066 | $776 | $1,842 |

| Alaska | $935 | $922 | $1,857 |

| Arizona | $1,208 | $761 | $1,969 |

| Arkansas | $1,057 | $760 | $1,817 |

| California | $937 | $896 | $1,834 |

| Colorado | $1,192 | $719 | $1,910 |

| Connecticut | $1,074 | $960 | $2,033 |

| Delaware | $904 | $924 | $1,828 |

| District of Columbia | $1,077 | $718 | $1,794 |

| Florida | $1,028 | $778 | $1,806 |

| Georgia | $1,058 | $821 | $1,879 |

| Hawaii | $1,033 | $1,130 | $2,163 |

| Idaho | $894 | $788 | $1,682 |

| Illinois | $1,080 | $767 | $1,847 |

| Indiana | $1,067 | $770 | $1,837 |

| Iowa | $1,161 | $762 | $1,923 |

| Kansas | $1,047 | $753 | $1,800 |

| Kentucky | $1,060 | $737 | $1,797 |

| Louisiana | $1,060 | $817 | $1,877 |

| Maine | $897 | $830 | $1,727 |

| Maryland | $1,093 | $742 | $1,835 |

| Massachusetts | $905 | $851 | $1,756 |

| Michigan | $1,072 | $746 | $1,818 |

| Minnesota | $1,067 | $689 | $1,757 |

| Mississippi | $1,046 | $837 | $1,884 |

| Missouri | $1,040 | $792 | $1,833 |

| Montana | $1,062 | $855 | $1,917 |

| Nebraska | $1,047 | $770 | $1,817 |

| Nevada | $1,002 | $848 | $1,850 |

| New Hampshire | $1,084 | $750 | $1,835 |

| New Jersey | $1,181 | $913 | $2,094 |

| New Mexico | $1,076 | $876 | $1,952 |

| New York | $1,032 | $879 | $1,911 |

| North Carolina | $1,036 | $875 | $1,911 |

| North Dakota | $1,045 | $791 | $1,836 |

| Ohio | $933 | $681 | $1,613 |

| Oklahoma | $1,027 | $734 | $1,761 |

| Oregon | $1,080 | $785 | $1,864 |

| Pennsylvania | $1,055 | $678 | $1,733 |

| Rhode Island | $1,093 | $802 | $1,896 |

| South Carolina | $1,058 | $837 | $1,895 |

| South Dakota | $1,055 | $704 | $1,759 |

| Tennessee | $1,033 | $773 | $1,806 |

| Texas | $1,031 | $833 | $1,864 |

| Utah | $909 | $788 | $1,697 |

| Vermont | $1,074 | $862 | $1,936 |

| Virginia | $1,050 | $787 | $1,837 |

| Washington | $1,077 | $824 | $1,901 |

| West Virginia | $1,067 | $904 | $1,971 |

| Wisconsin | $1,047 | $723 | $1,770 |

| Wyoming | $874 | $814 | $1,689 |

| Average | $1,041 | $807 | $1,847 |

Bankrate.com surveyed up to 10 lenders in each state in June 2015 and obtained online Good Faith Estimates for a $200,000 mortgage to buy a single-family home with a 20 percent down payment in a prominent city. Costs include fees charged by lenders, as well as third-party fees for services such as appraisals and credit reports. The survey excludes title insurance, title search, taxes, property insurance, association fees, interest and other prepaid items.

Top Reads from The Fiscal Times:

- You’re Richer Than You Think. Really.

- The 10 Fastest-Growing Jobs Right Now

- The 5 Worst Cities to Raise a Family

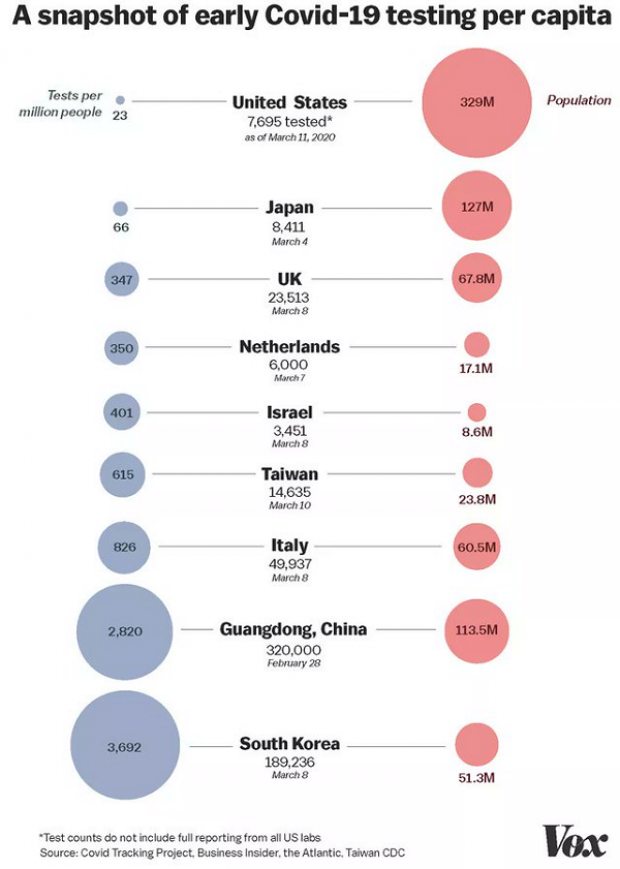

Chart of the Day: Long Way to Go on Coronavirus Testing

The White House on Friday unveiled plans for a new effort to ramp up testing for Covid-19, which experts say is an essential part of limiting the spread of the virus. This chart from Vox gives a sense of just how far the U.S. has to go to catch up to other countries that are dealing with the pandemic, including South Korea, the leading virus screener with 3,692 tests per million people. The U.S., by comparison, has done about 23 tests per million people as of March 12.

After Spending $2 Billion, Air Force Bails Out on Planned Upgrades of B-2 Bombers

The Air Force has scrapped a planned upgrade of its B-2 stealth bomber fleet — even after spending $2 billion on the effort — because defense contractor Northrup Grumman didn’t have the necessary software expertise to complete the project on time and on budget, Bloomberg’s Anthony Capaccio reports, citing the Pentagon’s chief weapons buyer.

Ellen Lord, the undersecretary of defense for acquisition and sustainment, told reporters that the nearly $2 billion that had already been spent on the program wasn’t wasted because “we are still going to get upgraded electronic displays.”

Big Hurdle for Sanders’ Plan to Cancel Student Debt

Bernie Sanders wants to eliminate $1.6 trillion in student debt, to be paid for by a tax on financial transactions, but doing so won’t be easy, says Josh Mitchell of The Wall Street Journal.

The main problem for Sanders is that most Americans don’t support the plan, with 57% of respondents in a poll last fall saying they oppose the idea of canceling all student debt. And the politics are particularly thorny for Sanders as he prepares for a likely general election run, Mitchell says: “Among the strongest opponents are groups Democrats hope to peel away from President Trump: Rust Belt voters, independents, whites, men and voters in rural areas.”

Number of the Day: $7 Million

That’s how much Michael Bloomberg is spending per day in his pursuit of the Democratic presidential nomination, according to new monthly filings with the Federal Election Commission. “In January alone, Bloomberg dropped more than $220 million on his free-spending presidential campaign,” The Hill says. “That breaks down to about $7.1 million a day, $300,000 an hour or $5,000 per minute.”