McDonald’s McTricks Aren’t Working

Turns out warm buns aren’t the solution to McDonald’s financial woes.

The burger giant announced Thursday that its sales slide continued in the second quarter, with same store sales falling 0.7 percent globally and by 2 percent in the U.S. Quarterly revenues dropped 10 percent to $6.5 billion, though without currency effects from a strong dollar they would have climbed 1 percent.

The results were good enough to top Wall Street’s expectations, but they showed again just how far McDonald’s has to go to win back customers.

Related: The 11 Worst Fast Food Restaurants in America

The fast food chain blamed the admittedly “disappointing” results on the failure of its products and promotions to draw customers to its stores as anticipated.

New CEO Steve Easterbrook, who took over in March, has promised to revamp the restaurant chain and improve sales by catering to consumers who prefer fresh, high quality food.

McDonald’s continues to try a variety of promotions and menu changes to win back diners. It recently started offering a double cheeseburger and fries for $2.50 as a summer deal and rolled out an “artisan grilled chicken sandwich.” It has also, among other things, enlarged its quarter pounder, tested a new breakfast bowl full of kale, rolled out flavored hot coffee in some locations and even tested a lobster roll in New England restaurants. And it upped the toasting time for its hamburger buns by 5 seconds.

So far, though, the new deals and menu options have failed to entice diners.

Related: 9 Ways McDonald’s Wants to Get You Excited About Its Food Again

Easterbrook did acknowledge that changing McDonalds’ image would take time, but he said Thursday that the company is “seeing early signs of momentum.”

The company will begin to offer all-day breakfast, which already accounts for 25 percent of the company’s sales. And it is continuing to simplify its menu options to lower costs.

Analysts wonder if such changes will be enough to boost consumer appetites for McDonald’s and how the company is going to reposition its brand. As Thursday earnings report made clear, introducing a younger, hip hamburglar isn’t going to cut it.

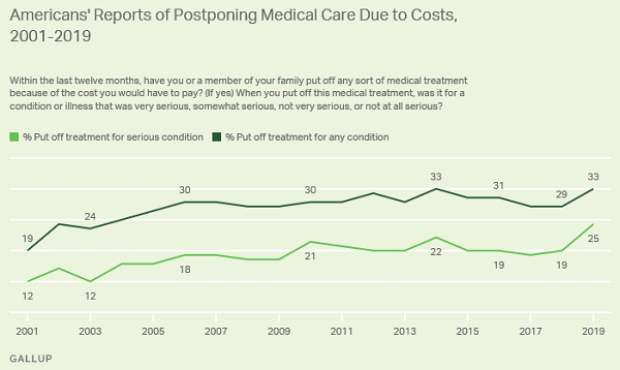

Increasing Number of Americans Delay Medical Care Due to Cost: Gallup

From Gallup: “A record 25% of Americans say they or a family member put off treatment for a serious medical condition in the past year because of the cost, up from 19% a year ago and the highest in Gallup's trend. Another 8% said they or a family member put off treatment for a less serious condition, bringing the total percentage of households delaying care due to costs to 33%, tying the high from 2014.”

Number of the Day: $213 Million

That’s how much the private debt collection program at the IRS collected in the 2019 fiscal year. In the black for the second year in a row, the program cleared nearly $148 million after commissions and administrative costs.

The controversial program, which empowers private firms to go after delinquent taxpayers, began in 2004 and ran for five years before the IRS ended it following a review. It was restarted in 2015 and ran at a loss for the next two years.

Senate Finance Chairman Chuck Grassley (R-IA), who played a central role in establishing the program, said Monday that the net proceeds are currently being used to hire 200 special compliance personnel at the IRS.

US Deficit Up 12% to $342 Billion for First Two Months of Fiscal 2020: CBO

The federal budget deficit for October and November was $342 billion, up $36 billion or 12% from the same period last year, the Congressional Budget Office estimated on Monday. Revenues were up 3% while outlays rose by 6%, CBO said.

Hospitals Sue to Protect Secret Prices

As expected, groups representing hospitals sued the Trump administration Wednesday to stop a new regulation would require them to make public the prices for services they negotiate with insurers. Claiming the rule “is unlawful, several times over,” the industry groups, which include the American Hospital Association, say the rule violates their First Amendment rights, among other issues.

"The burden of compliance with the rule is enormous, and way out of line with any projected benefits associated with the rule," the suit says. In response, a spokesperson for the Department of Health and Human Services said that hospitals “should be ashamed that they aren’t willing to provide American patients the cost of a service before they purchase it.”

See the lawsuit here, or read more at The New York Times.

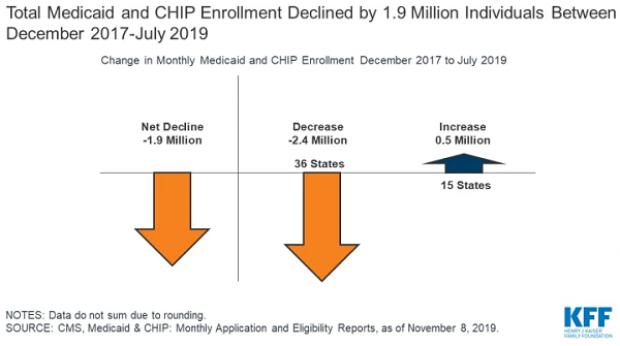

A Decline in Medicaid and CHIP Enrollment

Between December 2017 and July 2019, enrollment in Medicaid and the Children's Health Insurance Program (CHIP) fell by 1.9 million, or 2.6%. The Kaiser Family Foundation provided an analysis of that drop Monday, saying that while some of it was likely caused by enrollees finding jobs that offer private insurance, a significant portion is related to enrollees losing health insurance of any kind. “Experiences in some states suggest that some eligible people may be losing coverage due to barriers maintaining coverage associated with renewal processes and periodic eligibility checks,” Kaiser said.