McDonald’s McTricks Aren’t Working

Turns out warm buns aren’t the solution to McDonald’s financial woes.

The burger giant announced Thursday that its sales slide continued in the second quarter, with same store sales falling 0.7 percent globally and by 2 percent in the U.S. Quarterly revenues dropped 10 percent to $6.5 billion, though without currency effects from a strong dollar they would have climbed 1 percent.

The results were good enough to top Wall Street’s expectations, but they showed again just how far McDonald’s has to go to win back customers.

Related: The 11 Worst Fast Food Restaurants in America

The fast food chain blamed the admittedly “disappointing” results on the failure of its products and promotions to draw customers to its stores as anticipated.

New CEO Steve Easterbrook, who took over in March, has promised to revamp the restaurant chain and improve sales by catering to consumers who prefer fresh, high quality food.

McDonald’s continues to try a variety of promotions and menu changes to win back diners. It recently started offering a double cheeseburger and fries for $2.50 as a summer deal and rolled out an “artisan grilled chicken sandwich.” It has also, among other things, enlarged its quarter pounder, tested a new breakfast bowl full of kale, rolled out flavored hot coffee in some locations and even tested a lobster roll in New England restaurants. And it upped the toasting time for its hamburger buns by 5 seconds.

So far, though, the new deals and menu options have failed to entice diners.

Related: 9 Ways McDonald’s Wants to Get You Excited About Its Food Again

Easterbrook did acknowledge that changing McDonalds’ image would take time, but he said Thursday that the company is “seeing early signs of momentum.”

The company will begin to offer all-day breakfast, which already accounts for 25 percent of the company’s sales. And it is continuing to simplify its menu options to lower costs.

Analysts wonder if such changes will be enough to boost consumer appetites for McDonald’s and how the company is going to reposition its brand. As Thursday earnings report made clear, introducing a younger, hip hamburglar isn’t going to cut it.

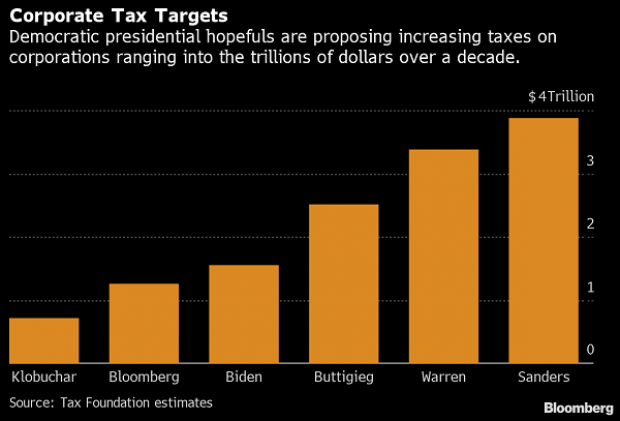

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

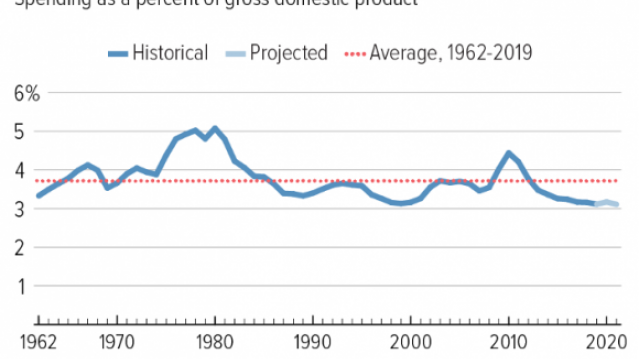

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

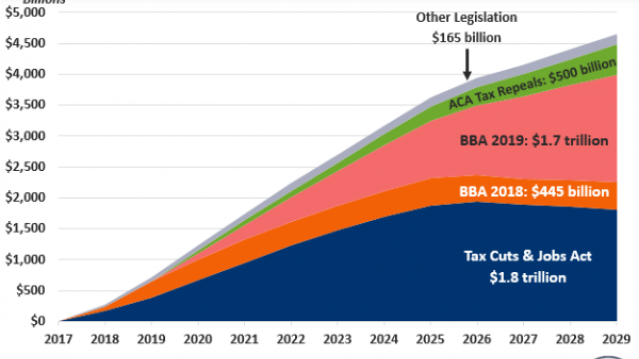

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

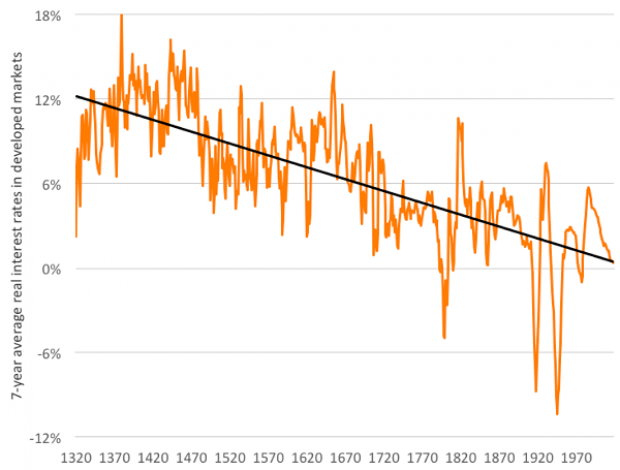

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

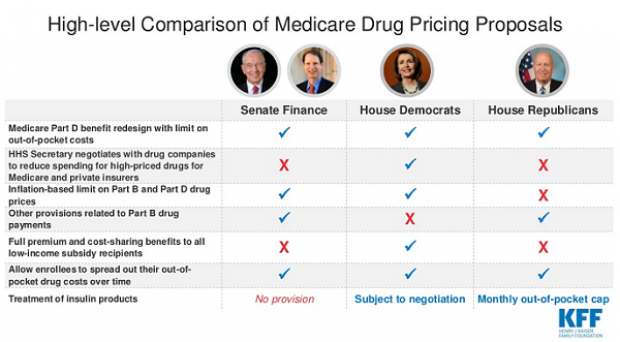

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.