Why You Should Shop Around for Car Insurance Right Now

If you haven’t shopped for auto insurance recently, you might want to spend an hour or so checking out other deals. It pays to review your policy and check what’s out there.

A new survey from insuranceQuotes.com shows that 66 percent of policyholders never or only rarely check to see if they could get the same or better coverage at a better price. The average American driver has been with the same auto insurance company for 12 years, and some have stayed with the same insurer for two to three decades, or longer.

Related: 5 Ways to Lower Your Car Insurance—Right Now

Millennials age 18 to 29 and senior citizens number among those least likely to shop around for auto insurance. At least six in 10 millennials with auto insurance assume you have to wait until your renewal date to switch insurance companies. And they’re not alone: 46 percent of Americans do not know that you can switch your auto insurance company at any time.

One of the reasons auto insurance may not be a priority for consumers? Auto pay options, while convenient, could be keeping car insurance payments and rates out of sight—and out of mind. Human nature and procrastination is another. “People think that it’s a task that might be difficult and time-consuming,” says senior analyst Laura Adams, “but it could be as simple as going to a website like insurancequotes.com, putting your information in for a free quote, and getting multiple quotes back. There’s no financial risk in looking for a new rate.”

Just spending an hour once a year to compare quotes from three different companies could potentially save you hundreds or thousands of dollars.

Related: A Quick Way to Save Big on Your Insurance

Experts suggest checking your car insurance rates the same way you would remember to change the oil in your car or swap the air filters in your home. Here are some tips to get started:

- Ask your current insurer if there are any company discounts you might be eligible for but don’t know about, such as the good-student discount. For college and grad students who have a B-average or better (or their parents) that could result in a significant discount.

- If you find a better deal, tell your current insurance company that you’re thinking of switching unless they can match the new offer or exceed it.

- If your current insurer refuses to negotiate, sign up for the new policy first—and then cancel the old one. “You always want to make sure you’re covered,” says Evans. “Insurance companies do not like to see a gap in coverage, and your rates could rise.”

- To get a wider variety of quotes, get online quotes from insurance company websites, consult with an independent agent, and look into companies that don’t use independent agents as well.

“Being married can cause your rate to decrease,” says Evan. “Marriage, getting good grades--these are all things that you have to self-report, which is why I recommend revisiting auto insurance at least once a year, as your life situation could change.”

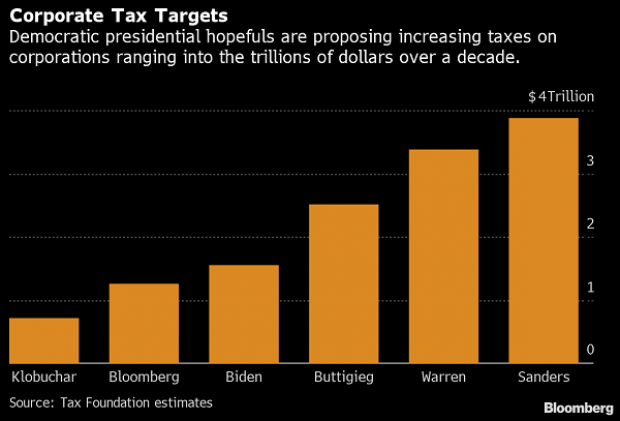

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

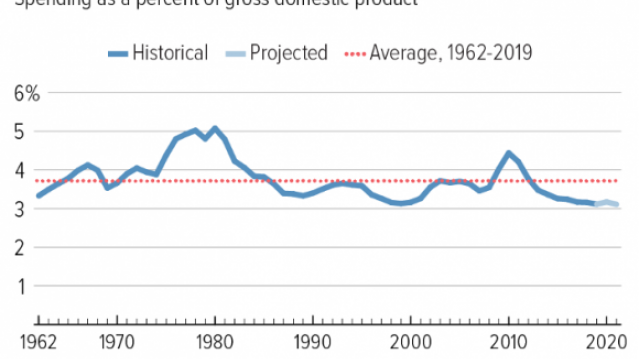

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

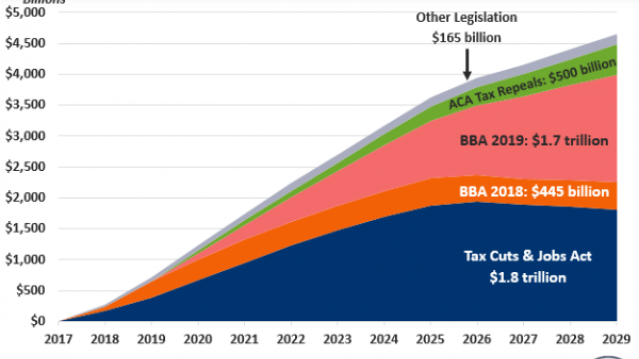

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

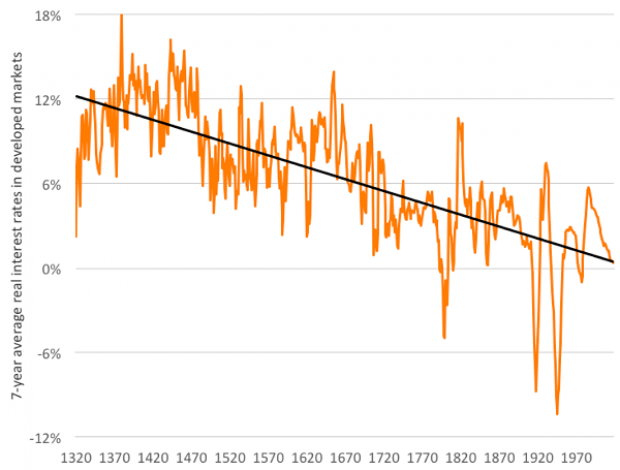

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

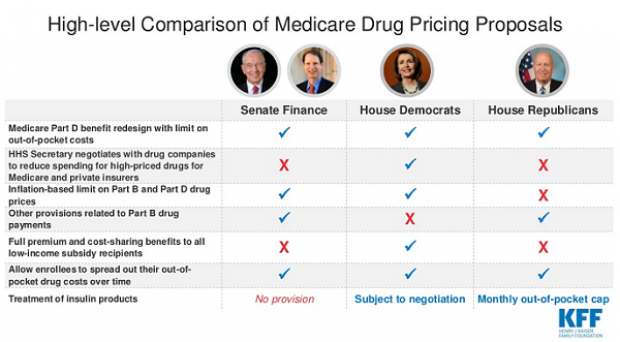

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.