Don’t Feel Like a Chump When You Close on Your New Mortgage

Mortgage closing costs dropped 7 percent over the past year, falling to $1,847 on a $200,000 loan, according to a new analysis by Bankrate.

Typical closing costs varied by state, ranging from $2,163 in Hawaii to $1,613 in Ohio. You can find the average rate for your state in the table below.

Lenders compete for business, so shopping around with at least three mortgage providers can help you reduce the fees associated with your loan. “Homebuyers have more say over closing costs than they think,” Bankrate Senior Mortgage Analyst Holden Lewis said in a statement.

Even as banks lower their mortgage fees, they’re increasing fees in most other categories, according to MoneyRates.com.

While lower mortgage fees are good news for homebuyers and those refinancing their loans, the average saving amount to just $140. That’s not much relative to the total costs associated with buying a house. The average down payment for homebuyers in the first quarter of 2015 was $57,710, for example.

Related: Want Your Own Home? Here’s How to Do the Math

The costs don’t stop once the buyers move in. On top of mortgage payments, homeowners face an average of more than $6,000 in additional costs related to their house, including homeowners insurance, property taxes and utilities.

The National Association of Realtors expects home prices to increase 6.5 percent this year to a median $221,900, which would put them at the same level as their 2006 record high.

For buyers, better news than the lower mortgage fees is that rates remain relatively low, falling to 3.98 percent last week, per Freddie Mac.

Closing costs | |||

|---|---|---|---|

| State | Average origination fees | Average third-party fees | Average origination plus third-party fees |

| Alabama | $1,066 | $776 | $1,842 |

| Alaska | $935 | $922 | $1,857 |

| Arizona | $1,208 | $761 | $1,969 |

| Arkansas | $1,057 | $760 | $1,817 |

| California | $937 | $896 | $1,834 |

| Colorado | $1,192 | $719 | $1,910 |

| Connecticut | $1,074 | $960 | $2,033 |

| Delaware | $904 | $924 | $1,828 |

| District of Columbia | $1,077 | $718 | $1,794 |

| Florida | $1,028 | $778 | $1,806 |

| Georgia | $1,058 | $821 | $1,879 |

| Hawaii | $1,033 | $1,130 | $2,163 |

| Idaho | $894 | $788 | $1,682 |

| Illinois | $1,080 | $767 | $1,847 |

| Indiana | $1,067 | $770 | $1,837 |

| Iowa | $1,161 | $762 | $1,923 |

| Kansas | $1,047 | $753 | $1,800 |

| Kentucky | $1,060 | $737 | $1,797 |

| Louisiana | $1,060 | $817 | $1,877 |

| Maine | $897 | $830 | $1,727 |

| Maryland | $1,093 | $742 | $1,835 |

| Massachusetts | $905 | $851 | $1,756 |

| Michigan | $1,072 | $746 | $1,818 |

| Minnesota | $1,067 | $689 | $1,757 |

| Mississippi | $1,046 | $837 | $1,884 |

| Missouri | $1,040 | $792 | $1,833 |

| Montana | $1,062 | $855 | $1,917 |

| Nebraska | $1,047 | $770 | $1,817 |

| Nevada | $1,002 | $848 | $1,850 |

| New Hampshire | $1,084 | $750 | $1,835 |

| New Jersey | $1,181 | $913 | $2,094 |

| New Mexico | $1,076 | $876 | $1,952 |

| New York | $1,032 | $879 | $1,911 |

| North Carolina | $1,036 | $875 | $1,911 |

| North Dakota | $1,045 | $791 | $1,836 |

| Ohio | $933 | $681 | $1,613 |

| Oklahoma | $1,027 | $734 | $1,761 |

| Oregon | $1,080 | $785 | $1,864 |

| Pennsylvania | $1,055 | $678 | $1,733 |

| Rhode Island | $1,093 | $802 | $1,896 |

| South Carolina | $1,058 | $837 | $1,895 |

| South Dakota | $1,055 | $704 | $1,759 |

| Tennessee | $1,033 | $773 | $1,806 |

| Texas | $1,031 | $833 | $1,864 |

| Utah | $909 | $788 | $1,697 |

| Vermont | $1,074 | $862 | $1,936 |

| Virginia | $1,050 | $787 | $1,837 |

| Washington | $1,077 | $824 | $1,901 |

| West Virginia | $1,067 | $904 | $1,971 |

| Wisconsin | $1,047 | $723 | $1,770 |

| Wyoming | $874 | $814 | $1,689 |

| Average | $1,041 | $807 | $1,847 |

Bankrate.com surveyed up to 10 lenders in each state in June 2015 and obtained online Good Faith Estimates for a $200,000 mortgage to buy a single-family home with a 20 percent down payment in a prominent city. Costs include fees charged by lenders, as well as third-party fees for services such as appraisals and credit reports. The survey excludes title insurance, title search, taxes, property insurance, association fees, interest and other prepaid items.

Top Reads from The Fiscal Times:

- You’re Richer Than You Think. Really.

- The 10 Fastest-Growing Jobs Right Now

- The 5 Worst Cities to Raise a Family

Tax Refunds Rebound

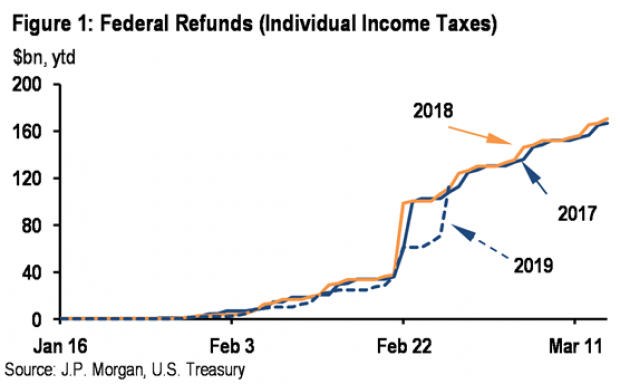

Smaller refunds in the first few weeks of the current tax season were shaping up to be a political problem for Republicans, but new data from the IRS shows that the value of refund checks has snapped back and is now running 1.3 percent higher than last year. The average refund through February 23 last year was $3,103, while the average refund through February 22 of 2019 was $3,143 – a difference of $40. The chart below from J.P. Morgan shows how refunds performed over the last 3 years.

Number of the Day: $22 Trillion

The total national debt surpassed $22 trillion on Monday. Total public debt outstanding reached $22,012,840,891,685.32, to be exact. That figure is up by more than $1.3 trillion over the past 12 months and by more than $2 trillion since President Trump took office.

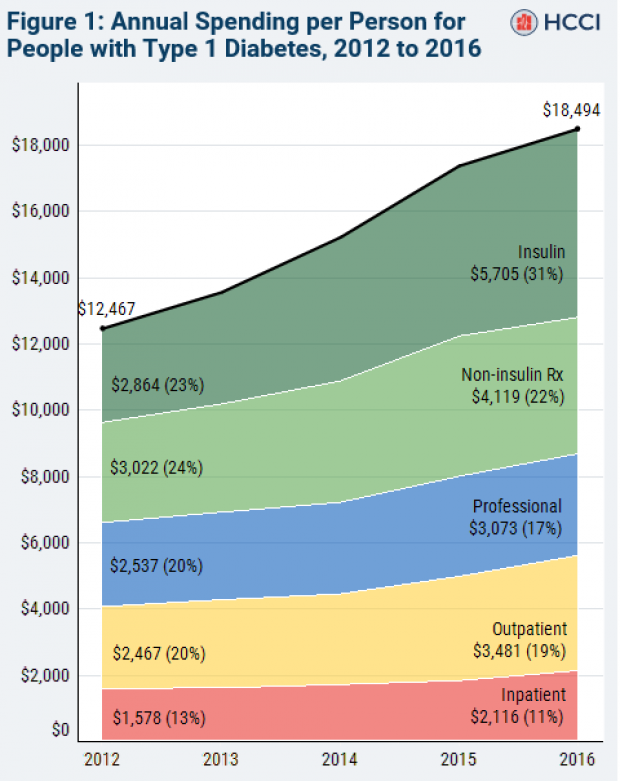

Chart of the Week: The Soaring Cost of Insulin

The cost of insulin used to treat Type 1 diabetes nearly doubled between 2012 and 2016, according to an analysis released this week by the Health Care Cost Institute. Researchers found that the average point-of-sale price increased “from $7.80 a day in 2012 to $15 a day in 2016 for someone using an average amount of insulin (60 units per day).” Annual spending per person on insulin rose from $2,864 to $5,705 over the five-year period. And by 2016, insulin costs accounted for nearly a third of all heath care spending for those with Type 1 diabetes (see the chart below), which rose from $12,467 in 2012 to $18,494.

Chart of the Day: Shutdown Hits Like a Hurricane

The partial government shutdown has hit the economy like a hurricane – and not just metaphorically. Analysts at the Committee for a Responsible Federal Budget said Tuesday that the shutdown has now cost the economy about $26 billion, close to the average cost of $27 billion per hurricane calculated by the Congressional Budget Office for storms striking the U.S. between 2000 and 2015. From an economic point of view, it’s basically “a self-imposed natural disaster,” CRFB said.

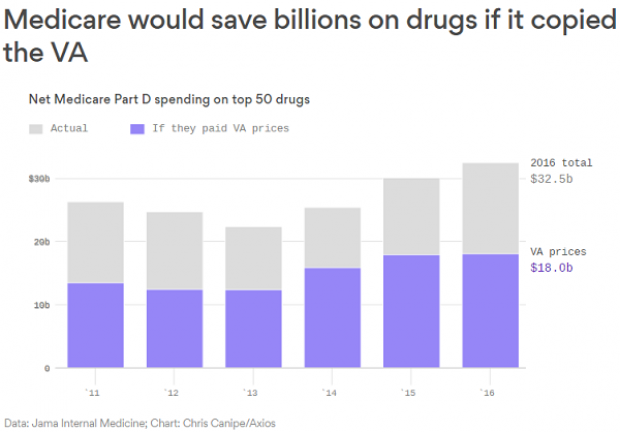

Chart of the Week: Lowering Medicare Drug Prices

The U.S. could save billions of dollars a year if Medicare were empowered to negotiate drug prices directly with pharmaceutical companies, according to a paper published by JAMA Internal Medicine earlier this week. Researchers compared the prices of the top 50 oral drugs in Medicare Part D to the prices for the same drugs at the Department of Veterans Affairs, which negotiates its own prices and uses a national formulary. They found that Medicare’s total spending was much higher than it would have been with VA pricing.

In 2016, for example, Medicare Part D spent $32.5 billion on the top 50 drugs but would have spent $18 billion if VA prices were in effect – or roughly 45 percent less. And the savings would likely be larger still, Axios’s Bob Herman said, since the study did not consider high-cost injectable drugs such as insulin.